The Federal Reserve Bank of New York reported Thursday in their Household Debt and Credit Report that mortgage debt lowered slightly in the second quarter of 2015.

The Federal Reserve Bank of New York reported Thursday in their Household Debt and Credit Report that mortgage debt lowered slightly in the second quarter of 2015.

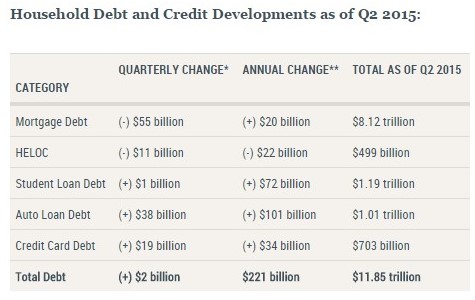

Total household indebtedness increased just $2 billion from Q1 2015.

According to the report, outstanding U.S. mortgage debt declined by 0.7 percent in the second quarter to $8.12 trillion. Mortgage debt experienced an increase of $20 billion annually and declined by $55 billion quarterly.

The New York Fed found that mortgage balances and HELOC dropped by $55 billion and $11 billion, respectively. In the second quarter, there were $466 billion in new mortgage originations and just under half of the Q2 strength in originations were driven by borrowers with credit scores over 780. On the other hand, only 8 percent ($38 billion) of all new mortgages were originated by borrowers with credit scores below 660.

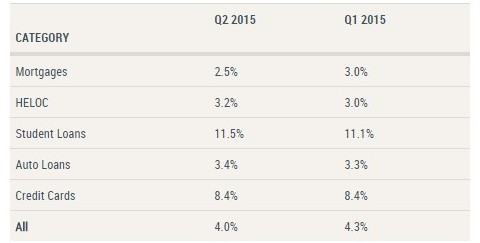

“Persistently tight underwriting standards imply that new mortgages continue to be originated predominantly to the most creditworthy borrowers,” said Wilbert van der Klaauw, SVP at the New York Fed. “The low rates of delinquency and new foreclosures reflect the higher quality of outstanding mortgage debt and improved economic conditions.”

Source: Federal Reserve Bank of New York

Earlier in August, a report titled "The Complex story of American Debt" from the PEW Charitable Trusts found that As Americans grow more accustomed to using credit to make purchases, debt levels continue to rise in the U.S. The report also noted that housing debt is the largest liability for most households, with other debt remaining higher than 1990's levels.

"This report explores a key element of wealth: household debt," the report said. "Debt is sometimes acquired for mobility enhancing purposes, such as to pay for college or purchase a home. But debt can also serve as a stopgap for families to cover regular expenses or deal with financial emergencies, especially if their savings are not sufficient. The type and amount of debt that households carry contribute to their wealth and their overall financial health."

However, the report determined that debt, in the sustainable form, is both a blessing and a curse. Without this debt families would not be able to achieve homeownership, obtain college degrees, or start businesses.

According to PEW, 80 percent of Americans hold some form of debt, with mortgage occupying the largest portion of this debt at 44 percent. This debt can also include car loans, unpaid credit card balances, medical and legal bills, and student loans.

"The long-term effects of debt on today’s young Americans are still to be determined," the report said. "But these findings suggest that accruing some debt at an early age can increase long-term savings and wealth-building by fueling investments in homes and education, which in turn stabilize and support families and communities. Sustainable debt can be a positive force for the economic mobility and financial security of young Americans and their families."

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news