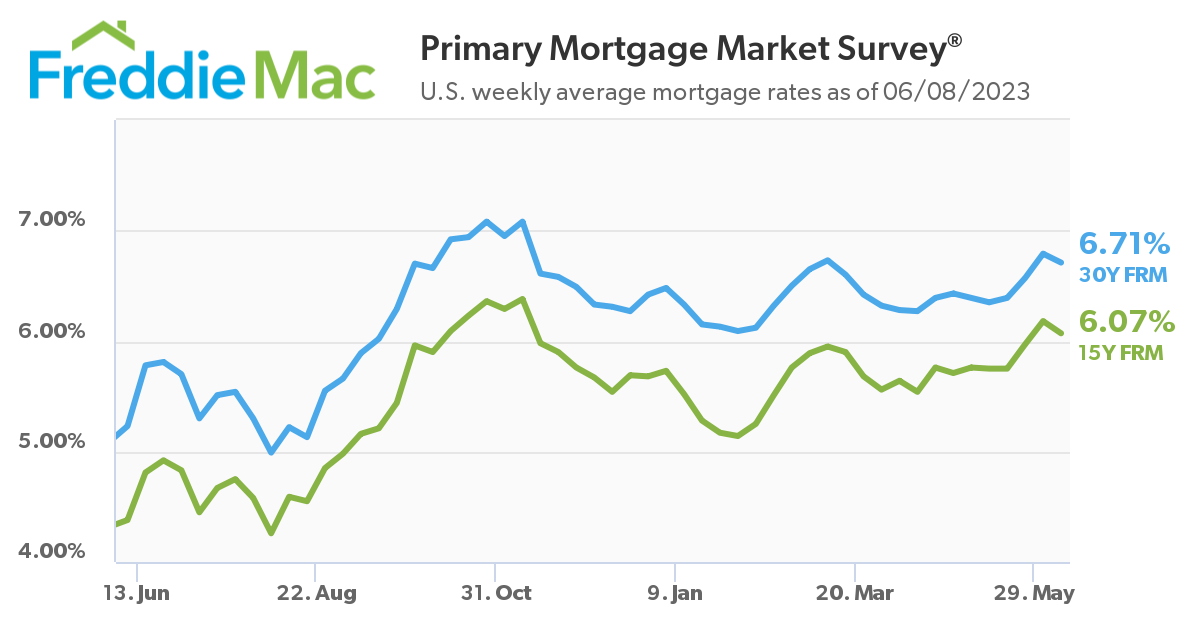

After climbing the past three weeks closer to the 7%-mark, Freddie Mac has reported the 30-year fixed-rate mortgage (FRM) averaging 6.71% for the week ending June 8, 2023, down from last week’s reading of 6.79%. A year ago at this time, the 30-year FRM averaged 5.23%.

After climbing the past three weeks closer to the 7%-mark, Freddie Mac has reported the 30-year fixed-rate mortgage (FRM) averaging 6.71% for the week ending June 8, 2023, down from last week’s reading of 6.79%. A year ago at this time, the 30-year FRM averaged 5.23%.

Also this week, the 15-year FRM averaged 6.07%, down from last week when it averaged 6.18%. A year ago at this time, the 15-year FRM averaged 4.38%.

“Mortgage rates decreased after a three-week climb,” said Sam Khater, Freddie Mac’s Chief Economist. “While elevated rates and other affordability challenges remain, inventory continues to be the biggest obstacle for prospective homebuyers.”

Although rates may have fallen for the first time in three weeks, buyers are still hesitant to join in the spring buying season, as the Mortgage Bankers Association (MBA) reported that overall application fell 1.4% week-over-week, and a 30% drop off in volume year-over-year. This marked the fourth consecutive week that overall app volume fell from the week prior.

“The housing market has gotten off to a slow start this summer due to higher mortgage rates, low inventory, and economic uncertainty,” said MBA President and CEO Bob Broeksmit. “Despite rates inching downward last week, both purchase and refinance activity fell on a weekly and annual basis. The labor market continues to be exceptionally strong, which could bring more buyers back into the market once rates move away from their recent highs.”

Another driver in the spring market downturn has been the lack of housing inventory, as Redfin reported this week that new listings of homes for sale fell 25% year-over-year to their lowest level of any early June on record. The limited inventory is keeping national home-price declines relatively modest, with the typical U.S. home price down 1.6% year-over-year, marking the smallest dip in three months and half the size of April’s 3.2% drop, the biggest drop recorded by Redfin in at least a decade.

“Homes priced under $500,000 are flying off the market because buyers in that price range don’t have many options,” said Sacramento Redfin Premier agent David M. Orr. “I've been working with one first-time homebuyer for about a year, and she’s adjusted her search as rates have risen. Now that mortgage rates are close to 7%, she’s looking at lower-priced, smaller homes. But the problem we’re facing now is competition: In that lower price range, it takes many misses before you get a hit. She just made an offer nearly $30,000 above asking price for a home listed at $429,000, but she lost out because it had four other offers. I’m advising buyers to get their loan pre-approved and look at homes under budget so they’re prepared to go above asking price.”

Affordability of a median-priced home also remains of high concern, as a new analysis by Zillow and Thumbtack, found that utility bills, property taxes, insurance and essential home maintenance can add up to $14,155 annually for the average U.S. homeowner, or an additional $1,180 per month on top of a typical mortgage payment.

The MBA reports in its latest Purchase Applications Payment Index (PAPI)—a measurement of how new monthly mortgage payments vary across time relative to income—the national median payment applied for by purchase applications increased 0.9% to $2,112 from a reported $2,093 in March.

“Despite stalling list prices, homebuyers continue to face higher monthly mortgage payments compared to one year ago,” noted Realtor.com Economist Jiayi Xu. “This persistent challenge is primarily attributed to elevated mortgage rates, making it more difficult for buyers to afford a typical home. According to a new survey by Realtor.com and Censuswide, the most common mortgage rate comfort-level cited for potential buyers constrained by financial factors was in the 3.0%-3.25% range, less than half of today’s level. Even for individuals with plans to purchase within the next year, almost 80% of them expressed concerns about being priced out of the market if housing prices and mortgage rates continue to rise. Consequently, affordability will play a crucial role in helping them achieve their goal of purchasing a home. Relator.com’s cross-market report showed that home shoppers from the expensive West and Northeast showed stronger interest in searching for affordability than a year ago. However, due to a limited number of markets that are considered more affordable options, buyers from the cheaper Midwest were more likely to be forced to compete in more expensive markets, thereby intensifying the challenges to get access to homeownership.”

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news