[1]Housing policy affects income inequality and single-family housing in a number of ways. According to a recent report [2] from the Urban Institute [3] written by Gregory Acs and Paul Johnson, mortgage interest and real estate tax and transfer programs, voucher programs, and zoning laws all impact income inequality differently.

[1]Housing policy affects income inequality and single-family housing in a number of ways. According to a recent report [2] from the Urban Institute [3] written by Gregory Acs and Paul Johnson, mortgage interest and real estate tax and transfer programs, voucher programs, and zoning laws all impact income inequality differently.Housing tax and transfer programs can create work incentives for some people and disincentives for others. This positively influences the distribution of income, Urban Institute reported.

The report also found that voucher programs that keep people stably housed help workers hold down steady jobs and reduce inequality. In addition, zoning laws can either increase or reduce economic isolation and segregation, thus increasing or reducing inequality.

"Setting aside any effects on households’ work and savings behaviors, housing subsidies to low-income families reduce income inequality while the mortgage interest and real estate tax deductions increase it," the authors said. "On net, the distribution of post-tax, post-transfer income is slightly more equal than it would be in the absence of these three programs."

Housing taxes and transfers maintain a balanced effect on income distribution, the authors noted.

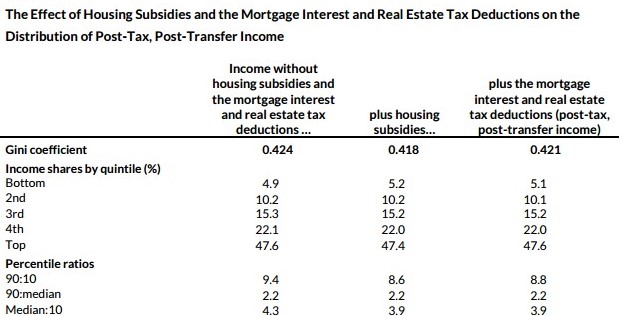

The Gini coefficient measures inequality on scale from 0 to 1, with 0 indicating perfect equality (all households have the same income) and 1 indicating perfect inequality (one household controls all the income).

In 2012, the Gini coefficient for pre-tax, post-transfer income was 0.470 in 2012, but fell to 0.421 after taxes were deducted. Likewise, the share of total income accruing to the poorest 20 percent of households rises from 4.3 to 5.1 percent while the share accruing to the top 20 percent falls from 51.5 to 47.6 percent.

The report also found that housing vouchers reduce inequality. If no housing subsidies and the mortgage interest and real estate tax deductions were in play, the Gini coefficient would measure inequality at 0.424. But when housing subsidies are added to income, the Gini falls to 0.418. The share of income accruing to the bottom quintile rises from 4.9 to 5.2 percent, and the share accruing to the top quintile falls from 47.6 to 47.4 percent.

On the other hand, mortgage interest and real estate tax deductions slightly push inequality up. When the value of those deductions and housing subsidies is added to income, the Gini coefficient rises from 0.418 to 0.421. Additionally, the share of income accruing to the bottom income quintile falls from 5.2 to 5.1 percent, and the share accruing to the top quintile rises from 47.4 to 47.6 percent.

“On net, the equalizing effects of housing subsidies outweigh the disequalizing effects of the mortgage interest and real estate tax deductions on the post-tax, post-transfer distribution of income,” the authors said. “Though the total value of housing subsidies is about half that of the mortgage interest and real estate deductions, those subsidies accrue to low-income households and represent a larger share of those households’ incomes than the deductions represent for higher-income households.”

They added, “As such, benefits targeted at low-income households will have a stronger equalizing effect than the disequalizing effect of the same or even larger benefits targeted at high-income."