Although a debt default is very unlikely, new scenario projections from Zillow show home sales would decrease sharply [1] as mortgage costs balloon, and would send the U.S. housing market back into a deep freeze.

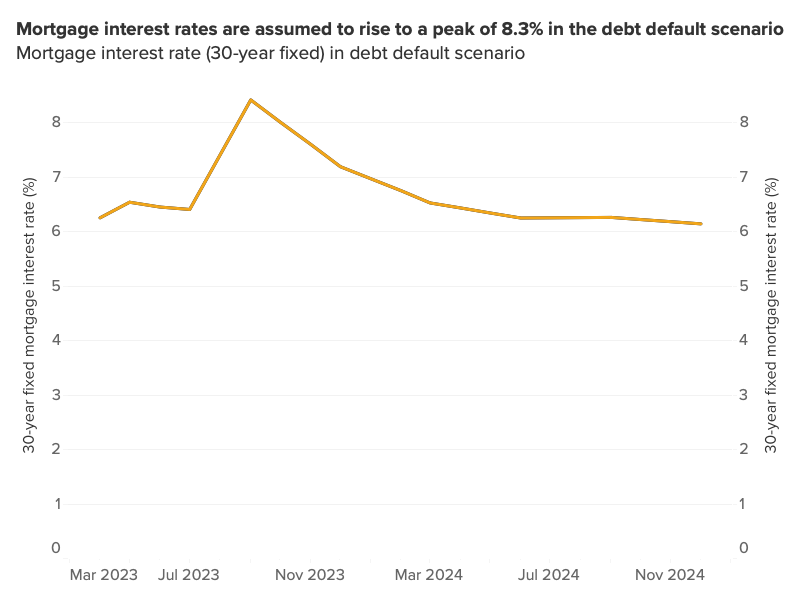

New data revealed the U.S. government defaulting on its debt could send the typical cost of a mortgage soaring by a whopping 22%. Mortgage rates rising above 8% would likely overwhelm a small price dip to make affording a home even more difficult and send home sales tumbling, according to the new Zillow analysis.

The U.S. has never defaulted on its debt, and it is very unlikely that the U.S. will fail to pay its debts now. This analysis projects what might happen in the unlikely worst-case scenario of a prolonged default, and is not a prediction that a default will occur.

Key findings:

- Home sales volume would likely decline sharply, with projected deficits of up to 23% fewer sales in the hardest hit month in a severe debt default scenario, than otherwise expected.

- Home values could be 5% lower than in our baseline, no-default forecast by the end of 2024 in the unlikely event of a debt default.

- Home values would not lose much ground, according to Zillow's analysis, but a sharp rise in mortgage rates would do further damage to housing affordability.

- Much uncertainty surrounds these estimates, but there’s little doubt that a default would be a major negative shock to housing market activity.

- Mortgage rates could reach 8.4% in the unlikely event of a debt default, sending the mortgage payment on a typical home 22% higher by September.

- Home sales activity might fall by nearly one-quarter from current projections at its lowest point, in September.

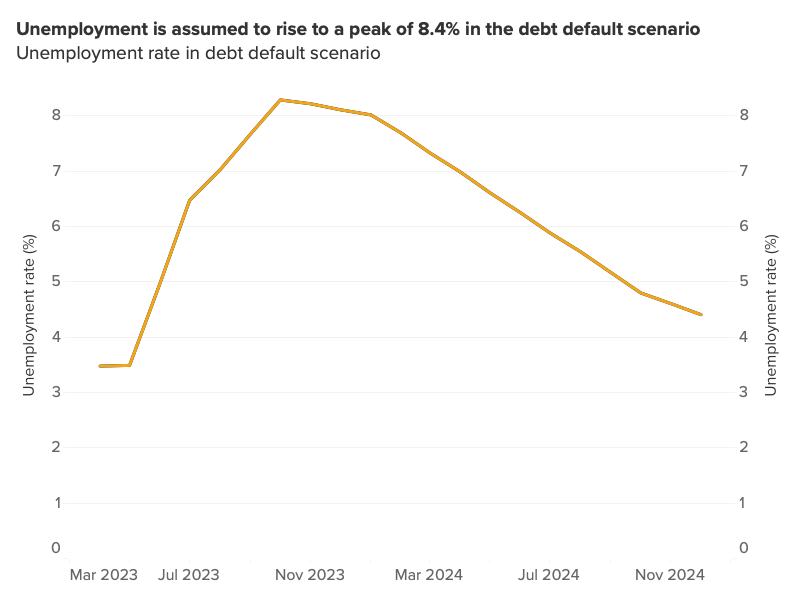

A debt default would almost certainly mean severe disruption for the economy, with the ripple effects taking their toll on the housing market. One highly likely consequence would be rising interest rates — including mortgage rates — as shaken confidence in Treasury [2] bills being repaid means investors would require a greater return before purchasing them. Mortgage rates tend to follow Treasury rates and would be expected to rise as a result.

"Homebuyers and sellers finally have been adjusting to mortgage rates over 6% this spring, but a debt default could potentially raise borrowing costs even higher and send the market into a deep freeze," said Zillow senior economist Jeff Tucker. "Home values might not see a notable drop, but higher mortgage rates would severely impair affordability, for first-time buyers especially. It is critically important to find a solution and not put more strain on Americans who are striving to achieve their homeownership dreams."

Home shoppers already are finding few options they can afford this spring, and it's estimated that a mortgage would cost 22% more in September in the event of a debt default than it otherwise would. That's on top of an 82% rise over the past two years.

A steep rise in mortgage rates — projected to peak at 8.4% in September in this scenario — would freeze sales in an already chilled market. If the affordability mountain grows even taller, fewer would-be homebuyers will be able to purchase a home. Higher mortgage rates also discourage homeowners, many of whom locked in their loans when mortgage rates were near 3%, from selling and reentering the market when their new loan would be much more costly.

Zillow projects this combined impact of homebuyers and home sellers pulling back would wipe nearly one-quarter of expected sales off the board in some months. If there were to be a debt default, the biggest projected deficit would come in September, with an estimated 23% fewer existing home sales.

Zillow economists don't expect home values would lose much ground, even with a default. Home values have turned the corner this spring, returning to growth near historical norms after a period of overheating and then a short-lived downturn. Home values tend to fall sharply when there is a glut of listings flooding the market, but very low inventory in this scenario would act as a parachute, keeping prices from falling too far, too fast.

Zillow forecasts that if the U.S. were to default on its debt, home values would begin to fall starting in August, but only by 1% from current levels through February 2024. Even in this pessimistic scenario, home values are expected to rise 1% from today to the end of next year. That's down from a current expectation of 6.5% growth over that period.

To read the full report, including more data, charts and methodology, click here [1].