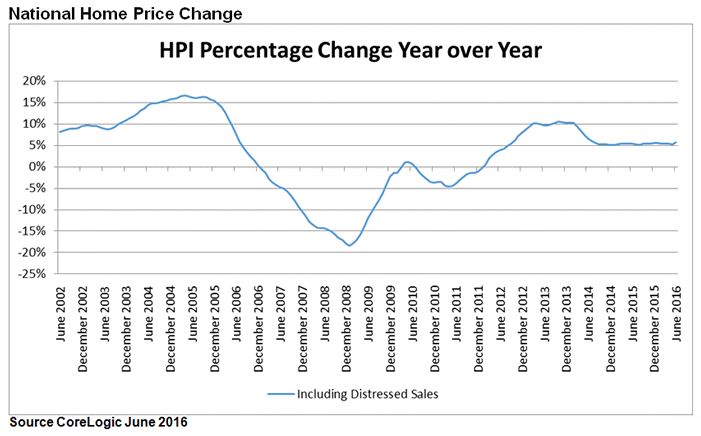

Home prices rose by 5.7 percent year-over-year in June, and that pace of appreciation is not expected to slow over the next year, according to data released Tuesday by CoreLogic.

Home prices rose by 5.7 percent year-over-year in June, and that pace of appreciation is not expected to slow over the next year, according to data released Tuesday by CoreLogic.

While CoreLogic’s June 2016 Home Price Index (HPI) reported that following the price appreciation of nearly 6 percent from June 2015, the company’s Home Price Forecast predicted that home prices will appreciate by another 5.3 percent from June 2016 to June 2017. Single-family home prices (including sales of distressed homes) are expected to reach a new peak on November 2017 if they continue at their current rate.

“Home prices continue to increase across the country, especially in the lower price ranges and in a number of metro areas,” said Anand Nallathambi, President and CEO of CoreLogic. “We see prices continuing to increase at a healthy rate over the next year by as much as 5 percent.”

CoreLogic’s HPI Forecast is a projection of home prices using the HPI and other economic variables, and values are derived from state-level forecasts by weighting indices according to the number of owner-occupied households for each state, according to CoreLogic.

June 2016 marked the 53rd consecutive month of year-over-year home price appreciation. Twenty-three states plus the District of Columbia reached new highs in home price appreciation in June, while two states had negative home price appreciation during the month (Connecticut at minus 1.7 percent and New Jersey at minus 0.8 percent), CoreLogic reported.

June 2016 marked the 53rd consecutive month of year-over-year home price appreciation. Twenty-three states plus the District of Columbia reached new highs in home price appreciation in June, while two states had negative home price appreciation during the month (Connecticut at minus 1.7 percent and New Jersey at minus 0.8 percent), CoreLogic reported.

Mortgage rates dropped to near historic lows in June (3.42 percent for the average 30-year FRM), which spurred on both homebuying and refinance activity. The average 30-year FRM is currently at 3.48 percent and is expected to remain below 4 percent for the remainder of the year.

“Mortgage rates dipped in June to their lowest level in more than three years, supporting home purchases,” said Dr. Frank Nothaft, chief economist for CoreLogic. "Local markets with strong economic growth have generally had stronger home-price growth. Among large metropolitan areas, Denver had the lowest unemployment rate and the strongest home-price appreciation.”

Click here to view CoreLogic’s Home Price Index for June.

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news