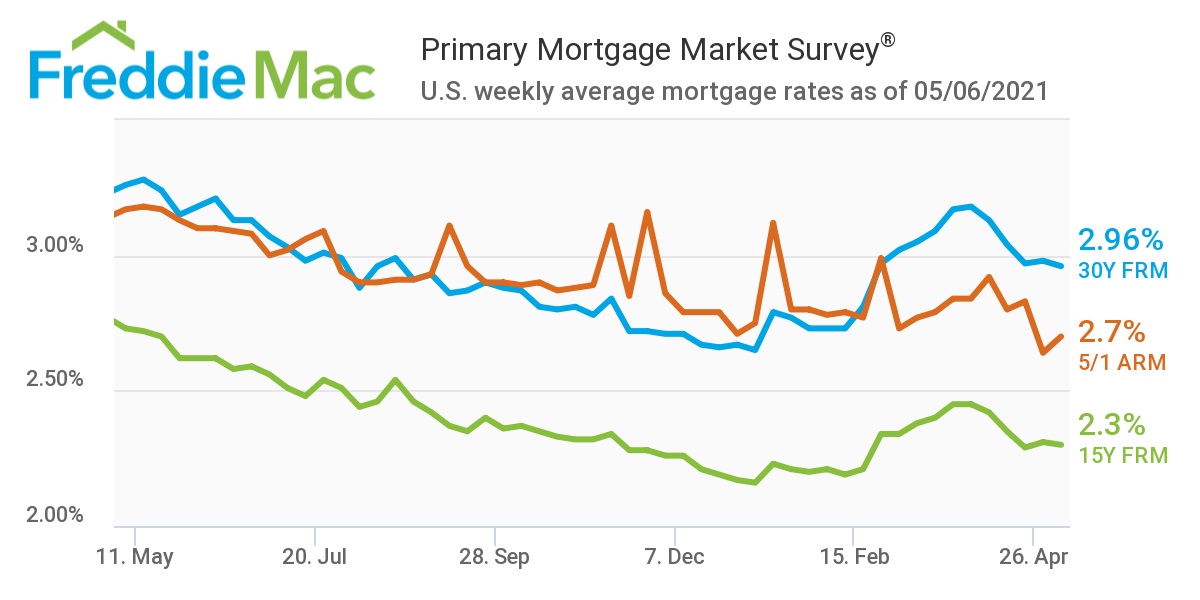

Mortgage rates remained under 3% this week, as Freddie Mac reported the 30-year fixed-rate mortgage (FRM) at an average of 2.96%, down two basis points from last week’s average of 2.98%.

Mortgage rates remained under 3% this week, as Freddie Mac reported the 30-year fixed-rate mortgage (FRM) at an average of 2.96%, down two basis points from last week’s average of 2.98%.

“Investors reacted to the unexpected decline in Treasury yields, especially following the slate of positive news this week, including jobless claims dropping below 500,000 for the first time since the pandemic declaration, strong April car and light truck sales, as well as higher factory orders and private payrolls,” said realtor.com Senior Economist George Ratiu.

A year ago at this time, the 30-year FRM averaged 3.26%.

More are returning to the workforce, as the U.S. Department of Labor’s latest report on unemployment insurance claims found a weekly decrease of 92,000 in claims from the previous week's revised level, the lowest level for initial claims since March 14, 2020 when it was at 256,000.

“Consumer income and spending are picking up, which is leading to an acceleration in economic growth,” said Sam Khater, Freddie Mac’s Chief Economist. “The combination of low and stable rates, coupled with an improving economy, is good for homebuyers. It’s also good for homeowners who may have missed prior opportunities to refinance and increase their monthly cash flow.”

Those missed refi opportunities that are now being taken care of are evidenced in this week’s Market Composite Index from the Mortgage Bankers Association (MBA). While overall mortgage application volume dropped by .09% in one week, the refinance share of mortgage activity increased to 61.0% of total applications, up from 60.6% the previous week.

“Real estate markets continue to see asking prices near record highs, as the favorable financing environment has motivated buyers to keep searching for homes, even amid tight inventory,” said Ratiu. “On a promising note, the latest weekly update from realtor.com shows that the number of sellers choosing to list their home is growing, as a rising number of large states, including Florida, New York, and New Jersey announced they are loosening or removing COVID restrictions. For first-time homebuyers, rising inventory and low interest rates open the window of opportunity wider as we move through May, hinting that we might see price gains begin to moderate.”

Realtor.com reports median listing prices grew at 15.4% over last year, marking 38 consecutive weeks of double-digit price growth. Home price gains garnered momentum for a second straight week, with median home listing prices stood at record highs, with the national median price reaching $375,000 in April.

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news