A new analysis by Redfin has found that housing markets in northern California are cooling faster than anywhere else in the U.S., amid high mortgage rates and a faltering stock market. Five of the 10 U.S. housing markets that have cooled fastest this year are located in northern California–San Jose, Oakland, San Francisco, Sacramento, and Stockton–and three of those five are in the Bay Area.

A new analysis by Redfin has found that housing markets in northern California are cooling faster than anywhere else in the U.S., amid high mortgage rates and a faltering stock market. Five of the 10 U.S. housing markets that have cooled fastest this year are located in northern California–San Jose, Oakland, San Francisco, Sacramento, and Stockton–and three of those five are in the Bay Area.

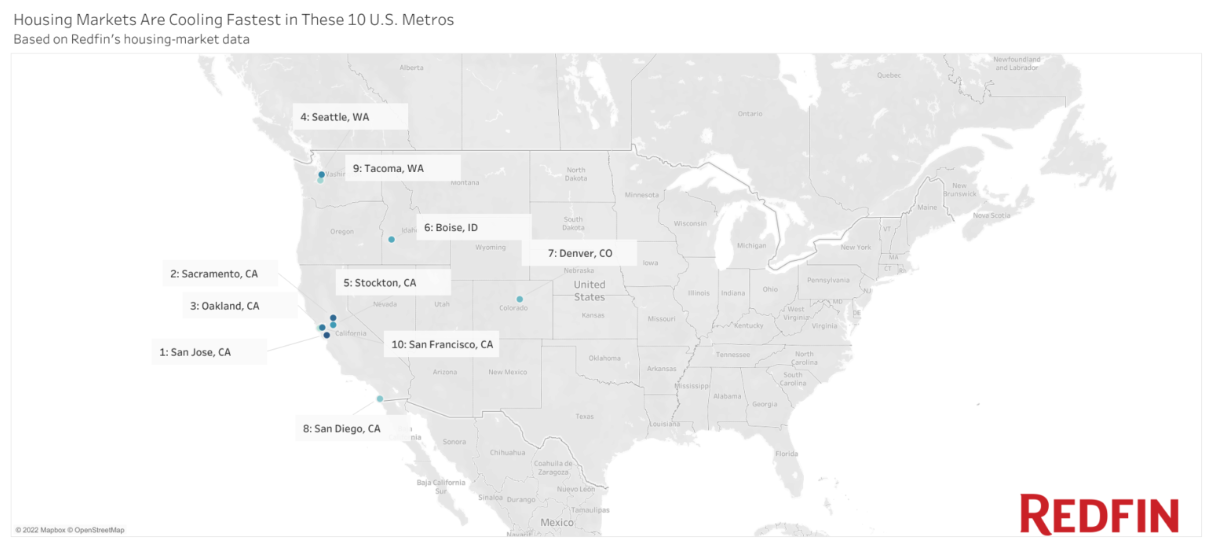

Nationwide, all 10 of the housing markets cooling fastest were in the western United States.

The housing market cooldown can be attributed largely due to the fact that mortgage rates nearly doubled in the first half of 2022, soaring to near the 6% mark, thus causing the average monthly mortgage payment to surge 45% year-over-year to $2,459 in June. This combo of high rates and rise in mortgage payments only furthered affordability issues for many.

“The housing market has changed drastically in the last month because higher rates make homes even more expensive than they used to be. At the same time, fewer people can afford pricey homes because of the volatile stock market,” said San Francisco Redfin Agent Joanna Rose. “In the early spring, every home was selling over its asking price with multiple bids. Then the number of people attending open houses dropped from 20 to two, and now some homes are sitting on the market for over a month and selling for under asking price. Supply is starting to pile up.”

Of these Golden State areas, the San Jose region was found to be cooling at the fastest clip, with measures of homebuyer demand and competition dropping off quicker than any other major metro in 2022. The supply of homes for sale in San Jose was up 10% year-over-year in May–but just three months earlier in February, supply was down 43%, indicating that buyers are now gobbling up fewer homes. And the share of homes that went off the market in two weeks was down 5% year over year in May, a big swing from the 22% year-over-year increase in February–that’s an indicator that homes are selling slower.

Following San Jose, the California regions cooling the fastest included Oakland, Stockton (located approximately 50 miles south of Sacramento), and San Francisco.

In dollar terms, mortgage rates reaching nearly 6% in the spring had a particularly big impact in higher priced areas like Northern California, where the average monthly mortgage payment on a $1 million home is roughly $5,750, with a 6% interest rate, nearly $1,400 higher than it would be with a 3% interest rate (assuming a 20% down payment). The increase is half as big with a home priced close to the national median: The typical monthly payment on a $450,000 home is about $2,600 with a 6% rate, about $700 higher than with a 3% rate.

“But there is good news for some buyers. People who can afford to buy right now could get something for $100,000 or $200,000 less than a few months ago, largely because homes are often no longer selling above asking price,” Rose said. “They’ll have a higher monthly payment for now due to the rise in mortgage rates but can refinance later if rates come down.”

On the other end of the spectrum, Albany, New York has cooled slower than any other metro this year, with measures of homebuyer demand and competition just slightly weaker in May than in February. The supply of homes for sale in Albany was down 19% year-over-year in May, compared with a 23% dip in February. Rounding out the top 10 markets that cooled by the slowest rate were Albany, followed by:

- El Paso, Texas

- Bridgeport, Connecticut

- Lake County, Illinois

- Rochester, New York

- New Brunswick, New Jersey

- Cincinnati, Ohio

- Akron, Ohio

- New Haven, Connecticut

- Virginia Beach, Virginia

Eight of the above markets have a median sales price below the national level of $431,000, with the two exceptions of Bridgeport and New Brunswick, which both have median sale prices below $575,000.

Click here for more on Redfin's analysis of the nation's fastest cooling markets.

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news