The 55+ single-family housing market is not only alive and well but is expected to continue in that path for the near term, according to a couple of recent surveys.

The 55+ single-family housing market is not only alive and well but is expected to continue in that path for the near term, according to a couple of recent surveys.

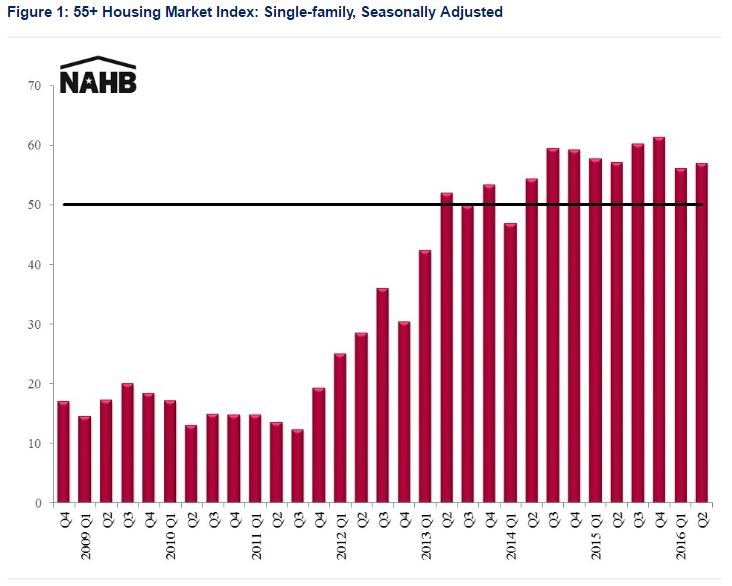

The National Association of Home Builders (NAHB)’s Housing Market Index (HMI) for the single-family 55+ market indicated that builders are more positive toward that segment. The HMI ticked up by one point in the second quarter to 57, marking the 9th consecutive quarter with a reading higher than 50. An HMI reading above 50 indicates that builders view conditions as good rather than poor.

The 55+ HMI is based on a survey that asks builders about the conditions of current sales, prospective buyer traffic, and anticipated six-month sales for builders’ respective markets are good, fair, or poor. Within the 55+ single-family HMI, the only component to increase in Q2 was prospective buyer traffic, which jumped by four basis points from the previous quarter up to 42. The index reading for present sales remained flat at 61 from Q1 to Q2. For expected sales for the next six months, the index fell by two points over-the-quarter in Q2 but still remained high at 69.

“Index results reflect gradual, steady growth in the 55+ housing market,” said Carmel Ford, economist with NAHB. “The market is benefiting from continued improvements in the overall housing market, a solid labor market, and historically low mortgage rates.”

NAHB’s findings that builders are more positive about the single-family 55+ housing market is consistent with another survey conducted in late July by Freddie Mac, which found that many 55+ homeowners are going against conventional wisdom by working until a later age, aging in place, or buying a second or even a third home rather than selling their homes to Gen Xers, downsizing, renting, or moving to an age-specific community. Freddie Mac Chief Economist Sean Becketti said that the 55 and over crowd “expect[s] to be an active part of our housing economy for quite a while longer.”

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news