A new report from Zillow [1] has found that entry-level home shoppers are dealing with faster-rising prices and more competition than those seeking more expensive homes.

A new report from Zillow [1] has found that entry-level home shoppers are dealing with faster-rising prices and more competition than those seeking more expensive homes.

"Buyers shopping for the least-expensive homes this spring aren't noticing much difference from the pandemic-era market heat," said Skylar Olsen, Zillow's Chief Economist [2]. "Competition is fierce, but there aren't many homes for sale, so buyers should be patient but prepared to move quickly and anticipate a bidding war once they find a home they love."

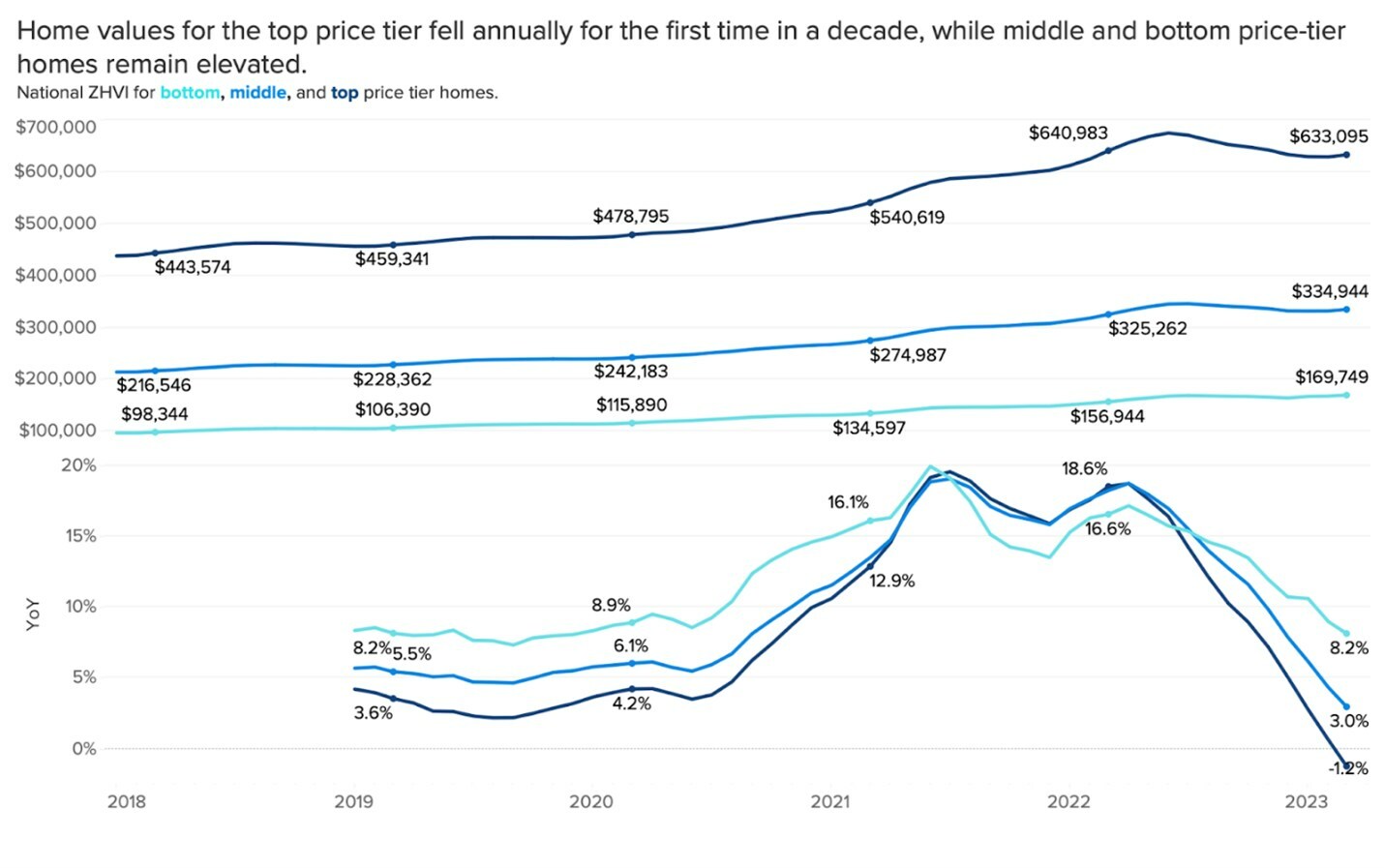

Typical home values for the least-expensive one-third of houses rose 8%–nearly $13,000–over the past year. Mid-level homes appreciated by 3%, and the most-expensive houses depreciated by 1%, the first loss of value for the top tier since 2012. Zillow reported that entry-level homes have exploded in value over the course of the pandemic across the U.S., gaining at least 60% more value since February 2020 in seven of the 50 largest markets, with Tampa, Florida; Richmond, Virginia; and Charlotte, North Carolina leading the charge.

The study found that mortgage rate hikes did more damage to monthly payments as home prices rise. This helps explain why top-tier home values are falling fastest annually in some of the most-expensive markets: San Francisco (-14%), San Jose (-11%), and Seattle (-11%).

A slight annual recovery in housing inventory has left out entry-level shoppers, as there are just 1% more homes available for sale in the bottom price tier, compared to 8% and 13% more in the slower-moving middle and top tiers, respectively.

Rate lock is contributing to a lower flow of new listings across price tiers. March saw record-low new listings for this time of year, down 22% from last year. But rate lock is having the biggest impact on entry-level buyers in expensive West Coast markets. San Jose, San Francisco, Sacramento, Portland, and Seattle all have fewer than half as many new bottom-tier listings in March compared to last year.

In the recent past, entry-level shoppers had an easier time finding discounts than their well-heeled colleagues, but that comparative benefit is gone now, too. The share of mid- and top-tier homes that sold above list price rose far above the bottom-tier share through most of the pandemic. Super-low rates had cranked up demand for more-expensive houses. But after mortgage rates peaked at 7% last fall, the share sold above list price for all three tiers converged; now they're tracking together.

Click here [1] for on Zillow’s analysis of entry-level home shoppers.