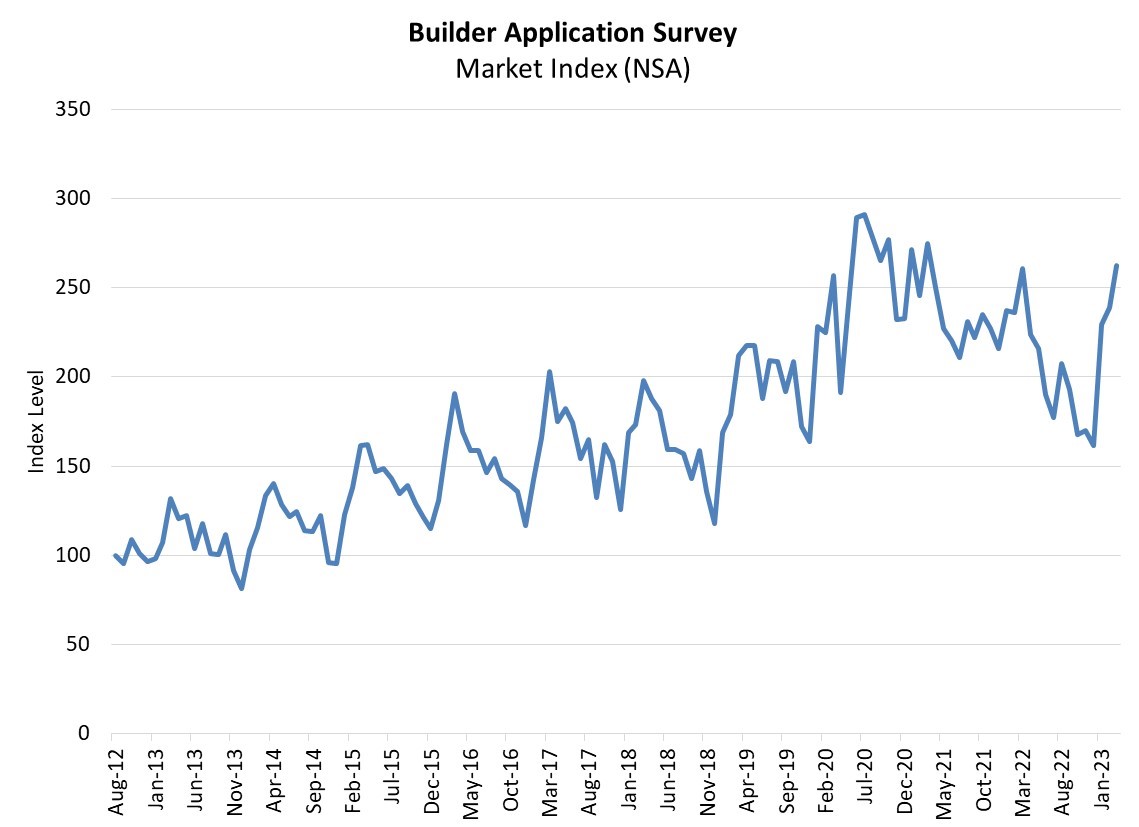

The Mortgage Bankers Association (MBA) Builder Application Survey (BAS) data for March 2023 shows mortgage applications for new home purchases increased 0.6% compared to one year ago. Compared to February 2023, applications increased by 10% month-over-month (note that this change does not include any adjustment for typical seasonal patterns).

The Mortgage Bankers Association (MBA) Builder Application Survey (BAS) data for March 2023 shows mortgage applications for new home purchases increased 0.6% compared to one year ago. Compared to February 2023, applications increased by 10% month-over-month (note that this change does not include any adjustment for typical seasonal patterns).

“Mortgage applications for new home purchases increased in March. Low for-sale inventory continues to constrain sales, along with mortgage rates that remain above 6%,” said Joel Kan, MBA’s VP and Deputy Chief Economist. “MBA’s estimate for new home sales was down 3% from the previous month. New home sales will be key to the housing market recovery in 2023, as they account for an increasing share of purchase activity as home builders maintain construction levels and offer concessions for buyers. On the other hand, existing home inventory remains low as many current homeowners are locked-in to their homes with a lower mortgage rate.”

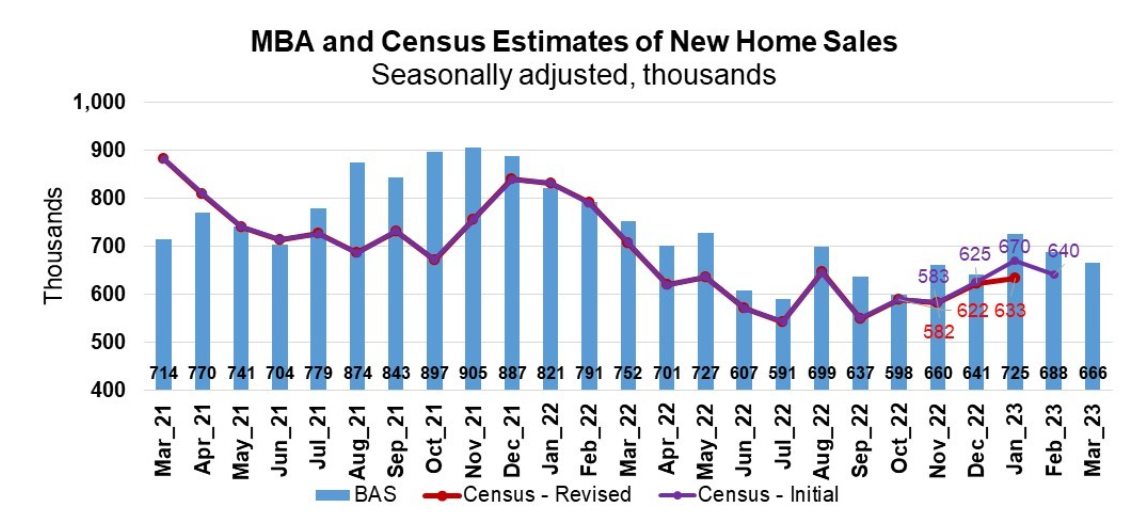

MBA estimates new single-family home sales, which has consistently been a leading indicator of the U.S. Census Bureau’s New Residential Sales report, is that new single-family home sales were running at a seasonally adjusted annual rate of 666,000 units in March 2023, based on data from the BAS.

The new home sales estimate is derived using mortgage application information from the BAS, as well as assumptions regarding market coverage and other factors.

The seasonally adjusted estimate for March is a decrease of 3.2% from February’s pace of 688,000 units. On an unadjusted basis, MBA estimates that there were 65,000 new home sales in March 2023, an increase of 6.6% from 61,000 new home sales in February.

By product type, conventional loans composed 66.4% of overall loan applications, FHA loans composed 22.6%, RHS/USDA loans composed 0.3%, and VA loans composed 10.7%. The average loan size of new homes increased from $406,953 in February to $407,015 in March.

And as First American Deputy Chief Economist Odeta Kushi notes, housing inventory issues still loom and this lack of options for buyers has hampered the start of the spring homebuying season.

“While builders still face several supply-side issues, in addition to a volatile mortgage rate environment, there is reason for cautious optimism,” noted Kushi. “Notably, builders are responding to the recent decline in mortgage rates and the persistent lack of existing-home inventory.”

Moving forward, the National Association of Home Builders (NAHB) reports that the nation’s homebuilders remained cautiously optimistic in April, as limited resale inventory helped to increase demand in the new home market as the industry continues to struggle with building material issues. NAHB reports that builder confidence in the market for newly built single-family homes in April rose one point to 45, according to the recently issued National Association of Home Builders (NAHB)/Wells Fargo Housing Market Index (HMI) released.

“For the fourth straight month, builder confidence has increased due to a lack of resale inventory despite elevated interest rates,” said NAHB Chairman Alicia Huey, a custom home builder and developer from Birmingham, Alabama. “Builders note that additional declines in mortgage rates, to below 6%, will price-in further demand for housing. Nonetheless, the industry continues to be plagued by building material issues, including lack of access to electrical transformer equipment.”

Kushi added, “New-home inventory now makes up 27% of total inventory. Historically, that share was more like 11%. When existing homes for sale are nearly non-existent, a new home at the right price may be an attractive option. Completions have outpaced starts since July 2022 and that will continue to put downward pressure on the number of single-family homes under construction. As new, completed home inventory rises, it will provide some relief to a supply-starved market and put downward pressure on new-home prices.”

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news