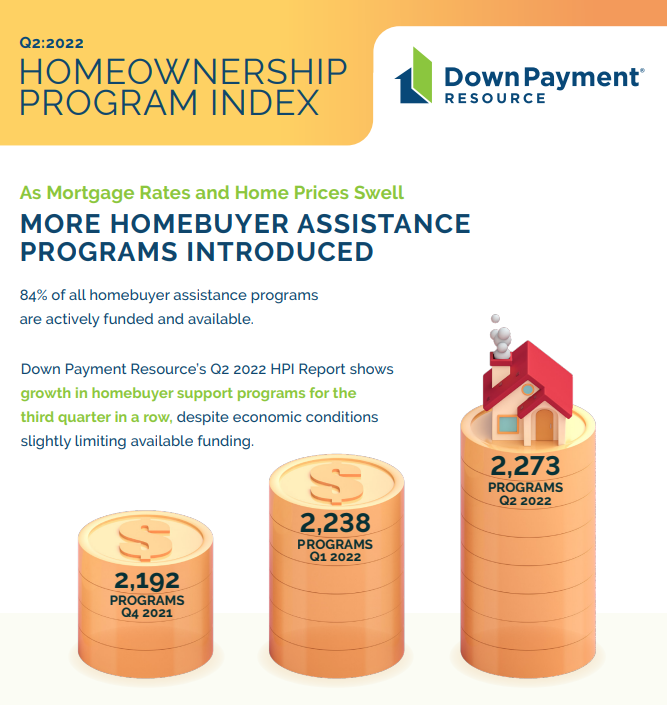

Down Payment Resource [1] (DPR) has announced findings from its latest Homeownership Program Index [2] (HPI), while the firm’s analysis of 2,273 homebuyer assistance programs in its DOWN PAYMENT RESOURCE database revealed that the net number of homebuyer assistance programs increased by 1.6% from Q1 to Q2 2022. This marks the third consecutive quarter the number of homebuyer assistance programs has grown.

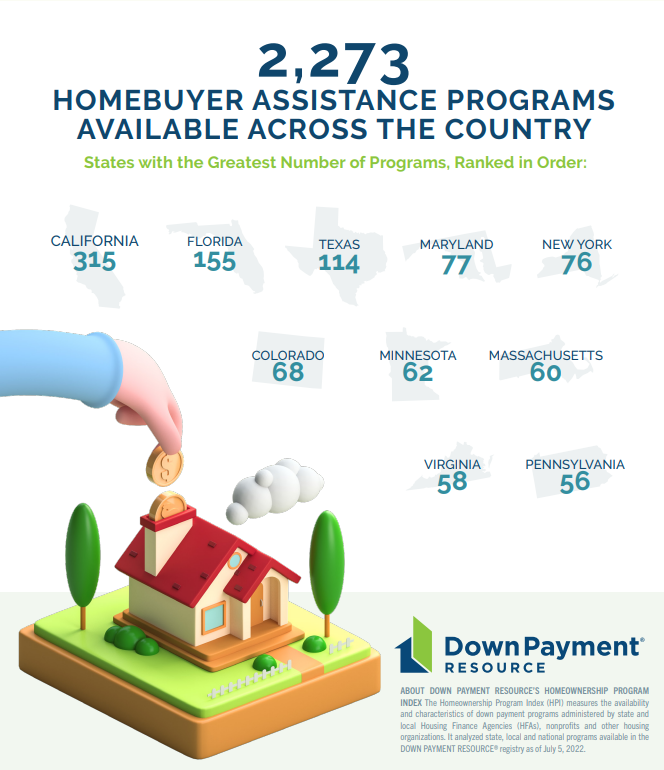

The Q2 2022 HPI examined a total of 2,273 homebuyer assistance programs that were active as of July 5, 2022.

Key findings are as follows:

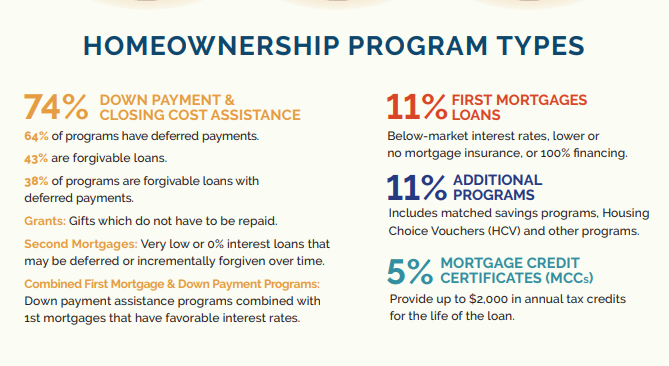

- The net number of homebuyer assistance programs increased. The number of programs increased by 35 in Q2 of 2022. Among them were five nationwide or multi-state programs and 12 statewide programs. Assistance for first mortgages, combined down payment and closing cost support, community second mortgages and deed restriction programs were also added.

- Support for manufactured homes increased again. For the third consecutive quarter the number of programs that support manufactured home purchases have increased. 625 programs now support manufactured home loans, up from 594 in Q1 2022.

- Programs offering veteran exemptions grew. The number of programs that waive first-time homebuyer requirements for veterans increased from 176 to 184 (4.5%) this quarter.

“Despite a slight increase in the number of inactive and suspended programs, our analysis indicates that opportunities for homebuyer assistance are continuing to grow,” said DPR CEO Rob Chrane. “With inflation reaching 40-year highs, aggressive interest rate hikes and limited housing inventory, connecting consumers with financial support for down payment and closing costs is more important than ever. In this especially challenging housing market, program providers are finding creative ways to help qualified homebuyers overcome economic obstacles and achieve the long-term financial benefits of homeownership.”

Breakdown of New Programs

A breakdown of the homebuyer assistance programs added last quarter are as follows:

- By assistance type: Four first mortgage programs, 11 combined assistance programs, five community seconds, six deed restriction programs and two Mortgage Credit Certificate (MCC) programs were added, among others.

- By region: There was a 7.6% increase in nationwide programs, a 1% increase in programs supporting home purchases in defined locales and a 1.3% increase in statewide programs. Programs supporting the western U.S. saw the largest percent growth of any region, increasing by 2.8%.

- By funding source: To-be-announced (TBA) programs saw the largest overall growth over the previous quarter with 12 TBA-funded programs added, a quarterly increase of 5.5%. Other funding sources that saw an increase in the number of programs available were bond programs, which increased by 2.2%, and State Housing Initiatives Partnership (SHIP) programs, which increased by 1.5%.

The number of inactive and temporarily suspended homebuyer assistance programs grew in Q2 2022, but this minor decrease in available funding was offset by the 35 programs added in the same timeframe. With inflation reaching its highest point in 40 years amid rising interest rates, expanding homeownership accessibility through down payment and closing cost assistance are important to serving homebuyers in these market conditions.

Further analysis of the Q2 2022 HPI findings, including infographics, examples of the programs described, and methodology can be found on DPR’s website here [2].