Home prices are still rising due to buyer demand and low inventories, supported by low mortgage rates, eased lending standards, and improving job markets, but they are doing so at a much slower pace. Does the home price slowdown mean that the housing market is beginning to stabilize?

Home prices are still rising due to buyer demand and low inventories, supported by low mortgage rates, eased lending standards, and improving job markets, but they are doing so at a much slower pace. Does the home price slowdown mean that the housing market is beginning to stabilize?

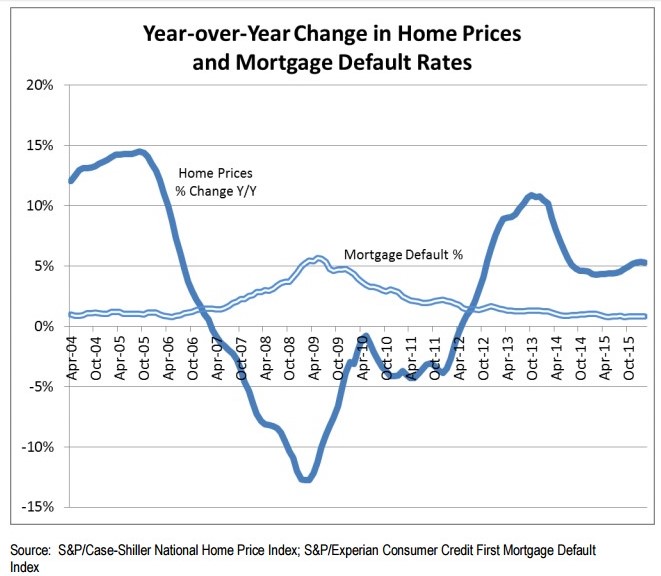

The S&P/Case-Shiller U.S. National Home Price Index (HPI) released Tuesday found that home prices 5.3 percent year-over-year in February 2016, flat from last month. Month-over-month, home prices only rose 0.2 percent from January to February.

According to the report, the 10-city composite increased 4.6 percent year-over-year in February, compared to 5.0 percent previously. Meanwhile, the 20-city composite’s year-over-year gain was 5.4 percent, down from 5.7 percent. The 10-city composite recorded a 0.1 percent month-over-month increase, while the 20-city composite posted a 0.2 percent increase in February.

"While one month does not make a trend, this is a sign that the U.S. housing market may be stabilizing in the wake of strong price appreciation between 2012 and 2014," said Ralph B. McLaughlin, Chief Economist at Trulia. "While the S&P/Case-Shiller National Home Price Index is an important metric to watch, it’s worth noting that the measure is more reflective of price movements in premium homes rather than middle or lower tier homes."

The HPI report found that Portland (11.9 percent), Seattle (11.0 percent), and Denver (9.7 percent) reported the highest year-over-year gains among the 20 cities. Seven cities reported greater price increases in the year ending February 2016 versus the year ending January 2016.

David M. Blitzer, Managing Director and Chairman of the Index Committee at S&P Dow Jones Indices, said, "Home prices continue to rise twice as fast as inflation, but the pace is easing off in the most recent numbers. The year-over-year figures for the 10-city and 20-city composites both slowed and 13 of the 20 cities saw slower year-over-year numbers compared to last month. The slower growth rate is evident in the monthly seasonally adjusted numbers: six cities experienced smaller monthly gains in February compared to January, when no city saw growth."

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news