HouseCanary, Inc. has released its latest National Rental Report, which compares insights from Q1 2022 and Q1 2023 to explore trends shaping the U.S. rental market for single-family detached listings, including price and supply shifts across the nation’s top 79 metropolitan statistical areas (MSA) with the most rental market activity.

HouseCanary tracks listing volume, new listings, and median listing price information for 46 states and 204 individual MSAs. The findings in today’s report represent an aggregation and summary of all single-family detached listing records between January 2020 and March 2023.

"High unaffordability and the uncertainty of where the housing market is headed has slowed down property acquisitions heavily, resulting in potential buyers minimizing risk by looking towards the single-family rental market," said Chris Stroud, Co-Founder and Chief of Research at HouseCanary. "Additionally, given that rent inflation has such a significant influence on overall inflation, a decline in rent inflation will have to come from apartments and multifamily in order to bring some relief to overall inflation."

Following a thorough analysis of the aggregated data, HouseCanary’s report identified the following key findings about the rental market for single-family detached listings in Q1 of 2023:

- Rental properties stayed on the market for an average of 30.4 days at the end of Q1 2023, roughly a 43.4% increase compared to Q1 2022 and a 12.6% increase sequentially. Over 35 MSAs saw a 50% increase in average days on market over the last year, most notably in the Southeast, with New Orleans, Raleigh, N.C. and Durham, N.C. seeing the most significant increases.

- Inflation continues to impact the housing market. Mortgage rates hit a two-month low in Q1 2023 and are now hovering just above 6%. This has helped stabilize purchase demand, bringing more potential renters into the market. The next few months will be very telling for the future of the single-family rental market, as increasing mortgage rates will likely continue to push potential homebuyers into the rental market.

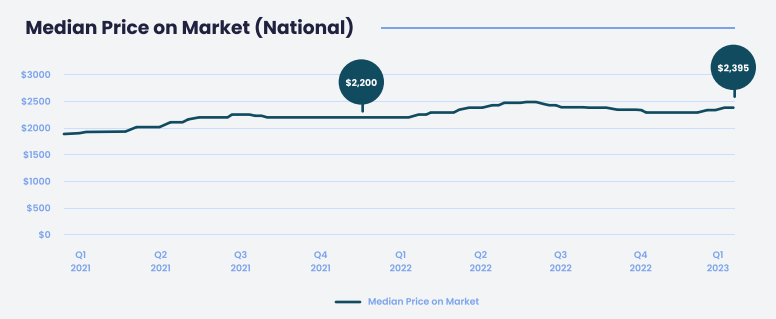

- Median national rent has increased 6% since the same time last year. The seasonal cooling in the rental market seen at the end of 2022 quickly reversed in Q1 2023, as many homebuyers waiting for the homebuying market to cool cut their losses and began renting, pushing rental prices upwards.

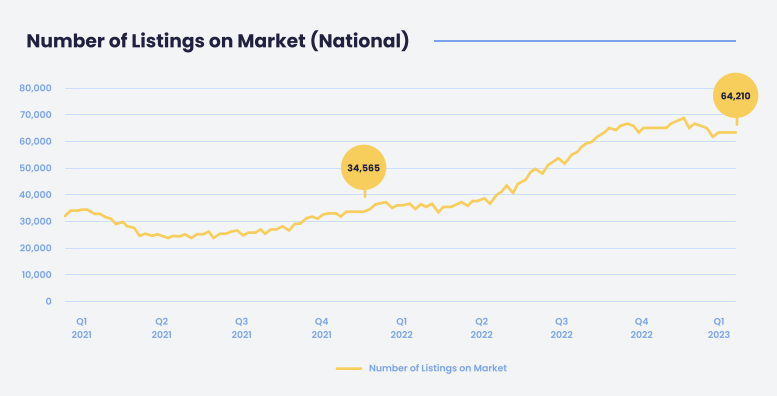

- Rental prices continue to remain high despite increasing supply. Regardless of the number of bedrooms, all rentals saw a year-over-year increase in price with the highest increase being in one bedroom rentals, which saw a 10.8% year-over-year increase.

- The South experienced the largest year-over-year growth rates in rental inventory out of any regions in the U.S. In addition, rental properties in Southern states also experienced the highest growth rates for how long they stayed on the market.

Mortgage rates are now above 6%, causing demand and future demand for purchases to stabilize, according to the Mortgage Applications Index from MBA. With demand being at historically low numbers, potential home buyers waiting on the sidelines are increasing the demand for rentals. Additionally, given that rent inflation has such a significant influence on overall inflation, a decline in rent inflation will have to come from apartments and multifamily in order to bring some relief to overall inflation.

To read the full report, including more data, charts and methodology, click here.

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news