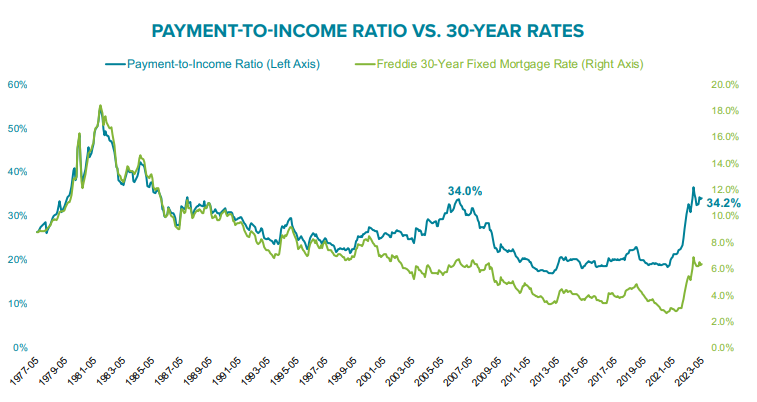

As 30-year mortgage rates rose again in May, each of the 100 largest U.S. markets remained less affordable than its own long-term average, according to Black Knight's latest Mortgage Monitor Report for April 2023 [1].

Nationally, it now takes 34.2% of the median household income to make principal and interest (P&I) payments on the median-priced home purchased with 20% down using a 30-year fixed-rate mortgage.

The Data & Analytics [2] division of Black Knight revealed that the spring homebuying season is defying historical norms, as this month’s report details the intersection of affordability, inventory, demand, and credit availability. As Black Knight VP of Enterprise Research Andy Walden explains, the challenges facing homebuyers—and the real estate and housing finance industries more widely—are only becoming more deeply entrenched as the months go on.

Key Findings:

- According to Optimal Blue rate lock data from Black Knight, after pulling within 15% of pre-pandemic levels on rate dips earlier this year, in recent weeks purchase activity fell back to a 34% deficit on shrinking demand.

- Likewise, rising borrower credit scores and down payments among recent rate locks point to the tightening of credit availability compounding the challenges facing potential homebuyers.

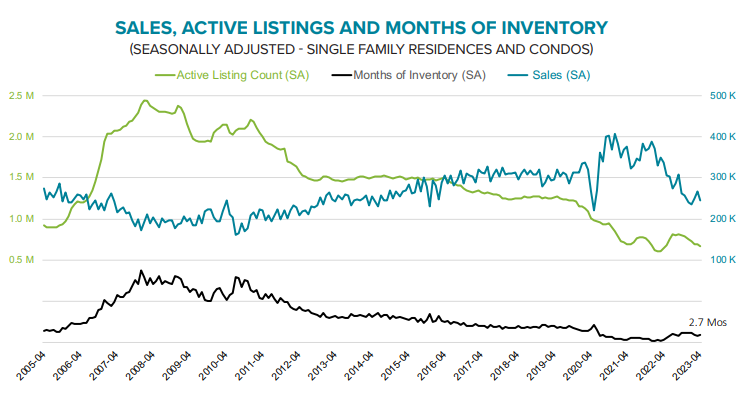

- Black Knight Collateral Analytics data showed home sales volumes fell in April, as a lack of both affordability and inventory continue to create major market headwinds.

- Having worsened in eight of the past nine months on a seasonally adjusted basis, for-sale inventory is now at its lowest level since April 2022, with inventory deteriorating in 95% of major markets since the start of 2023.

- This continues to put upward pressure on home prices this spring, with April marking the fourth consecutive monthly increase on a seasonally adjusted basis

- April’s seasonally adjusted +0.46% increase was roughly on par with the 30-year average of +0.48% for the month, and would equate to a 5.5% annualized growth rate if sustained for a 12-month period.

- Despite prices firming, annual growth slipped to 0.0% in April – marking the first time home prices have been flat year over year since the market began to recover in the wake of the 2007–2008 global financial crisis.

“In a sense, the gridlocked housing market has been feeding on itself,” said Walden. “While elevated interest rates continue to weigh on both affordability and demand, they’re simultaneously constricting supply as well as would-be sellers who locked in ultra-low rates early in the pandemic continue to sit on the sidelines. The combination of lower supply and demand in April led to both slowing sales and firming prices. As home sales dipped, April marked the fourth consecutive month of home price gains, which are now almost universally rising across the country again on a seasonally adjusted basis. Only Austin, Texas—the sole market where inventory is back above pre-pandemic levels—is still seeing meaningful price corrections continuing into the spring. In today’s market, interest rates are acting as a double-edged sword, reducing or increasing both demand and supply as they rise and fall, making it challenging to find a rate-driven path to easing affordability and home prices.

“Amidst all of this, we’re also beginning to see clear signs of tightening credit availability. Our Optimal Blue rate lock data shows that average credit scores and down payments are on the rise, with tightening credit compounding the significant challenges already facing potential home buyers and the origination market alike. According to our McDash loan-level mortgage performance dataset, April purchase credit scores were the highest on record, dating back to 2000, when Black Knight first started tracking the metric. Pullbacks in purchase rate lock volumes have continued, dropping 11% from the week ending March 25 to the week ending May 20, in what would typically be the heart of the homebuying season. Indeed, purchase locks have fallen back down to more than 30% below pre-pandemic levels, after pulling to within 15% on rate dips in mid-January and mid-March. Demand is obviously suffering, and the fact that this spring’s strengthening home prices have erased more than 60% of the ‘correction’ seen late last year isn’t likely to help much on that front.”

April's Mortgage Monitor Report also dives deeper into housing market trends at the geographical level. Along the West Coast, where inventory levels have pulled back again this spring, prices have begun to rise again, reversing some of the correction in prices from late last year. San Jose, CA—among the metros that saw the largest price corrections in 2022—ranked in the top 20% of markets in terms of single-month seasonally adjusted price gains in April (+0.8%), while San Diego prices were up by 0.9% and Seattle by +0.7% in the month.

Hartford, CT, (+1.3%)—the market with the largest inventory deficit nationwide, with 81% fewer active listings compared to pre-pandemic levels—experienced the largest single-month price gains, followed by Milwaukee (+1.2%), Detroit (+1.1%), Cleveland (+0.9%), Columbus, Ohio (+.9%), and Boston (+.9%). If sustained, Hartford’s monthly gains would equate to an annual home price growth rate of 15.3%, again sparking the risk of a reheating housing market should inventory shortages persist.

Price strengthening this spring has erased more than 60% of the declines seen late last year at the national level, and at the current rate of growth would fully erase those corrections by mid-2023.

To read the full report, including more data, charts and methodology, click here [1].