With the federal income tax filing deadline approaching, taxes are a priority on many people’s minds. A new LendingTree study revealed just how much and in which areas Americans are paying the highest and lowest property taxes.

With the federal income tax filing deadline approaching, taxes are a priority on many people’s minds. A new LendingTree study revealed just how much and in which areas Americans are paying the highest and lowest property taxes.

How much one pays in property taxes — also called real estate taxes — varies significantly and can be influenced based on the home’s worth and location, among other key factors.

Key Findings:

- Property taxes can vary significantly across the nation’s 50 largest metros. For example, annual median property taxes in Birmingham, Ala. — where homeowners pay the least in real estate taxes — are $8,096 cheaper than in the New York metro, where they’re the highest.

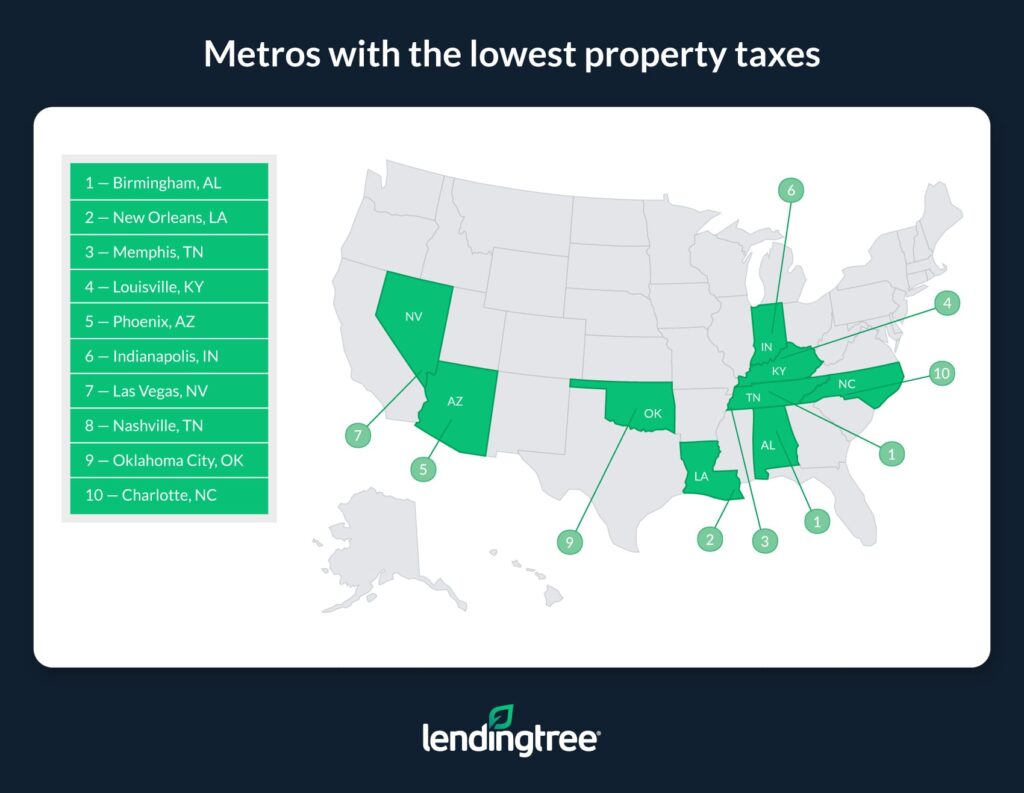

- Birmingham, Ala., is the only metro where median property taxes are less than $1,000 a year. The median amount of property taxes paid by homeowners in Birmingham is just shy of that total at $995. For comparison, residents in the next two metros with the lowest median real estate taxes — New Orleans and Memphis, Tenn. — owed $1,506 and $1,672 a year, respectively. Seven of the 10 metros with the lowest property taxes are in the South.

- New York, San Jose, Calif., and San Francisco are the metros where homeowners pay the most in property taxes. Unsurprisingly, residents in these metros known for their expensive real estate shell out a lot of money in property taxes each year. The median amount paid is $9,091 in New York, $8,858 in San Jose and $7,335 in San Francisco.

- Since 2019, median property taxes have increased in each of the nation’s 50 largest metros. Property taxes increased the most in Tampa, Fla., where the median amount paid increased by 18.0% from 2019 to 2021. In Hartford, Conn., the increase was the smallest at 1.1%. Remember that real estate taxes can vary significantly by person, meaning that some people’s property taxes may have increased by considerably more or less than their area’s overall rate.

- Median property taxes on homes without a mortgage are $692 less expensive, on average, than on homes with mortgages. There are various reasons, ranging from home values tending to be less expensive on homes without a mortgage to some states having tax exemptions or reductions for older homeowners who may be more likely to own their home outright. Salt Lake City, Seattle, Portland, Ore., Boston, Virginia Beach, Va., and Nashville, Tenn. — the six metros where median property taxes are slightly higher for homes without a mortgage — illustrate there are exceptions.

Metros with the lowest property taxes

No. 1: Birmingham, Ala.

- Median property taxes paid — all homes: $995

- Median property taxes paid — homes with a mortgage: $1,152

- Median property taxes paid — homes without a mortgage: $774

- Percentage increase in median property taxes paid on all homes from 2019 to 2021: 6.2%

No. 2: New Orleans

- Median property taxes paid — all homes: $1,506

- Median property taxes paid — homes with a mortgage: $1,733

- Median property taxes paid — homes without a mortgage: $1,174

- Percentage increase in median property taxes paid on all homes from 2019 to 2021: 12.1%

No. 3: Memphis, Tenn.

- Median property taxes paid — all homes: $1,672

- Median property taxes paid — homes with a mortgage: $1,810

- Median property taxes paid — homes without a mortgage: $1,372

- Percentage increase in median property taxes paid on all homes from 2019 to 2021: 3.5%

Metros with the highest property taxes

No. 1: New York

- Median property taxes paid — all homes: $9,091

- Median property taxes paid — homes with a mortgage: $9,342

- Median property taxes paid — homes without a mortgage: $8,669

- Percentage increase in median property taxes paid on all homes from 2019 to 2021: 4.6%

No. 2: San Jose, Calif.

- Median property taxes paid — all homes: $8,858

- Median property taxes paid — homes with a mortgage: $10,000

- Median property taxes paid — homes without a mortgage: $5,816

- Percentage increase in median property taxes paid on all homes from 2019 to 2021: 14.2%

No. 3: San Francisco

- Median property taxes paid — all homes: $7,335

- Median property taxes paid — homes with a mortgage: $8,422

- Median property taxes paid — homes without a mortgage: $5,278

- Percentage increase in median property taxes paid on all homes from 2019 to 2021: 8.2%

LendingTree analyzed U.S. Census Bureau data on the median amount paid annually in each of the nation’s 50 largest metros. New research showed that homeowners in some metros can soon expect to shell out thousands of dollars more a year in property taxes than homeowners in other parts of the country.

To read the full report, including more data, tips, charts and methodology, click here.

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news