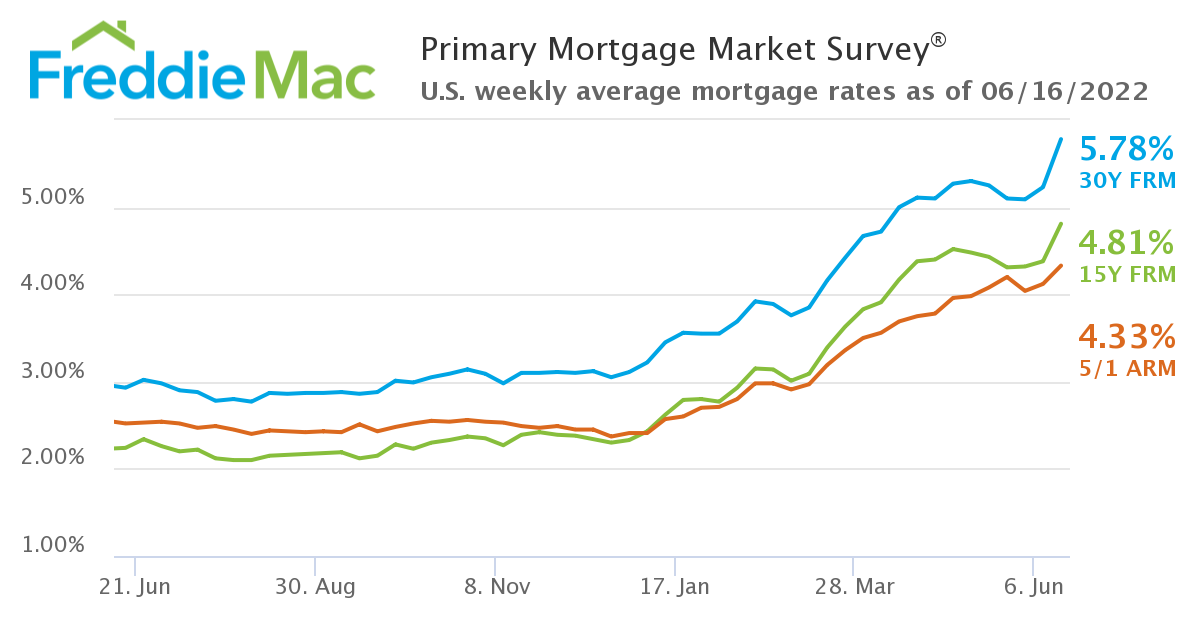

As the nation sat and waited for the Fed to raise rates [1], the 30-year fixed-rate mortgage (FRM) wasted no time getting a jump on the Fed’s news, jumping to an average of 5.78% over last week’s reading of 5.23%, according Freddie Mac’s latest Primary Mortgage Market Survey (PMMS) [2] for the week ending June 16, 2022. A year ago at this time, the 30-year FRM averaged 2.93%.

As the nation sat and waited for the Fed to raise rates [1], the 30-year fixed-rate mortgage (FRM) wasted no time getting a jump on the Fed’s news, jumping to an average of 5.78% over last week’s reading of 5.23%, according Freddie Mac’s latest Primary Mortgage Market Survey (PMMS) [2] for the week ending June 16, 2022. A year ago at this time, the 30-year FRM averaged 2.93%.

And with the Fed’s anticipated rate hike of the nominal interest rate [1] to 0.75% as a means to combat steadily rising inflation coming to fruition yesterday, mortgage rates experienced the largest one-week jump since Freddie Mac has been gauging mortgage rates in 1987.

And as a result of the massive rate hike, the market is forecast to cool and near a point of balance, according to Sam Khater, Freddie Mac’s Chief Economist [3].

“These higher rates are the result of a shift in expectations about inflation and the course of monetary policy,” said Khater. “Higher mortgage rates will lead to moderation from the blistering pace of housing activity that we have experienced coming out of the pandemic, ultimately resulting in a more balanced housing market.”

Also this week, Freddie Mac reported the 15-year FRM averaging 4.81% with an average 0.9 point, up from last week when it averaged 4.38%. A year ago at this time, the 15-year FRM averaged 2.24%. And, the five-year Treasury-indexed hybrid adjustable-rate mortgage (ARM) averaged 4.33% with an average 0.3 point, up from last week when it averaged 4.12%. A year ago at this time, the five-year ARM averaged 2.52%.

Anticipating the rate hike, homebuyers led a small rush to shop and lock in rates last week, as the Mortgage Bankers Association (MBA) found mortgage application volume rising 6.6% week-over-week [4].

National Association of Realtors (NAR) Chief Economist Lawrence Yun [5] agrees with Khater on an impending market slowdown.

“Home sales have recently been trending down towards 2019 figures,” noted Yun. “Sales could fall even further with some inventory sitting on the market for more than a month like in the pre-pandemic days. Pricing a listed home properly will, therefore, be the key to attracting buyers. In the meantime, rental demand will strengthen along with rents. Only when consumer price inflation tops out and starts to fall will mortgage rates stabilize or even decline a bit. That is why providing additional oil supplies will be critical in containing consumer prices and interest rates.”

But for today’s buyer, prices are growing more and more out of reach, as not only rates are quickly becoming a deterrent, but the cost of construction continues to show no sign of leveling off as the National Association of Home Builders (NAHB) reported [6] residential construction material costs were up 19% year-over-year.

“Single-family home building is slowing as the impacts of higher interest rates reduce housing affordability,” said Jerry Konter, Chairman of NAHB and a home builder and developer from Savannah, Ga. [7] “Moreover, construction costs continue to rise, with residential construction materials up 19% from a year ago. As the market weakens due to cyclical factors, the long-term housing deficit will persist and continue to frustrate prospective renters and home buyers.”

As Hannah Jones, Economic Data Analyst at Realtor.com [8], notes, many are simply temporarily throwing in the towel altogether as inflationary concerns are taking a larger portion of their budgets.

“The median list price for a home in the U.S. was $447,000 in May [9], up 18% since May 2021, and mortgage rates rose more than two percentage points in the same timeframe,” said Jones. “This means that it is about 65%, or $820 a month, more costly to finance 80% of the median priced U.S. home now than it was in May 2021, dwarfing conventional inflation measures. However, the housing market is showing signs of balancing, as more houses were listed for sale this week compared to the same week last year, offering more options to buyers. To contend with the seemingly ever-climbing price of purchasing a home, some buyers are looking to relatively affordable locales or opting out of the purchase market altogether, choosing to rent instead, despite the fact that those annual costs are also climbing.”