CoreLogic has released its latest Single-Family Rent Index (SFRI), which analyzes single-family rent price changes nationally and across major metropolitan areas.

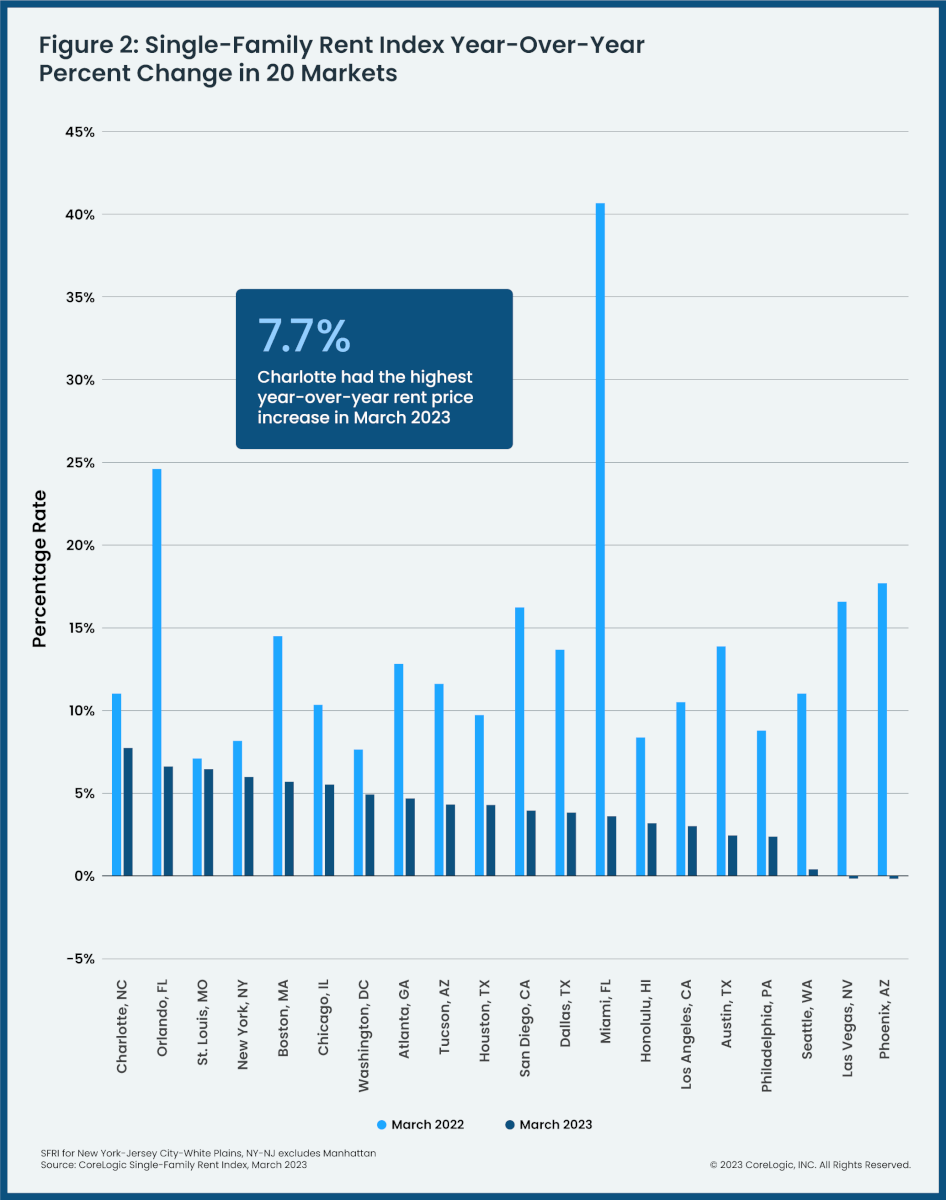

Annual single-family rent growth dipped to 4.3% in March, marking nearly a year of decelerating gains. All tracked metros posted lower rent growth than in March 2022. Las Vegas and Phoenix saw rents decline year-over-year, mirroring trends observed in CoreLogic’s most recent home price data. Charlotte, North Carolina topped the list for the highest rent growth in March, but the 7.7% increase for this metro was well below that of the 25-to-41% gains recorded for top metros in March 2022.

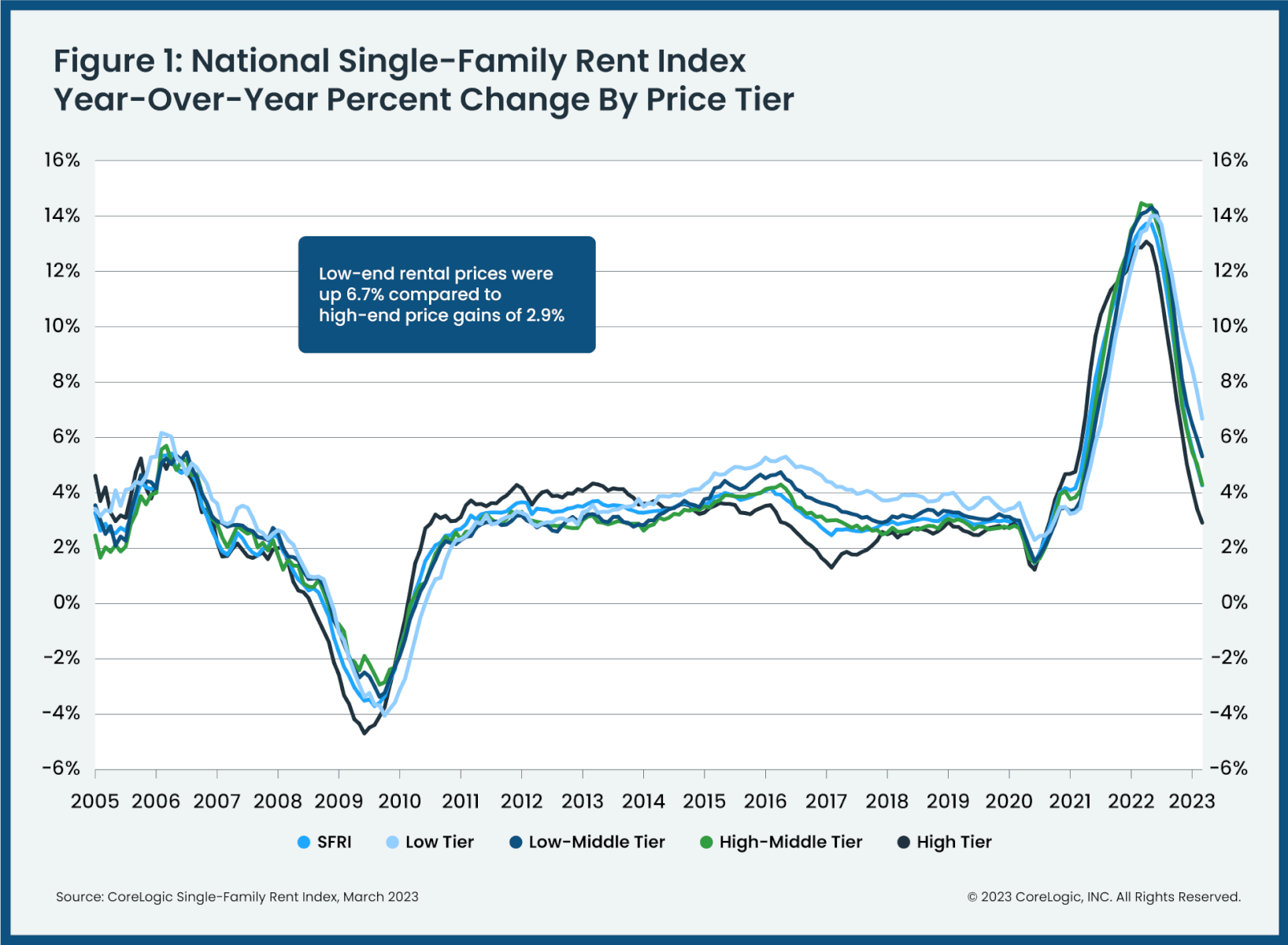

And while overall U.S. rent growth remains slightly elevated above pre-pandemic rates, higher-priced property gains are normalizing. In March, year-over-year rental cost growth slowed in all four price tiers that CoreLogic tracks, but the lowest tier posted the highest growth, suggesting that a lack of affordability continues to pressure tenants’ budgets amid a scarce inventory of lower-cost rentals. Furthermore, while rent growth slowed to its lowest rate since February 2021, single-family rents continued to increase, and the cumulative gain since February 2020 has totaled 23.2%.

“Single-family rent price gains continued to slow year over year in March, with growth at about one-third of the rate as observed one year earlier,” said Molly Boesel, principal economist at CoreLogic. “The slowdown is more pronounced in the higher-priced tier, where growth is now about the same as it was before the pandemic. However, gains in the lower tier are still twice the pre-pandemic rate, with all tracked metro areas posting increases at that price level.”

To gain a detailed view of single-family rental prices across different market segments, CoreLogic examines four tiers of rental prices and two property-type tiers. National single-family rent growth across those tiers, and the year-over-year changes, were as follows:

- Lower-priced (75% or less than the regional median): up 6.7%, down from 13.4% in March 2022.

- Lower-middle priced (75% to 100% of the regional median): up 5.3%, down from 14.1% in March 2022.

- Higher-middle priced (100% to 125% of the regional median): up 4.3%, down from 14.5% in March 2022.

- Higher-priced (125% or more than the regional median): up 2.9%, down from 12.9% in March 2022.

- Attached versus detached:Attached single-family rental prices grew by 5% year over year in March, compared with the 3.2% increase for detached rentals.

Charlotte, North Carolina posted the highest year-over-year increase in single-family rents in March 2023, at 7.7%. Orlando, Florida and St. Louis registered the next highest annual gains, a respective 6.6% and 6.4%. Las Vegas and Phoenix saw annual rent price declines, both at -0.2%.

The next CoreLogic Single-Family Rent Index will be released on June 20, 2023, featuring data for April 2023.

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news