Mortgage rates and mortgage applications both took a small dip last week, as jittery investors continued to turn to government-backed bonds in the lead-up to the Federal Reserve [1]’s June meeting and a shaky European market.

Mortgage rates and mortgage applications both took a small dip last week, as jittery investors continued to turn to government-backed bonds in the lead-up to the Federal Reserve [1]’s June meeting and a shaky European market.

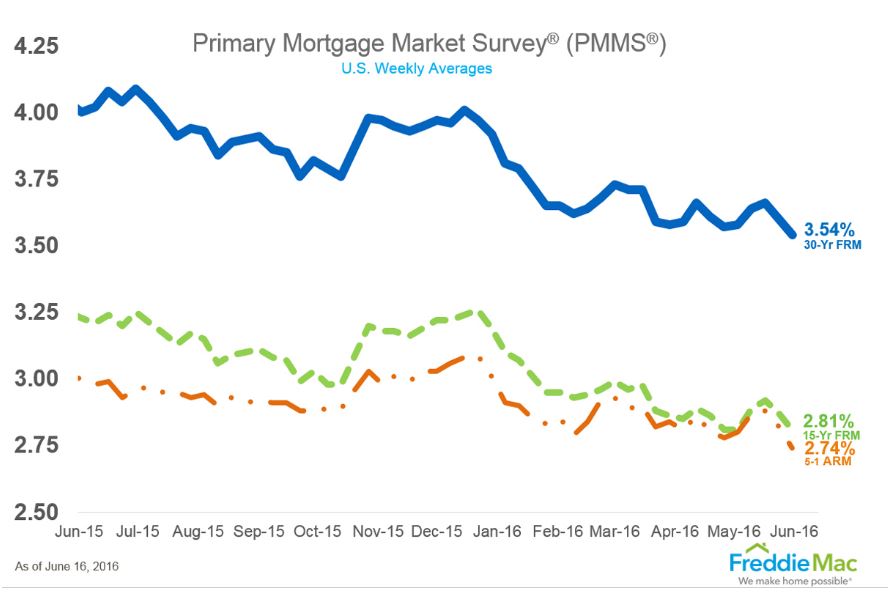

According to Freddie Mac [2]’s latest Primary Mortgage Market Survey [3], all three categories of fixed-rate mortgages dropped by 0.5 percent (to 3.54 percent) for the week ending June 16, making it the second straight week of declines. All are also down about the same amount from a year ago.

Meanwhile, the Mortgage Bankers Association's [4] (MBA) Weekly Mortgage Applications Survey [5] for the week ending June 10 showed that mortgage applications are down 2.4 percent on a seasonally adjusted basis from one week earlier. On an unadjusted basis, the Index increased 21 percent compared with the previous week.

The Refinance Index also decreased, by 1 percent from the previous week. The seasonally adjusted Purchase Index decreased 5 percent from one week earlier. The unadjusted Purchase Index increased 17 percent compared with the previous week and was 16 percent higher than the same week one year ago.

According to MBA, the Federal Housing Administration [6] share of total applications decreased to 11.8 percent from 13.0 percent the week prior. The U.S. Department of Veteran Affairs [7] share of total applications decreased to 11.1 percent from 11.5 percent the week prior. The U.S. Department of Agriculture [8] share of total applications decreased to 0.6 percent from 0.7 percent the week prior.

According to MBA, the Federal Housing Administration [6] share of total applications decreased to 11.8 percent from 13.0 percent the week prior. The U.S. Department of Veteran Affairs [7] share of total applications decreased to 11.1 percent from 11.5 percent the week prior. The U.S. Department of Agriculture [8] share of total applications decreased to 0.6 percent from 0.7 percent the week prior.

The MBA also reported that average contract interest rates for 30-year fixed-rate mortgages, whether standard or jumbo, as well as average contract rates for FHA-backed fixed 30-year loans and for fixed 15-year loans all dropped to their lowest levels in months.

The average contract interest rate for 5/1 adjustable-rate mortgages also decreased (from 2.96 to 2.87 percent) last week, hitting its lowest level since May.

Sean Becketti, chief economist, Freddie Mac, attributed the dips to investor wariness over Wednesday's Fed decision to once again stand pat on rates, as well as growing anticipation of the U.K.'s upcoming European Union referendum, which will “make it difficult for Treasury yields and—more importantly—mortgage rates to substantially rise in the upcoming weeks,” Becketti said.

"The 10-year Treasury yield continued its free fall this week as global risks and expectations for the Fed's June meeting drove investors to the safety of government bonds,” he said. “The 30-year mortgage rate responded by falling 6 basis points for the second straight week—yet another low for 2016.”