Would-be sellers are becoming more reluctant to list their homes as surging prices begin to come down. With fewer new listings, buyers’ bargaining power is reaching its limit now that demand has stabilized, and homeowners who are choosing to list are increasingly pricing to meet buyers where they are.

According to a new report from Redfin [1], new listings of homes for sale fell 15% in the four weeks ending August 21, marking the biggest annual decline since the start of the pandemic, as there were fewer sellers and buyers in the market due to rising mortgage rates and economic uncertainty. As a result, the supply of for-sale homes fell 0.6% from the previous four-week period. Though that’s a slight decline, it’s only the second time total supply has dropped from the prior four-week period since February; the first time was last week. The dearth of homeowners putting their homes up for sale is partly a reaction to reduced demand and falling prices.

Those who are listing their homes are starting to price in line with lower demand. The median asking price of newly listed homes dropped 5% from the record high set in May, and sale prices dropped 6% from the record high set in June. The share of for-sale homes with a price drop leveled off after rising throughout the spring and early summer.

“Sellers are coming to terms with the fact that volatile mortgage rates have dampened demand. Some sellers are pricing lower, and some homeowners are staying put because they’re nervous they won’t get a good offer or they’re hesitant to give up their low mortgage rate,” said Redfin Economics Research Lead Chen Zhao. “Because the number of homes for sale is no longer rising, buyers’ newfound bargaining power is reaching its limit. It’s worth noting that early demand indicators such as tours and requests for help from agents are elevated from their June lows and remain steady. So there is a pool of interested buyers out there, but sellers need to price fairly to attract them. If more sellers and buyers find that middle ground on price, we could see sales strengthen a bit.”

Leading indicators of homebuying activity:

- For the week ending August 25, 30-year mortgage rates rose to 5.55%. That’s down from a 2022 high of 5.81% but up from 3.22% at the start of the year.

- Fewer people searched for “homes for sale” on Google. Searches during the week ending August 20 were down 16% from a year earlier, but up 12% from late May.

- The seasonally adjusted Redfin Homebuyer Demand Index—a measure of requests for home tours and other home-buying services from Redfin agents—was down 12% year over year during the week ending August 21. But it was up 18% from the 2022 low in June.

- Touring activity as of August 21 was down 6% from the start of the year, compared to a 12% increase at the same time last year, according to home tour technology company ShowingTime [3].

- Mortgage purchase applications were down 21% from a year earlier during the week ending August 19, while the seasonally adjusted index was down 1% week over week.

Key housing market takeaways for 400+ U.S. metro areas:

- The median home sale price was $371,125, up 6% year over year. Prices have declined 6% from the record high of $394,775 hit during the four-week period ending June 19. A year ago, they rose 0.6% during the same period.

- Only two metro areas saw a year-over-year decline in their median home-sale price, both in the Bay Area: Oakland, CA, where prices fell 0.5% to $937,500, and San Francisco, where prices were down 3.9% to $1,453,750.

- The median asking price of newly listed homes increased 10% year over year to $382,475. Asking prices are down 5% from the all-time high set during the four-week period ending May 22. Last year during the same period they were down just 0.4%.

- The monthly mortgage payment on the median asking price home was $2,305 at the current 5.55% mortgage rate, up 38% from $1,665 a year earlier, when mortgage rates were 2.87%. That’s down from the peak of $2,461 reached during the four weeks ending June 12.

- Pending home sales were down 17% year over year.

- New listings of homes for sale were down 15% from a year earlier, the largest decline since May 2020.

- Active listings (the number of homes listed for sale at any point during the period) fell 0.6% from the prior four-week period, the biggest decline since January 2022. On a year-over-year basis, they rose 4.3%.

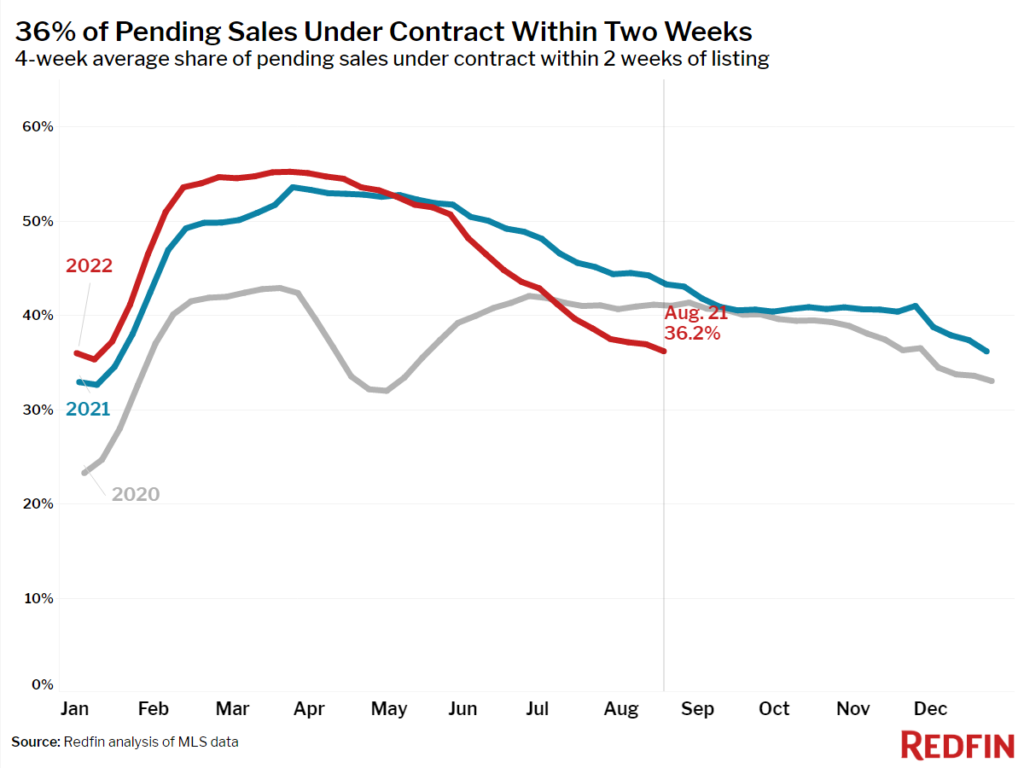

- Some 36% of homes that went under contract had an accepted offer within the first two weeks on the market, little changed from the prior four-week period but down from 43% a year earlier.

- Approximately 24% of homes that went under contract had an accepted offer within one week of hitting the market, little changed from the prior four-week period but down from 30% a year earlier.

- Homes that sold were on the market for a median of 25 days, up from 21 days a year earlier and the record low of 17 days set in May and early June.

- An estimated 38% of homes sold above list price, down from 50% a year earlier.

- On average, 7.7% of homes for sale each week had a price drop, a record high but unchanged from the prior four-week period.

- The average sale-to-list price ratio, which measures how close homes are selling to their asking prices, declined to 100.0% from 101.5% a year earlier. In other words, the average home sold at its asking price.

To read the full report, including more charts and methodology, click here [1].