Homebuyer affordability numbers seem to have stabilized in June, with the national median payment that loan applicants applied for fell by $4 from $1,897 in May to $1,893 currently.

Homebuyer affordability numbers seem to have stabilized in June, with the national median payment that loan applicants applied for fell by $4 from $1,897 in May to $1,893 currently.

This information comes from the Mortgage Bankers Association’s (MBA) Purchase Applications Payment Index (PAPI), which measures how new monthly mortgage payments vary across time and relative to income, using data from the MBA’s Weekly Applications Survey.

“Median mortgage applications payments have held steady during the last two months but remain much higher than earlier this year. The typical homebuyer’s mortgage payment in June was $509 more than in January, which is why—along with rising economic uncertainty and high inflation—purchase demand has slowed in markets across the country,” said Edward Seiler, MBA's Associate VP, Housing Economics, and Executive Director, Research Institute for Housing America. “There are signs that home-price growth is moderating, which is good news for overall affordability if mortgage rates also start declining. The median loan amount in June was down $10,182 from May and has dropped more than $20,000 since it peaked in February.”

Added Seiler, “Sixteen states in June experienced improving affordability conditions due to lower mortgage application amounts.”

The national PAPI decreased 0.2% to 163.9 from 163.4 in May and 162.8 in April, meaning payments on new mortgages take up a smaller share of a typical person’s income. Compared to June 2021 (119.3), the index jumped 37.4%. For borrowers applying for lower-payment mortgages (the 25th percentile), the national mortgage payment remained flat at $1,241.

Other high-level takeaways from the report include:

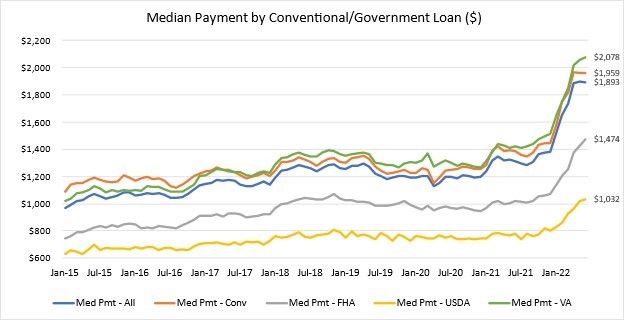

- The national median mortgage payment was $1,893 in June, down from $1,897 in May and $1,889 in April. Payments have increased $509 (36.8%) in the first six months of 2022.

- The national median mortgage payment for FHA loan applicants was $1,474 in June, up from $1,430 in May and $1,022 in June 2021.

- The national median mortgage payment for conventional loan applicants was $1,959, down from $1,960 in May and up from $1,389 in June 2021.

- The top five states with the highest PAPI were: Idaho (264.2), Nevada (254.6), Arizona (240.2), Utah (217.3), and Florida (211.6).

- The top five states with the lowest PAPI were: Washington, D.C. (103.1), Connecticut (108.2), Alaska (115.4), West Virginia (118.5) and Louisiana (119.0).

- Homebuyer affordability increased slightly for Black households, with the national PAPI decreasing from 159.5 in May to 159.2 in June.

- Homebuyer affordability increased slightly for Hispanic households, with the national PAPI decreasing from 155.2 in May to 154.9 in June.

- Homebuyer affordability increased slightly for White households, with the national PAPI decreasing from 165.1 in May to 164.7 in June.

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news