In a new report conducted by Zillow, it was found that Housing Choice Vouchers are failing to keep up with rising rents, thus exposing rent-burdened households to economic uncertainty or even homelessness. Zillow found that nearly 10 times more qualified voucher recipients exist than actual vouchers in most large U.S. metros. The analysis also found voucher values grew at less than half the pace of typical rent during the pandemic.

In a new report conducted by Zillow, it was found that Housing Choice Vouchers are failing to keep up with rising rents, thus exposing rent-burdened households to economic uncertainty or even homelessness. Zillow found that nearly 10 times more qualified voucher recipients exist than actual vouchers in most large U.S. metros. The analysis also found voucher values grew at less than half the pace of typical rent during the pandemic.

"Renters across the country are struggling as costs have skyrocketed and vouchers have failed to keep up," said Orphe Divounguy, Senior Economist at Zillow. "Better calculating for voucher values and more funding are good short-term solutions, but building more homes is the long-term answer."

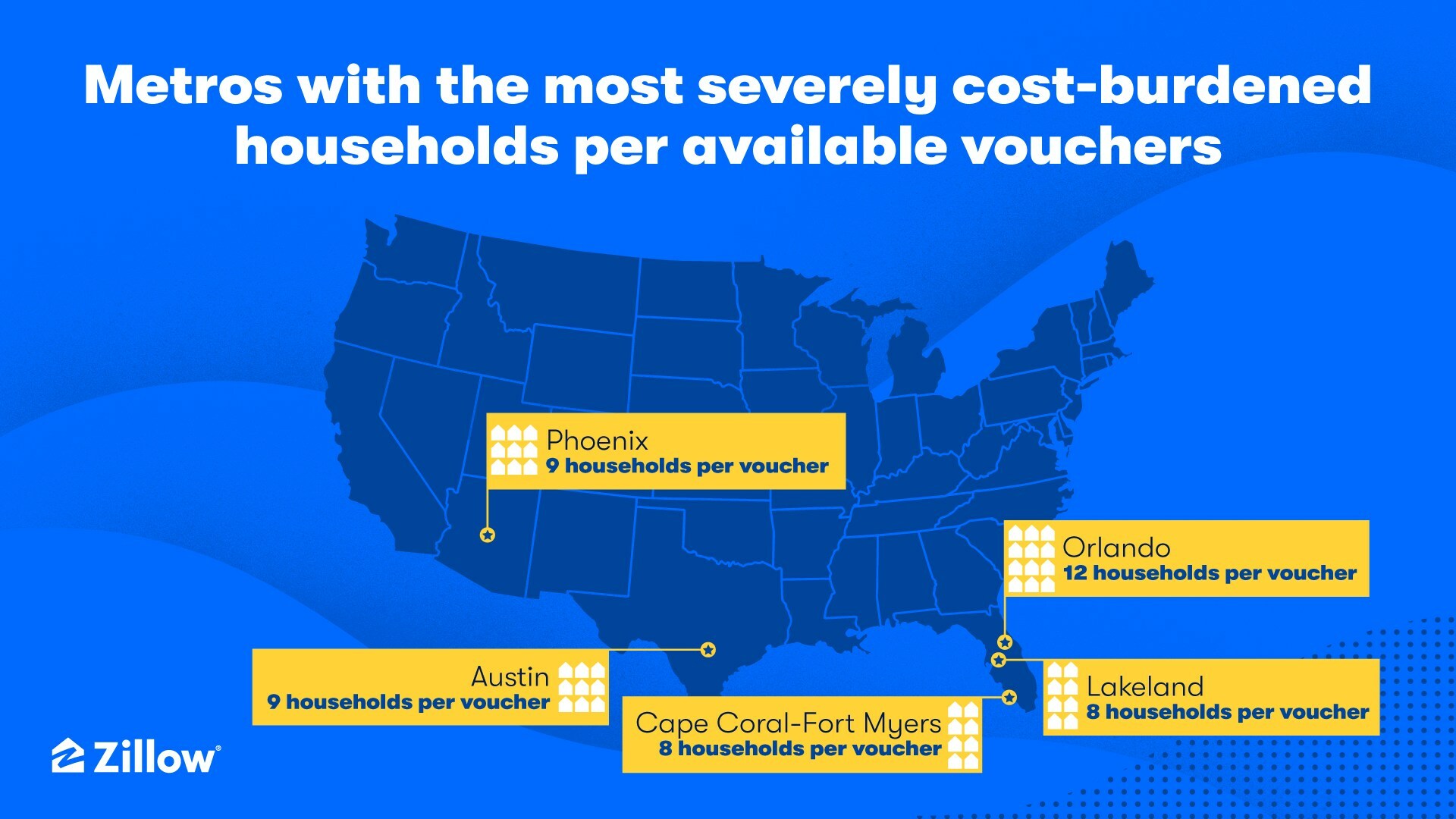

Zillow research found there was not a single large metro area with enough vouchers to meet demand. Across the country, there were nearly 10 times as many eligible voucher recipients as there were vouchers. In addition, there were nearly four times more severely cost-burdened households than voucher recipients.

Several metros in Florida stand out for their mismatches between vouchers and those who need them. Orlando had the highest mismatch in the nation, with 12 severely cost-burdened households for every available voucher.

Between February 2020 and February 2022, the typical U.S. rent grew by 18%, but voucher values grew by only 7%. Counties with the biggest disparity between rent growth and voucher values were scattered throughout the country, but Florida—a state that experienced among the fastest rent increases in the country—stood out again with several counties suffering the largest gaps. In Miami-Dade County, rent growth outpaced voucher values by almost 50 percentage points in those two years.

The Housing Choice Voucher Program is a critical rental assistance program provided by the U.S. Department of Housing & Urban Development (HUD), and is sometimes referred to as Section 8. The program pays landlords a portion of the rent directly on behalf of the tenant, and the tenant pays the difference.

Eligibility for a housing voucher is based on income and family size. In general, a family's income may not exceed 50% of the median income for the county or metropolitan area in which the family chooses to live. Typically, a voucher holder pays about 30% of their income as rent and the program pays the rest, up to a ceiling determined by HUD as the fair market value.

Recent Zillow research found that it would take four full-time minimum wage workers to reasonably afford a two-bedroom rental, illustrating the financial challenges that many renters face today. With voucher values eroding, voucher holders will have fewer options for places to rent and will likely be forced farther away from neighborhoods with amenities and job centers. The increase in rents leaves many rent-burdened families exposed to eviction, health crises and homelessness.

Redfin recently reported that the median U.S. asking rent fell 0.4% year-over-year to $1,937 in March—the first annual decline since March 2020 and the lowest median asking rent in 13 months. By comparison, rents were up 17.5% one year earlier, in March 2022. The median asking rent in March was unchanged from February. It remained $322 higher (19.9%) than it was at the onset of the pandemic three years earlier, though wages increased at roughly the same pace during this time.

“Rents are falling, but it feels more like they’re just returning to normal, which is healthy to some degree,” said Dan Close, a Redfin Real Estate Agent in Chicago, where the median asking rent in March was 9.2% lower than it was a year earlier. “It’s similar to the cost of eggs. You can say egg prices are plummeting, but what’s really happening is they’re finally making their way back to the $3 norm instead of $5 or $6. Rents ballooned during the pandemic, and are now returning to earth.”

As part of National Fair Housing Month, Zillow is highlighting several policy solutions that could improve this program:

- Zillow is working with HUD to help improve the formula used to calculate fair market rent values. By incorporating the Zillow Observed Rent Index (ZORI), HUD's fair market rents should become more responsive to rent increases. Most critically, without an increase in funding, fewer vouchers could leave many rent-burdened voucher-eligible families behind.

- Increasing landlord participation can also help keep people housed. Lawmakers could pass source-of-income protections to ensure all housing providers participate in the program. Additionally, policymakers should find ways to shore up housing provider education and outreach, and to streamline and modernize programs so that landlords feel more confident navigating this program successfully.

"I applaud Zillow for shining a 100-megawatt spotlight on the immense rental affordability challenges facing millions of low-income families across the United States," said Dennis C. Shea, Executive Director of the J. Ronald Terwilliger Center for Housing Policy. "This critical research challenges policymakers to take immediate action. Strengthening the Housing Choice Voucher program, encouraging greater landlord participation in the program by enacting the Choice in Affordable Housing Act, and increasing the supply of affordable rental homes by passing the Affordable Housing Credit Improvement Act should all be on Congress's must-do list."

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news