Positive data indicators in the growing single-family rental (SFR) market signal ample opportunities for investors to profit and flourish in this space. Which markets provide the most opportunity for SFR investors?

Positive data indicators in the growing single-family rental (SFR) market signal ample opportunities for investors to profit and flourish in this space. Which markets provide the most opportunity for SFR investors?

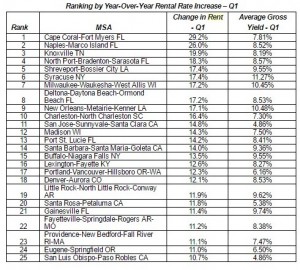

RentRange identified the top 25 metropolitan statistical areas (MSAs) with the largest rental rate increases from last year and highest gross yields, or the total annual income an investor receives from an investment property divided by the price or value for the property, for the first quarter of 2016.

The report showed that Florida cities led single-family rental price growth for the first quarter and Wisconsin and New York should be on investors' watch list for the year.

“The single-family rental market across the U.S. continues to offer significant opportunity for investors,” said Wally Charnoff at RentRange. “The robust data available today empowers even non-institutional investors to analyze geographies and select the investment locations throughout the U.S. that are most opportune, as opposed to being limited to their own backyard."

According to the market data and analytics provider for the single-family rental industry, three new markets joined the top 10 spots on the list this quarter:

According to the market data and analytics provider for the single-family rental industry, three new markets joined the top 10 spots on the list this quarter:

The RentRange data shows a shake-up in the top 25 MSAs for rental rate increases, with three new markets taking spots in the top 10 compared to last quarter: Naples-Marco Island, FL, Syracuse, NY and Milwaukee-Waukesha-West Allis, WI.

CEO of Invitation Homes, John Bartling, said in an interview that SFR offers tremendous opportunities for investors to realize an attractive risk adjusted return.

"As an industry, the U.S. housing economy is evolving, rental demand is surging, and professionally-managed single-family rental homes will continue to be a desirable option, with a quality of choice, for many Americans," he said. "At the same time, the industry is maturing and investors are becoming more sophisticated about the asset class."

MReport recently talked with Fiona Simmonds, Chief Development and Administration Office for B2R Finance to discuss the rental market, what investors need to know going in, and the role technology plays in the space.

Simmonds stressed the importance of having an education about financing options in the single-family rental market.

"There are a number of different ways to apply for financing, everything from traditional banks and government entities all the way to the other end of the spectrum, hard money lenders," Simmonds said. "Each one of those comes with its own set of rules and regulations that may work for some investors and may not work for others. That also depends on the number of houses that you have as well, so those parameters may change as your portfolio grows."

On the technology front, Simmonds added, "getting a mortgage has been one of the most difficult processes for anyone, whether it’s owner-occupied or otherwise. We want to help alleviate some of the pain points. This doesn’t indicate that there are lower requirements when it comes to borrower qualifications, but all things being equal, having technology helps facilitate the application process. We see that as a huge differentiator."

Morningstar’s April 2016 Performance Summary Covering All Morningstar-Related Securitizations found that March’s property-level data for 24 single-family rental securitizations showed a “stable” performance for the single-borrower, single-family rental asset class.

“Vacancy rates and delinquency rates generally remained steady or improved,” authors Brian Alan, Brian Sandler, and Rohit Jadhav wrote. “Retention rates remained high for majority of the deals. Turnover rates increased for the third consecutive month in line with the increase in lease expirations.”

The Five Star Institute President and CEO, Ed Delgado, recently announced the formation of the Single-Family Rental Association (SFRA), a member-led conduit for connection and training in the growing single-family rental market. The SFRA will lead the single-family rental sector in identifying emerging trends, discussing solutions, and formulating best practices. Click here to apply for membership.

“The Single-Family Rental Association will be leading the dialogue on best practices and new business opportunities in the single-family rental market,” Delgado said. “The SFRA will fill the gap as a resource for a sector that has been largely underserved and often misrepresented.”

The SFRA will offer ongoing training and education, networking, and business opportunities, in conjunction with the Five Star Institute’s Second Annual Single-Family Rental Summit on November 1-3, 2016 at the Frisco Conference Center at the Embassy Suites Hotel, Frisco, Texas.

Click here to register for this event.

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news