Although interest rates have been at historical lows, they have been highly responsive to the general level of interest rates, causing originators' profits to suffer.

Although interest rates have been at historical lows, they have been highly responsive to the general level of interest rates, causing originators' profits to suffer.

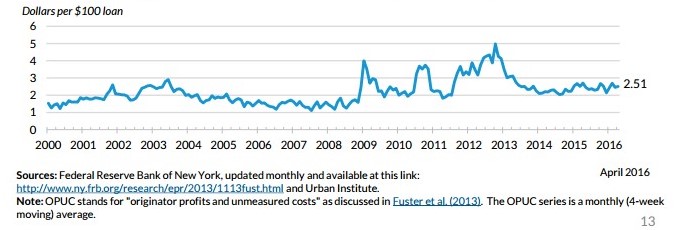

A report from Urban Institute found that originator profitability, which is a calculation from the Federal Reserve Bank of New York of the price at which the originator actually sells the mortgage into the secondary market and adds the value of retained servicing as well as points paid by the borrower, has been in the narrow range of 2.04 to 2.70 since 2014, and stood 2.51 in Apr 2016.

"When originator profitability is high, mortgage rates tend to be less responsive to the general level of interest rates, as originators are capacity-constrained," the report said.

Urban Institute also reported that first lien originations for the year of 2015 totaled approximately $1,735 billion. Portfolio originations made up 30 percent of this total, the data showed. FHA and VA and private label originations account for 23 percent and 0.7 percent, respectively.

Meanwhile, the GSE share fell to 46 percent from 47 percent in 2014, showing the decrease in FHA market share due to the FHA premium cut.

In January 2015, the Federal Housing Administration (FHA) announced a reduction of 0.50 percent to its annual mortgage insurance premium.

The FHA also noted that there would be positive benefits for middle-class and lower-income homebuyers, particularly first-time buyers, but this may not necessarily be the case according to data from the Urban Institute.

"This step is part of the President’s broader effort to expand responsible lending to creditworthy borrowers and increase access to sustainable rental housing for families not ready or wanting to buy a home," said The White House Office of the Press Secretary.

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news