It is no secret that the price of everything has been rising of late, and it seems that some of the pressure caused by inflation and rising interest rates is finally starting to trickle down to the housing market.

It is no secret that the price of everything has been rising of late, and it seems that some of the pressure caused by inflation and rising interest rates is finally starting to trickle down to the housing market.

According to Redfin, early-stage homebuying demand is beginning to falter as new listings are down 7% year-over-year, as rates for a 30-year fixed mortgage hit 5% and median asking prices topped $397,747 bringing the typical homebuyer's average monthly payment to $2,288, an all-time high.

Among other statistics that show slowing demand, 3% fewer people searched “homes for sale” on Google compared to a year ago and the Redfin Homebuyer Demand Index dropped 3% compared to a 5% increase last year. Touring activity from the beginning of the year to April 10 is also down 23 percentage points compared to the same period last year and mortgage applications are down 6% from a year earlier.

In addition to mortgage rates hitting 5%—the highest they have been since February 2011—the rate at which they increased is also the fastest since 1994 as they rose 0.28% from 4.72% over the course of a week.

Redfin is also closely watching the accelerating share of home listings with price drops, which is climbing at its fastest spring pace since at least 2015, another sign that demand is not meeting sellers’ expectations.

“There really is a limit to homebuyer demand, even though the market over the past few years has made it seem endless,” said Daryl Fairweather, Redfin’s Chief Economist. “The sharp increase in mortgage rates is pushing more homebuyers out of the market, but it also appears to be discouraging some homeowners from selling. With demand and supply both slipping, the market isn’t likely to flip from a seller’s market to a buyer’s market anytime soon.”

Even though some metrics show that demand may be softening, the market is still “as hot as ever for homebuyers” with new records continually being set. Forty-five percent of homes that went under contract found a buyer within one week, and the average home that sold went for 2.4% above its asking price.

“If a home is on the market for more than a week, people start to wonder why or assume something is wrong with it,” said Redfin Boston real estate agent James Gulden. “Every offer I’ve written recently has faced multiple offers, but some people have finally had enough of all the competition and are pulling out. They’re becoming less willing to make a risky offer in a high-stress bidding war situation.”

Other high-level takeaways from the report covering the four-week period ending April 10 include:

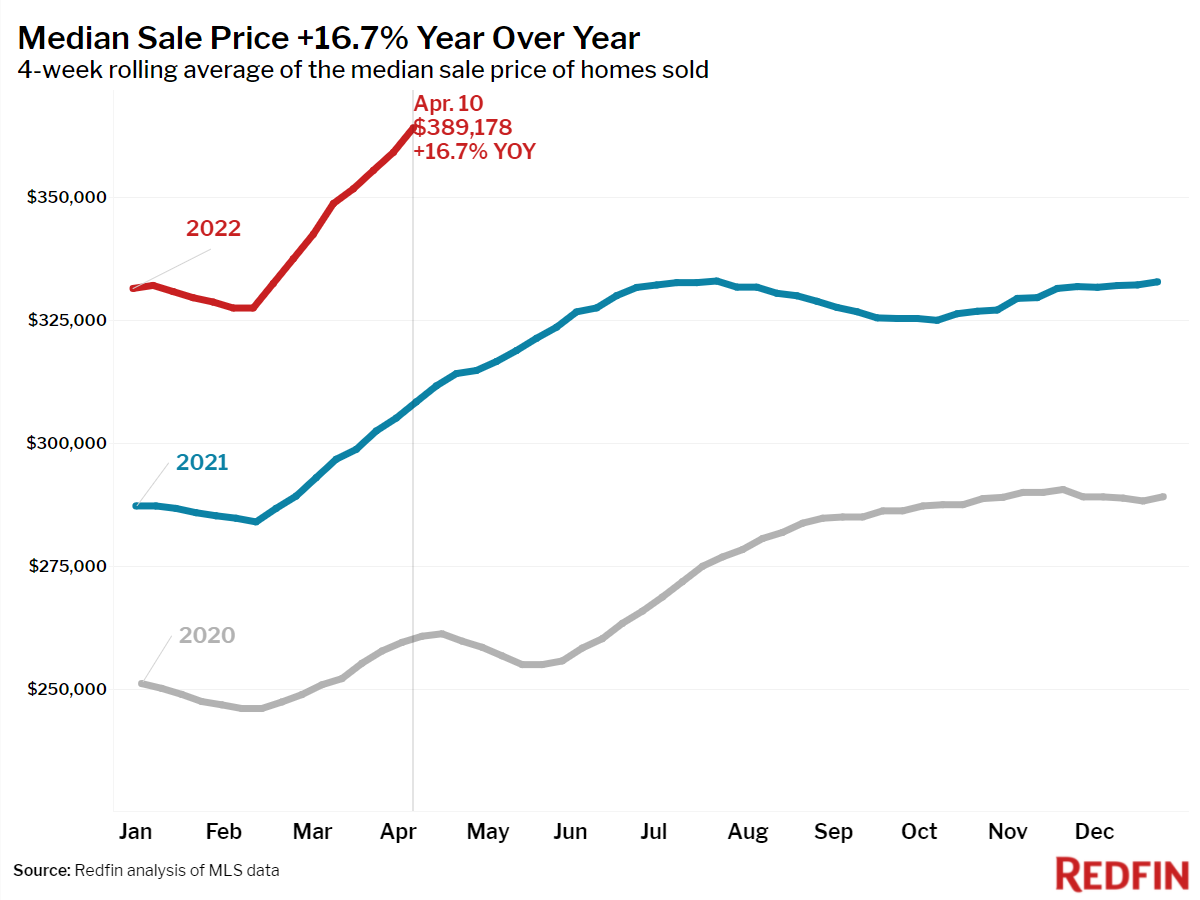

- The median home sale price was up 17% year over year to a record high of $389,178.

- The median asking price of newly listed homes increased 14% year over year to $397,747.

- The monthly mortgage payment on the median asking price home rose to a record high of $2,288 at the current 5% mortgage rate. This was up 35% from a year earlier, when mortgage rates were 3.04%.

- Pending home sales were up 1% year over year.

- New listings of homes for sale were down 7% from a year earlier, the 21st-straight annual decline.

- Active listings (the number of homes listed for sale at any point during the period) fell 23% year over year.

- 58% of homes that went under contract had an accepted offer within the first two weeks on the market, an all-time high. This was up from the 55% rate of a year earlier.

- 44% of homes that went under contract had an accepted offer within one week of hitting the market, an all-time high. This was up from 41% during the same period a year earlier.

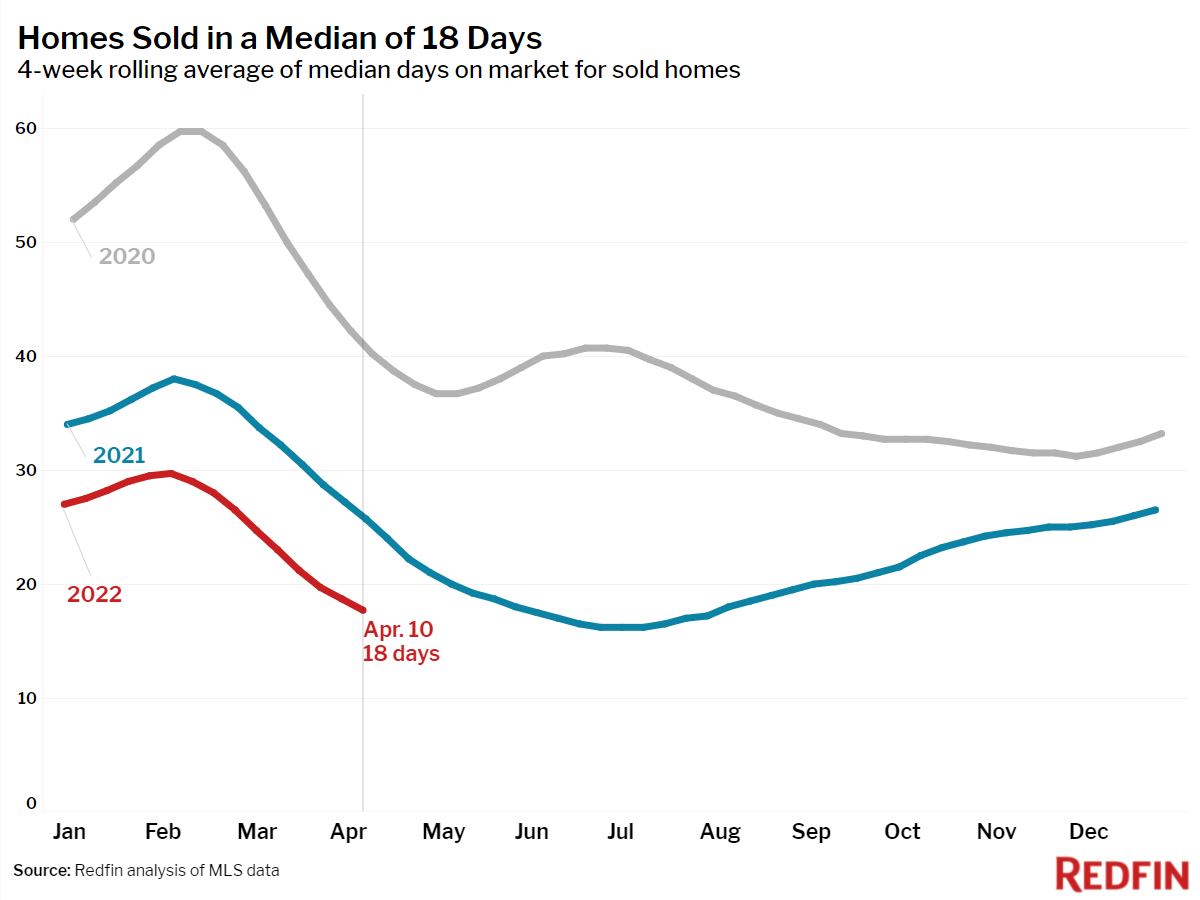

- Homes that sold were on the market for a median of 18 days, down from 26 days a year earlier.

- 54% of homes sold above list price, up from 42% a year earlier, and just shy of the all-time high seen in July of 2021.

- On average, 3.2% of homes for sale each week had a price drop, with 13% dropping their price in the past four weeks. That’s up from 10% a month earlier and 9% a year ago. The share of listings with price drops is climbing faster during this time of year than they have since at least 2015. Typically during this time of year the share of homes with price drops is slightly down month over month.

- The average sale-to-list price ratio, which measures how close homes are selling to their asking prices, rose to an all-time high of 102.4%. In other words, the average home sold for 2.4% above its asking price. This was up from 100.4% in 2021.

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news