Fixed-rate mortgages are dropping in the wake of the U.K.’s Brexit vote, with 30-year FRMs hitting a three-year low this week. Thirty-year rates are, in fact, only 17 basis points higher than the all-time low of 3.31 percent, hit in November of 2012.

Fixed-rate mortgages are dropping in the wake of the U.K.’s Brexit vote, with 30-year FRMs hitting a three-year low this week. Thirty-year rates are, in fact, only 17 basis points higher than the all-time low of 3.31 percent, hit in November of 2012.

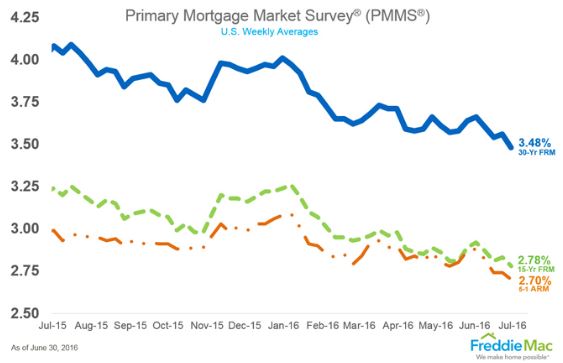

Freddie Mac [1]’s latest weekly Primary Mortgage Market Survey [2] set average 30-year fixed-rate mortgage [3] at 3.48 percent for the week ending June 30. Last week, that average was 3.56 percent, and a year ago it was 4.08 percent. Likewise, 15-year [4] fixed-rate mortgages averaged 2.78 percent, down from last week’s 2.83 percent and down 3.24 percent from last year.

“The immediate impact of Brexit on the mortgage market is the major decline in rates which produces lower monthly payments,” Realtor.com Chief Economist Jonathan Smoke said. “This means that a well-qualified buyer can afford an 8 percent higher price since the beginning of the year. The increase in buying power is more than offsetting the higher prices.”

Even 5-year Treasury-indexed hybrid adjustable-rate mortgages [5] are down. They averaged 2.70 percent this week, compared to last week’s 2.74 percent and last year’s 2.99.

Sean Becketti, chief economist, Freddie Mac, said that in the wake of the U.K.’s decision to leave the European Union, the yield on the 10-year U.S. Treasury bond plummeted 24 basis points.

“This week's survey rate is the lowest since May 2013 and only 17 basis points above the all-time low,” Becketti said. “This extremely low mortgage rate should support solid home sales and refinancing volume this summer.”

“This extremely low mortgage rate should support solid home sales and refinancing volume this summer.”

Sean Becketti, Chief Economist, Freddie Mac

Perhaps, but as far as mortgage applications go, this week’s activity was slower than last week’s. According to the Mortgage Bankers Association [6], mortgage applications dropped 2.6 percent from last week. On an unadjusted basis, the pace decreased 3 percent compared to last week.

The MBA’s Refinance Index also decreased, by 2 percent, and the seasonally adjusted Purchase Index decreased 3 percent from one week earlier. The unadjusted Purchase Index decreased 4 percent, but was up 13 percent than the same week one year ago.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances hit its lowest level since May 2013, 3.75 percent, but the average contract interest rate for 30-year fixed-rate jumbo mortgages increased to 3.74 percent from 3.70 percent.

The average contract interest rate for 30-year fixed-rate mortgages backed by the FHA remained unchanged at 3.61 percent.