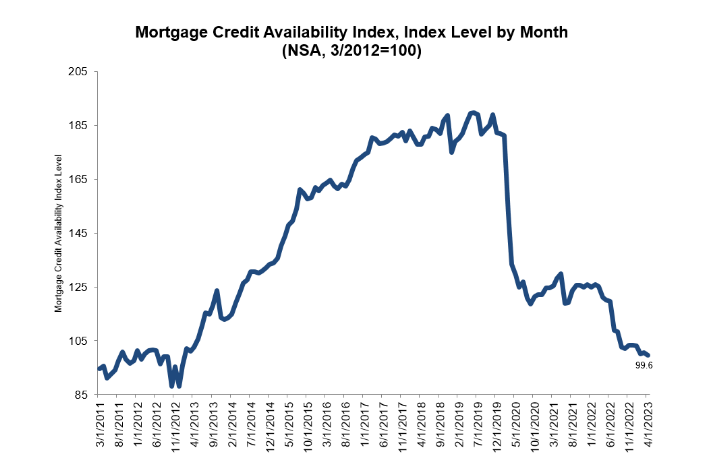

According to new research from the Mortgage Bankers Association (MBA), consumers credit availability decreased in April 2023 as reported by the Mortgage Credit Availability Index (MCAI) which uses data from the ICE Mortgage Technology.

According to new research from the Mortgage Bankers Association (MBA), consumers credit availability decreased in April 2023 as reported by the Mortgage Credit Availability Index (MCAI) which uses data from the ICE Mortgage Technology.

The MCAI fell by 0.9% to 99.6 in April. A decline in the MCAI indicates that lending standards are tightening, while increases in the index are indicative of loosening credit. The index was benchmarked to 100 in March 2012.

Also, the Conventional MCAI increased 0.5%, while the Government MCAI decreased by 2.1%. Of the component indices of the Conventional MCAI, the Jumbo MCAI increased by 1.5%, and the Conforming MCAI fell by 1.1%.

“Mortgage credit availability declined in April to the lowest level since January 2013, reflecting the tightening in broader credit conditions stemming from recent banking sector challenges and an uncertain economic outlook,” said Joel Kan, MBA’s VP and Deputy Chief Economist. “The contraction was driven by reduced demand for loan programs such as certain adjustable-rate mortgages loans, cash-out and streamline refinances, and those with lower credit score requirements. Government credit supply decreased for the third consecutive month, as industry capacity continues to adjust to significantly reduced origination volume, along with the expectations of a weakening economy later this year.”

Added Kan, “Even with high mortgage rates and reduced credit availability, the lack of for-sale inventory continues to be the biggest hurdle to more home purchase growth this year.”

The MCAI fell by 0.9% to 99.6 in April. The Conventional MCAI increased 0.5%, while the Government MCAI decreased by 2.1%. Of the component indices of the Conventional MCAI, the Jumbo MCAI increased by 1.5%, and the Conforming MCAI fell by 1.1%.

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news