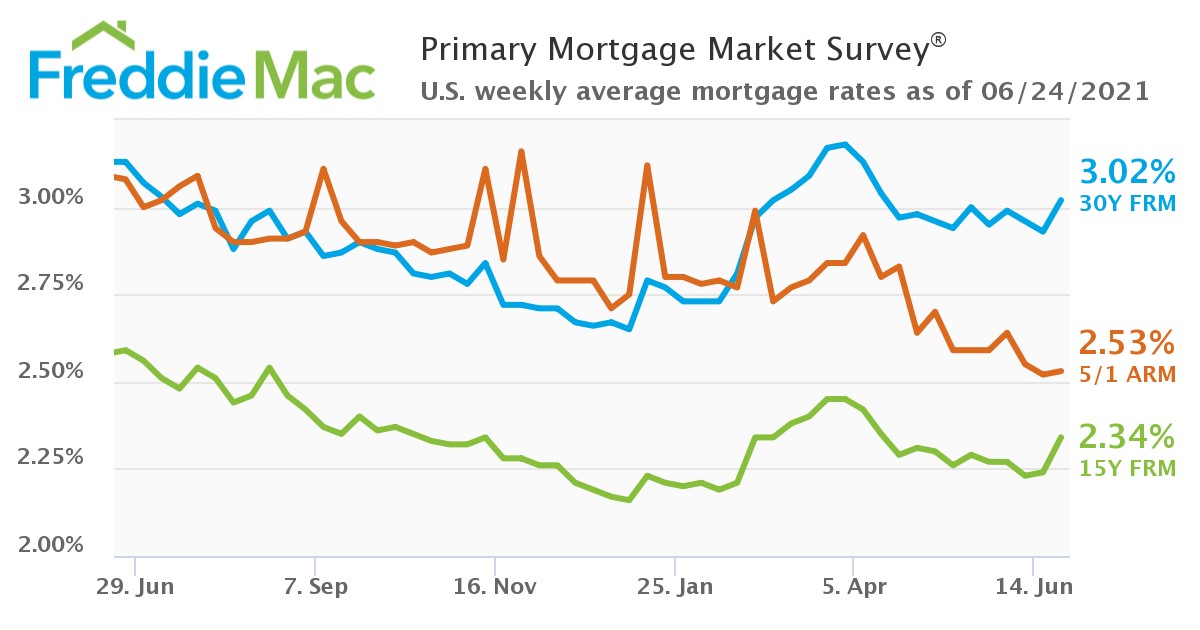

For the first time in over two months, mortgage rates have risen above the 3% mark, as this week’s Primary Mortgage Market Survey (PMMS) from Freddie Mac found the 30-year fixed-rate mortgage (FRM) moving up to the 3.02% mark, up from last week’s average of 2.93%.

For the first time in over two months, mortgage rates have risen above the 3% mark, as this week’s Primary Mortgage Market Survey (PMMS) from Freddie Mac found the 30-year fixed-rate mortgage (FRM) moving up to the 3.02% mark, up from last week’s average of 2.93%.

A year ago at this time, the 30-year FRM averaged 3.13%.

“Mortgage rates have risen above 3% for the first time in 10 weeks,” said Sam Khater, Freddie Mac’s Chief Economist. “As the economy progresses and inflation remains elevated, we expect that rates will continue to gradually rise in the second half of the year. For those homeowners who have not yet refinanced–and there remain many borrowers who could benefit from doing so–now is the time.”

Freddie Mac also reported this week that the 15-year FRM averaged 2.34%, with an average 0.7 point, up from last week when it averaged 2.24%. A year ago at this time, the 15-year FRM averaged 2.59 percent.

Fannie Mae's Economic and Strategic Research (ESR) Group recently revised some earlier predictions for 2021, upgrading its overall economic growth expectations for full-year 2021 to 7.1%, one-tenth higher than its previous forecast. The group of economists noted that, while they believe some consumer spending and price increases (to which they attribute the changes) are transitory, price pressure in several sectors, housing included, could last into next year.

As noted by Khater, now may be the time for those who could benefit from a refinance, as rates remain marginally above the 3% mark. However, a recent survey by Zillow of more than 1,300 homeowners found that fewer than one-fourth of established homeowners refinanced their mortgages over the past 12 months. While more than half (59%) of those surveyed have refinanced the mortgage on their current home at least once, with just 22% of respondents saying they did so within the past year.

And while the share of homeowners who have chosen to refinance seems somewhat low, the Mortgage Bankers Association (MBA) reported this week that the refi share of overall mortgage application volume increased slightly this week to 62.5% of total application volume, up from 61.7% the previous week.

Are those on the sidelines realizing this is their last chance to jump on the refi bandwagon before mortgage rates ascend upward into unfriendly territory?

One trend that lingers is the demand to supply dilemma, as National Association of Realtors (NAR) reported this week that median home prices nationwide saw a record year-over-year increase of 23.6% in May to $350,300, with existing-home sales dropping for a fourth consecutive month, by 0.9% between April and May. Slowly declining sales is a trend that experts attribute to short supply—which they say could improve in the coming months—and unaffordability.

“Interest rates remain low and extremely enticing—mortgage refinances saw a solid gain this week—however, with prices of new and existing homes up 18% and 24% from last year, buyers are running out of steam,” said Realtor.com Senior Economist George Ratiu. “This week’s decline in sales of both new and existing homes underscored the diminishing benefit of low rates. Homeownership remains a central pillar of Americans’ personal, social and financial wealth, and even the youngest demographic cohort, Gen Z, has plans to someday purchase a home of their own. For housing, the message is clear: with almost 75% of Gen Z members leaning toward buying a home long-term, in addition to the millions of millennials who are driving today’s markets, we need more new construction, especially at affordable prices. Without additional supply, favorable financing remains a one-legged stool trying to provide a wobbly foundation for sustainable growth.”

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news