One task that has never been easy in the housing market is getting a mortgage loan for under $50,000, but small loans are quickly nearing the point of nonexistence which will create barriers of entry for homeownership.

One task that has never been easy in the housing market is getting a mortgage loan for under $50,000, but small loans are quickly nearing the point of nonexistence which will create barriers of entry for homeownership.

A recent report from Urban Institute [1] found that from 2004 to 2011, the national share of these small loans remained between 3 and 4 percent, but by 2014, it had declined to just 2.3 percent.

"The absence of small loans may seem insignificant in high-cost markets, but in cities like Kalamazoo, Michigan, and Tampa, Florida, a significant portion of the housing stock sells for $50,000 or less. And if potential buyers can’t get a mortgage for these houses, they’ll miss that important first rung on the homeownership ladder that helps both families and neighborhoods," Urban Institute said.

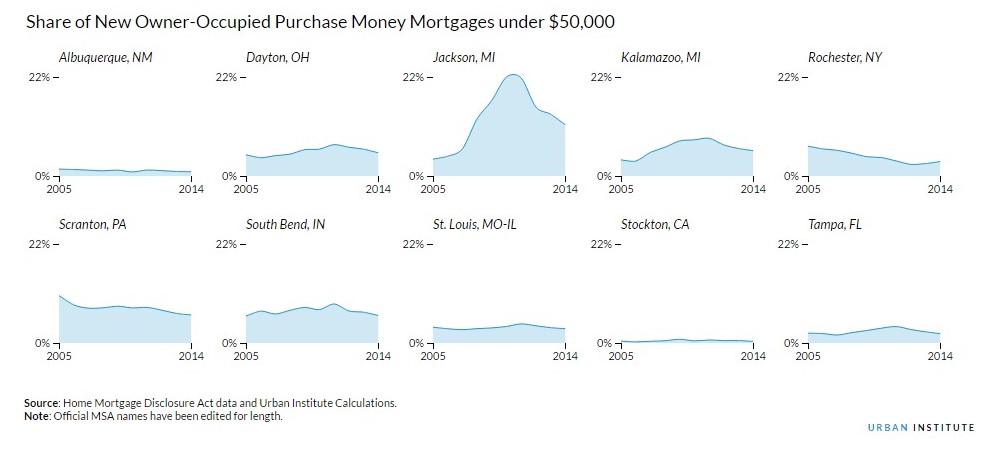

Urban Institute examined 10 metropolitan statistical areas (MSAs) where a substantial share of the housing stock is worth less than $50,000. In 2014, lower-valued homes accounted for over 8 percent of the stock in each of these MSAs (except in Stockton-Lodi, California). These shares have been on the rise since the housing crisis. In Tampa, the share of lower-priced homes increased from 5 percent in 2007 to 11 percent in 2014.

"The number of small mortgages doesn’t match the number of lower-value homes: the share of owner-occupied, purchase mortgages under $50,000 has steadily declined over the same postcrisis period. That share in Tampa has always been less than 3.5 percent but dropped to 2.1 percent in 2014," the report stated.

Urban Institute found that the decline in small loans has been accompanied by an increase in the denial rates for applicants for these loans. Calculations based on Housing Mortgage Disclosure Act data showed that the denial rate for loans under $50,000 is higher than the denial rate on larger loans in the postcrisis years. In 2014, for the conventional channel, the denial rate for sub- $50,000 loans was 22 percent, much higher than the 17 percent rate for loans between $50,000 and $100,000. The gap is even larger in the government loan market: 33 percent compared with 20 percent.

"Tight credit and the low profitability of small loans are making it extra hard for those who want to purchase," the report said. "Moreover, lenders don’t find these loans attractive. Loan origination costs are largely fixed and recovered either through the sale of the loan or, over time, through the financing spread and payment for servicing. Smaller loans generate lower sales prices, spreads, and servicing income, making them less economically attractive to lenders."

The report continued, "Small mortgage loans are important to the vitality of hundreds of urban communities throughout the United States. Bringing them back will be hard, and we don’t have any immediate or easy solutions. We’re eager to work with policymakers and industry leaders to understand the impact of the loss of these loans and develop strategies to encourage their availability."