According to Bank of America’s 2021 Homebuyer Insights Report: Home Improvement and Equity Spotlight, two-thirds of younger homeowners surveyed plan to renovate their homes this year. The survey found that there is no lack of means in which to perform these renovations, real home equity reached a new peak of $20.2 trillion in Q2 of 2021, meaning more homeowners can use cash from their home equity to achieve their goals.

According to Bank of America’s 2021 Homebuyer Insights Report: Home Improvement and Equity Spotlight, two-thirds of younger homeowners surveyed plan to renovate their homes this year. The survey found that there is no lack of means in which to perform these renovations, real home equity reached a new peak of $20.2 trillion in Q2 of 2021, meaning more homeowners can use cash from their home equity to achieve their goals.

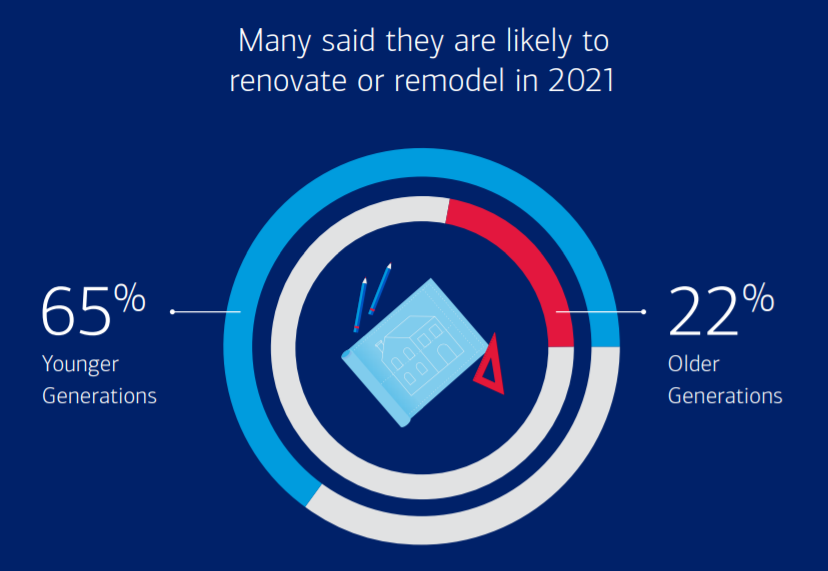

According to Bank of America’s survey of 2,000 adults who currently own a home or plan to in the future, many are eager to refresh their living space. This is particularly true for younger generations and Gen X, as nearly two-thirds (65%) of younger homeowners (ages 18-43), and 60% of Gen X homeowners (ages 44 to 56) are likely to renovate this year, compared to 22% of older homeowners (ages 57 to 75).

Pandemic-related factors such as remote work and the need for a home office and a family center has led many owners to tailor their homes to their needs, as twice as many respondents reported they’re approaching home improvements as a means of greater enjoyment in their living space (67%), compared to those seeking to increase their home’s value (33%).

“Traditionally, home improvement projects have been measured through the lens of return-on-investment, but we’re seeing that the emotional connection to one’s home is just as important,” said Ann Thompson, Specialty Lending Executive at Bank of America. “Customizing a home and bringing it up to date can create a place your family can enjoy for generations to come and help build a legacy and long-term wealth.”

According to the National Association of Home Builders, the median age of the nation’s owner-occupied housing stock is 39 years. Given this, many homeowners may either want to bring their homes up to date, or need to replace well-worn parts of their homes–and many are taking remodeling into their own hands.

More than two-in-five (44%) younger homebuyers surveyed say they would prefer to buy a fixer-upper and improve it over time than to buy a home that’s move-in ready. Meanwhile, seven out of 10 (71%) younger homeowners have recently completed do-it-yourself (DIY) work compared to 42% of older generations. Among those who’ve done DIY work–50% learned from watching videos online, and 39% were inspired by TV shows such as HGTV.

The study also found that sustainability is important to younger generations, as half of younger generations want to add solar panels (51%) and energy-efficient appliances (48%), as well as use sustainable or recycled materials (43%). In comparison, only one-third of older generations want to add solar panels (33%) and energy-efficient appliances (36%), or use sustainable or recycled materials (32%).

In terms of funding these renovations, only 41% of younger current homeowners know they can access a home equity line of credit (HELOC) to finance significant improvements to their home. Those polled said they plan to pay for the work with one or more the following: using money in savings (62%), taking out a HELOC (32%), putting it on a credit card (24%), or using money invested in the stock market (18%).

“While we see so many design ideas we’d like to try, homeowners don’t get much information when it comes to how to pay for these exciting changes,” said Thompson. “A home equity line of credit is a great financing choice for more significant home renovations.”

While older homeowners (59%) are slightly more likely than younger homeowners (52%) to have used a HELOC for significant home improvements, younger homeowners have used HELOCs for more varied purposes, such as paying for tuition (14% vs. 2%) and buying a car (27% vs. 12%). As for Gen X homeowners who’ve likely spent more time in their homes and have greater equity to tap, they’re using HELOCs for home improvements (52%), buying a car (32%) and paying for tuition (4%).

Click here to view Bank of America’s 2021 Homebuyer Insights Report: Home Improvement and Equity Spotlight in its entirety.

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news