Mortgage credit availability increased in June according to the latest Mortgage Credit Availability Index [1] (MCAI), a report from the Mortgage Bankers Association [2] (MBA) that analyzes data from ICE Mortgage Technology [3].

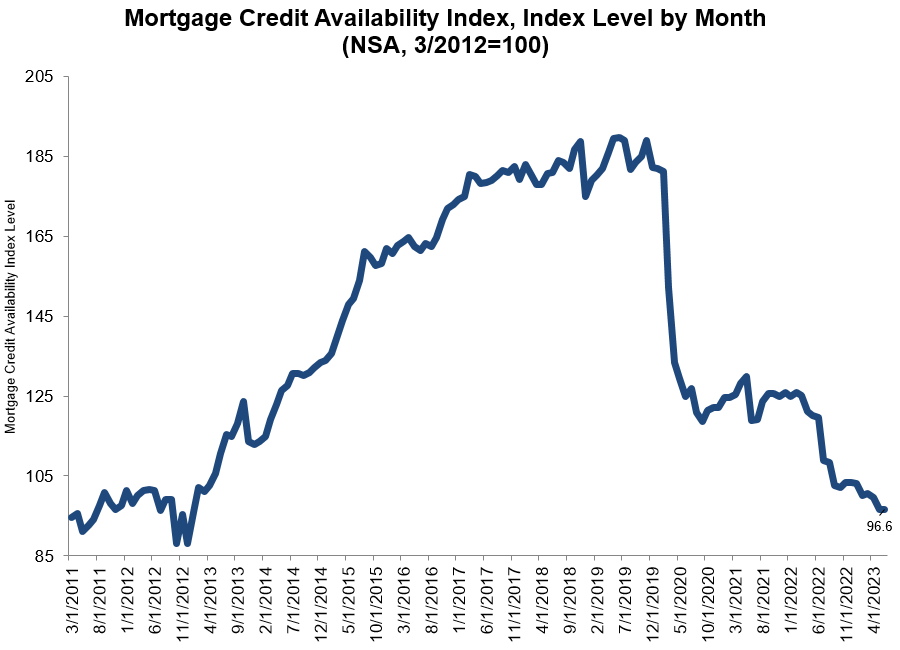

The MCAI rose by 0.1% to 96.6 in June. A decline in the MCAI indicates that lending standards are tightening, while increases in the index are indicative of loosening credit. The index was benchmarked to 100 in March 2012.

The Conventional MCAI was unchanged, while the Government MCAI was essentially unchanged. Of the component indices of the Conventional MCAI, the Jumbo MCAI decreased by 0.2%, and the Conforming MCAI rose by 0.2%.

“Mortgage credit availability was essentially unchanged in June, remaining close to the lowest level since early 2013, as the industry continues to operate at reduced capacity,” said Joel Kan, MBA’s VP and Deputy Chief Economist. “Lenders are streamlining their operations by offering fewer loan programs, with some exiting certain channels. Data from our Weekly Applications Survey indicated that June mortgage applications were more than 30 percent lower than a year ago and at the slowest pace since December 2022.”

Kan continued, “The Jumbo Index declined slightly by 0.2%—the second straight monthly decrease—as liquidity conditions have been tightening for jumbo lending.”

Conventional, Government, Conforming, and Jumbo MCAI Component Indices

The MCAI rose by 0.1% to 96.6 in June. The Conventional MCAI was unchanged, while the Government MCAI was essentially unchanged. Of the component indices of the Conventional MCAI, the Jumbo MCAI decreased by 0.2%, and the Conforming MCAI rose by 0.2%.

To read the full report, including more data, charts, and methodology, click here [1].