Federal and local government agencies have added significant building costs that did not exist as recently as 15 years ago, which has had an adverse effect on many housing markets, according to a recent survey of more than 100 builders by John Burns Real Estate Consulting (JBREC).

The survey found that in many instances, the government added these extra costs in order to protect the environment and improve the surrounding area for existing residents.

“While these are noble goals, builders have to charge more for new homes—or simply not build homes in many instances,” said John Burns, CEO of John Burns Real Estate Consulting.

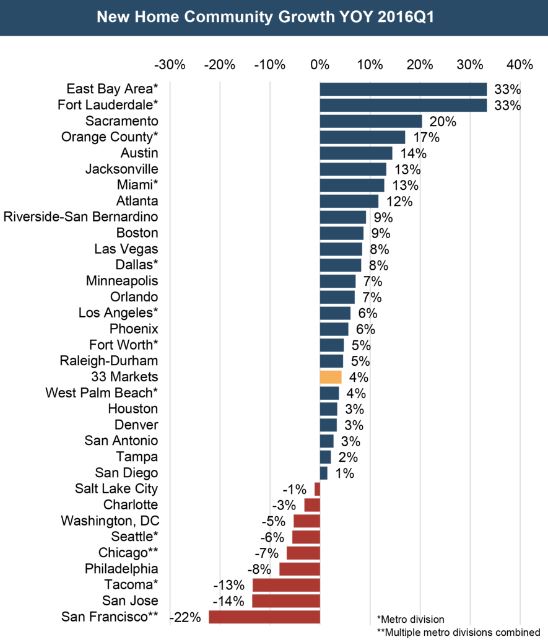

Analysis of the top 33 markets in the country found that the number of new home communities has increased by only 4 percent in the last year, according to Burns. At that pace, the number of new homes permitted will not reach 1.1 million until 2023, which is consistent with historical averages.

While the survey found there are many reasons why the recovery is not stronger, local government was the primary reason that volume recovery was stronger in some areas than in others. The survey found that government attitudes toward housing tend to be either friendly and affordable or unfriendly and unaffordable.

Areas where builders can quickly build to meet demand like Texas and Georgia, which are well-known for business-friendly environments, fit into the friendly and affordable category; particularly Texas, which has opened up huge amounts of land for development in the last decade due to massive investments in freeway infrastructure. Texas also features new homes near employment centers that tend to be cheaper than in most areas even when home price appreciation is considered.

Meanwhile, states like Virginia, Illinois, New Jersey, California, and Washington (excepting downtown Seattle) are well known for being difficult for builders, regulation-wise, according to JBREC. These places feature areas that are highly desirable to live, but they have become very expensive, and on top of that, demand is outpacing new construction, JBREC reported.

“The bottom line is that there is a huge correlation between government attitudes and new home construction and prices,” Burns said. “We strongly believe that the large, affordable markets will grow faster than the other markets.”

Click here to view the full survey.

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news