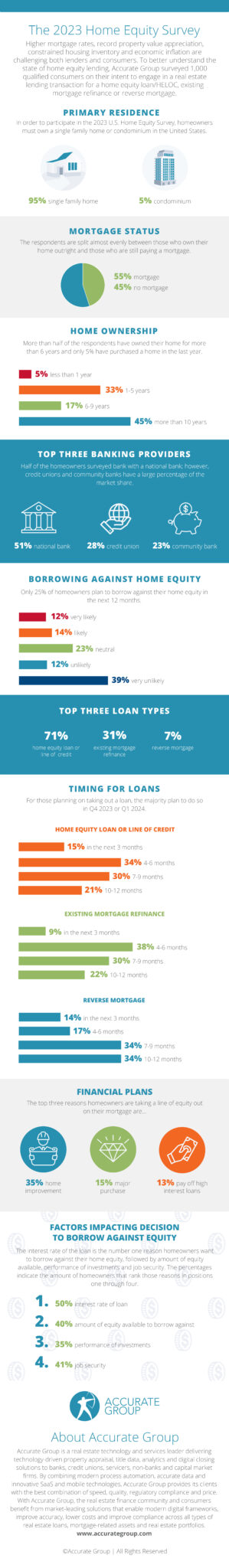

According to the first quarter 2023 U.S. Housing Equity Loan Survey [1] published by the Accurate Group [2], which is a provider of real estate appraisal, title data, analytics, and e-closing solutions, which polled 1,000 consumers nationwide and is designed to capture homeowner intentions and tolerances for engaging in the real estate market over the next year. Specifically, the survey focuses on how homeowners plan to leverage home equity; questions centered around the likelihood of homeowners to apply for a home equity line of credit or mortgage...or refinanance an existing mortgage or utilize a reverse mortgage.

According to the first quarter 2023 U.S. Housing Equity Loan Survey [1] published by the Accurate Group [2], which is a provider of real estate appraisal, title data, analytics, and e-closing solutions, which polled 1,000 consumers nationwide and is designed to capture homeowner intentions and tolerances for engaging in the real estate market over the next year. Specifically, the survey focuses on how homeowners plan to leverage home equity; questions centered around the likelihood of homeowners to apply for a home equity line of credit or mortgage...or refinanance an existing mortgage or utilize a reverse mortgage.

The intent of the survey is to provide lenders, loan services, and originators with critical insights into borrowers’ plans to participate in the real estate lending market during this time of national—and global—economic uncertainty and high interest rates which are poised to increase even higher in the months to come.

Key findings of the survey as highlighted by the Accurate Group’s survey include:

- 26% of homeowners are very likely or likely to borrow against their home equity in the next 12 months; 51% are unlikely or very unlikely to borrow against their home equity; 23% are neutral.

- 71% of homeowners plan to take out a home equity loan or line of credit (HELOC)

- 31% of homeowners plan to refinance a mortgage

- 7% of homeowners plan to take out a reverse mortgage

Top three reasons homeowners are taking out a HELOC:

- 35% for home improvement

- 15% for a major purchase

- 13% to pay off high interest loans

Four biggest factors impacting a decision to borrow against equity:

- 50% interest rate of the loan

- 40% amount of equity available to borrow against

- 35% performance of financial investments

- 41% job security

“Higher mortgage rates, record levels of home price appreciation, constrained housing inventories and economic inflation are challenging for both lenders and borrowers,” said Paul Doman [3], President and CEO of Accurate Group. “We conducted this survey to give lenders, loan services and originators better insight into homeowner sentiment to help them plan appropriately and identify strategic opportunities for loan volume growth. This report sheds light on what lenders could expect in the next 12 months as they navigate the evolving real estate market.”