While some homeowners can comfortably manage their housing costs, many others remain financially distressed. A new survey from LendingTree revealed nearly 18 million owner-occupied households are housing-cost burdened.

While some homeowners can comfortably manage their housing costs, many others remain financially distressed. A new survey from LendingTree revealed nearly 18 million owner-occupied households are housing-cost burdened.

What housing cost-burdened looks like varies by homeowner. To define it, those who spend at least 31% of their monthly income on housing costs — including their mortgage payment and other costs like insurance and utilities — are considered cost-burdened.

LendingTree analyzed U.S. Census Bureau American Community Survey data to determine the share of owner-occupied households in each state spending at least 31% of their income on monthly housing costs.

Millions of owner-occupied households across the country are cost-burdened, and some types of households — like those headed by single mothers — are much more likely to overspend on housing costs than others.

Key Findings:

- Some 21.48% of owner-occupied households in the U.S. are housing cost-burdened. To put that into perspective, 17,768,140 owner-occupied homes are cost-burdened.

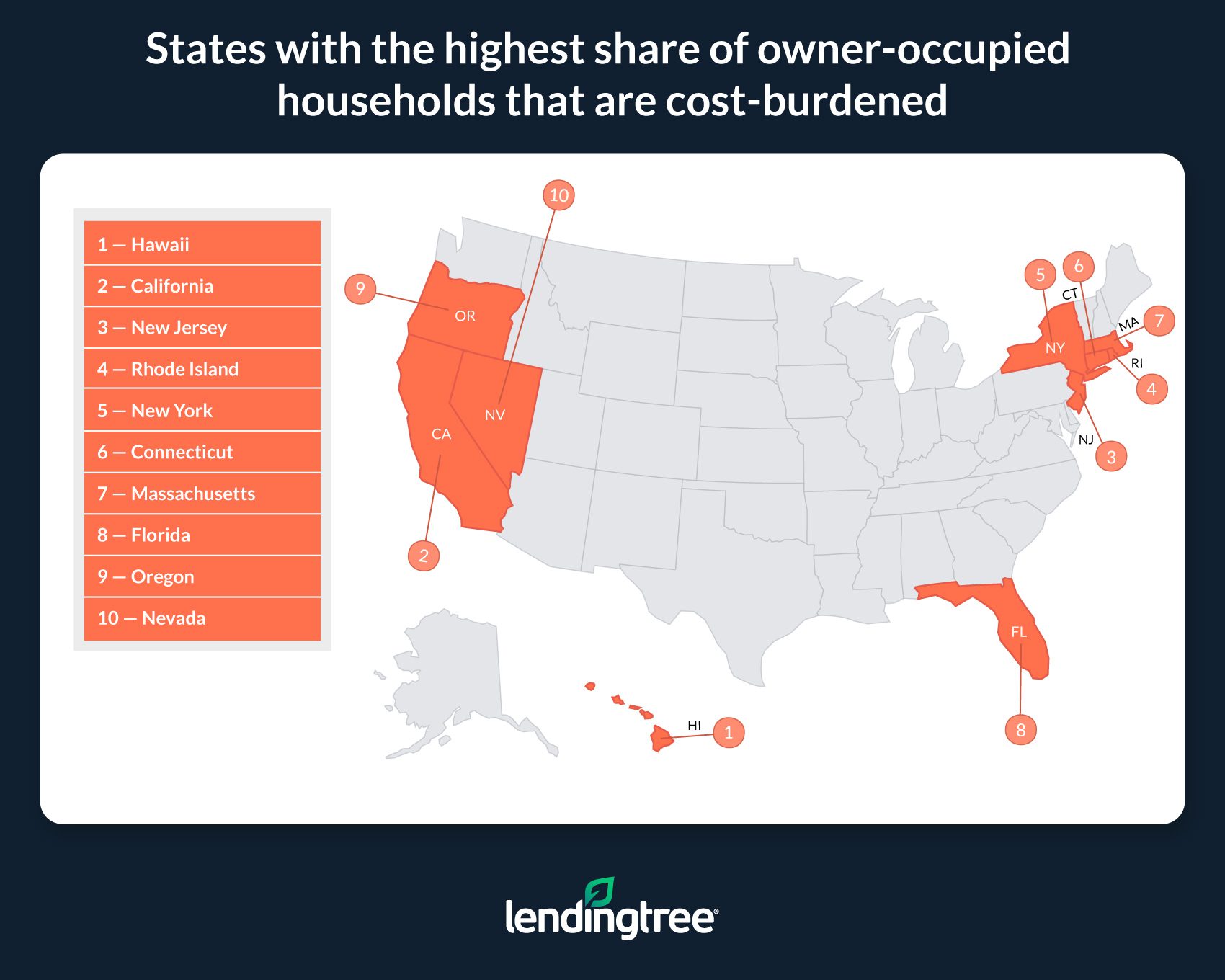

- Hawaii, California and New Jersey have the largest share of cost-burdened homes. An average of 29.98% of owner-occupied households in these states are housing cost-burdened.

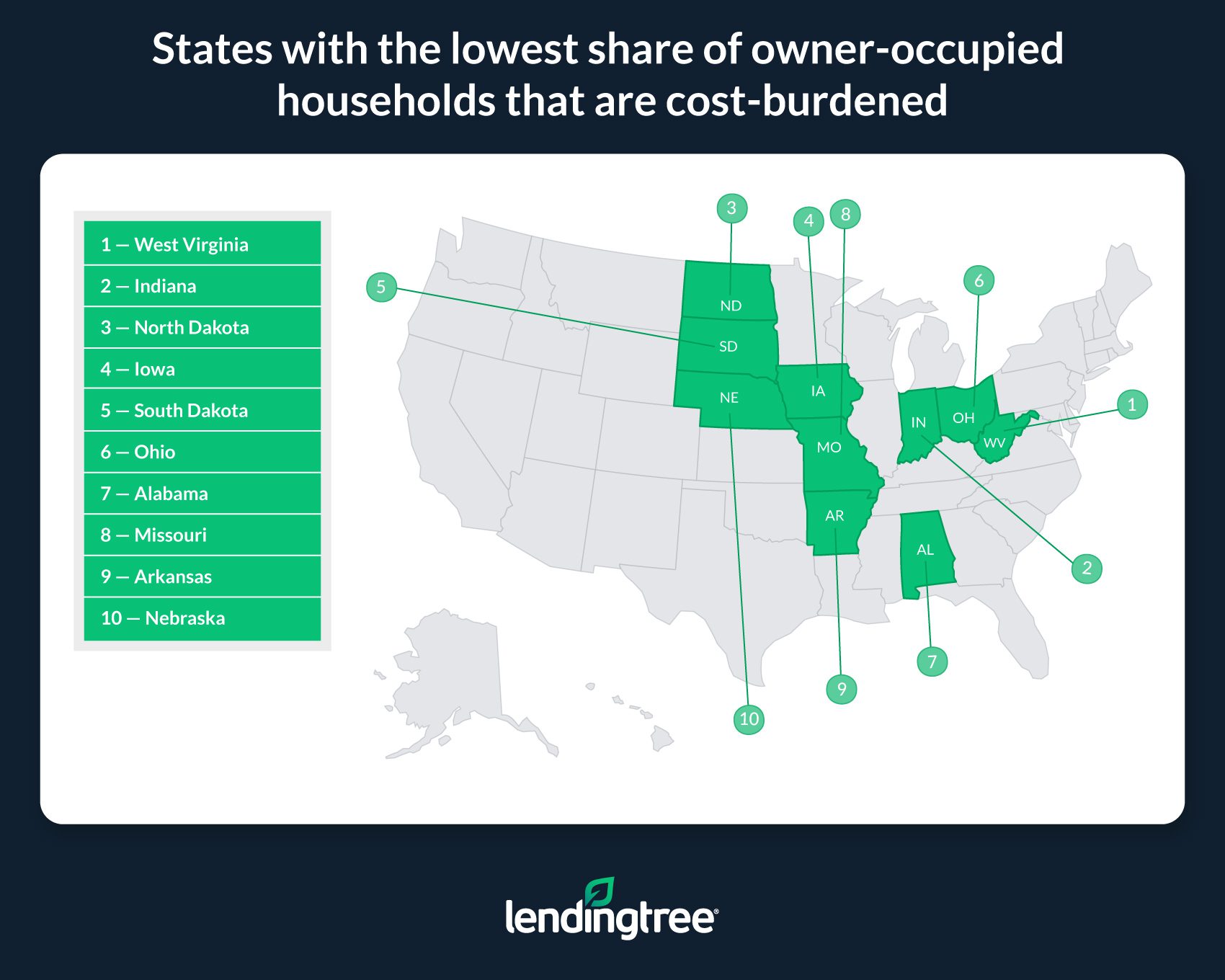

- The least cost-burdened states are West Virginia, Indiana and North Dakota. Across these states, an average of 14.97% of owner-occupied households are housing cost-burdened.

- Married couple households are least likely to be housing cost-burdened. Nationwide, 14.47% of owner-occupied households headed by married couples without children younger than 18 living at home are cost-burdened. The share is slightly higher for couples with kids at home at 15.80%. While dealing with housing costs generally appears more challenging for people whose kids live with them, married couples across the board tend to earn enough money to comfortably manage their housing expenses.

- Single women homeowners are most likely to be housing cost-burdened. An estimated 39.62% of single women homeowners who live by themselves and 43.31% of single women homeowners with children younger than 18 are housing cost-burdened.

- Though single men aren’t as burdened by housing costs as single women, they still face more difficulty than married couples. Some 32.59% of single men homeowners who live by themselves are housing cost-burdened, versus 30.36% of single men homeowners with children younger than 18. Single men are the only group where parents with children younger than 18 living at home are less likely to be cost-burdened.

States with the highest share of housing cost-burdened owner-occupied households

No. 1: Hawaii

- Share of housing cost-burdened households: 31.81%

- Share of households owned and occupied by married couples with children younger than 18 that are housing cost-burdened: 29.75%

- Share of households owned and occupied by married couples without children younger than 18 that are housing cost-burdened: 22.52%

- Share of households owned and occupied by single women who live alone that are housing cost-burdened: 57.10%

- Share of households owned and occupied by single mothers with children younger than 18 that are housing cost-burdened: 59.37%

- Share of households owned and occupied by single men who live alone that are housing cost-burdened: 46.83%

- Share of households owned and occupied by single fathers with children younger than 18 that are housing cost-burdened: 48.19%

No. 2: California

- Share of housing cost-burdened households: 29.65%

- Share of households owned and occupied by married couples with children younger than 18 that are housing cost-burdened: 24.83%

- Share of households owned and occupied by married couples without children younger than 18 that are housing cost-burdened: 22.91%

- Share of households owned and occupied by single women who live alone that are housing cost-burdened: 49.66%

- Share of households owned and occupied by single mothers with children younger than 18 that are housing cost-burdened: 50.51%

- Share of households owned and occupied by single men who live alone that are housing cost-burdened: 42.92%

- Share of households owned and occupied by single fathers with children younger than 18 that are housing cost-burdened: 39.05%

No. 3: New Jersey

- Share of housing cost-burdened households: 28.47%

- Share of households owned and occupied by married couples with children younger than 18 that are housing cost-burdened: 20.54%

- Share of households owned and occupied by married couples without children younger than 18 that are housing cost-burdened: 20.24%

- Share of households owned and occupied by single women who live alone that are housing cost-burdened:52.17%

- Share of households owned and occupied by single mothers with children younger than 18 that are housing cost-burdened: 56.51%

- Share of households owned and occupied by single men who live alone that are housing cost-burdened: 43.83%

- Share of households owned and occupied by single fathers with children younger than 18 that are housing cost-burdened: 39.10%

States with the lowest share of housing cost-burdened owner-occupied households

No. 1: West Virginia

- Share of housing cost-burdened households: 14.28%

- Share of households owned and occupied by married couples with children younger than 18 that are housing cost-burdened:10.00%

- Share of households owned and occupied by married couples without children younger than 18 that are housing cost-burdened: 7.70%

- Share of households owned and occupied by single women who live alone that are housing cost-burdened: 27.13%

- Share of households owned and occupied by single mothers with children younger than 18 that are housing cost-burdened: 27.69%

- Share of households owned and occupied by single men who live alone that are housing cost-burdened: 23.11%

- Share of households owned and occupied by single fathers with children younger than 18 that are housing cost-burdened: 32.73%

No. 2: Indiana

- Share of housing cost-burdened households: 15.05%

- Share of households owned and occupied by married couples with children younger than 18 that are housing cost-burdened: 9.78%

- Share of households owned and occupied by married couples without children younger than 18 that are housing cost-burdened: 8.19%

- Share of households owned and occupied by single women who live alone that are housing cost-burdened: 32.81%

- Share of households owned and occupied by single mothers with children younger than 18 that are housing cost-burdened: 35.28%

- Share of households owned and occupied by single men who live alone that are housing cost-burdened: 24.19%

- Share of households owned and occupied by single fathers with children younger than 18 that are housing cost-burdened: 23.71%

No. 3: North Dakota

- Share of housing cost-burdened households: 15.57%

- Share of households owned and occupied by married couples with children younger than 18 that are housing cost-burdened: 10.16%

- Share of households owned and occupied by married couples without children younger than 18 that are housing cost-burdened: 10.19%

- Share of households owned and occupied by single women who live alone that are housing cost-burdened: 29.31%

- Share of households owned and occupied by single mothers with children younger than 18 that are housing cost-burdened: 58.85%

- Share of households owned and occupied by single men who live alone that are housing cost-burdened: 26.40%

- Share of households owned and occupied by single fathers with children younger than 18 that are housing cost-burdened: 16.40%

It’s well-known that owning or buying a home can be an expensive investment and process. While some homeowners can comfortably manage their housing costs, others remain housing cost-burdened and unable to.

To read the full report, including more data, tips, charts and methodology, click here.

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news