Freddie Mac has released the results of its Primary Mortgage Market Survey (PMMS), showing that the 30-year fixed-rate mortgage (FRM) had averaged 5.66%.

“The market’s renewed perception of a more aggressive monetary policy stance has driven mortgage rates up to almost double what they were a year ago,” said Sam Khater, Freddie Mac’s Chief Economist. “The increase in mortgage rates is coming at a particularly vulnerable time for the housing market as sellers are recalibrating their pricing due to lower purchase demand, likely resulting in continued price growth deceleration.”

New Data Summary:

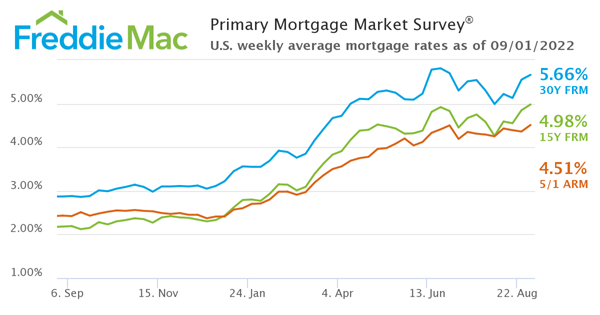

- The 30-year fixed-rate mortgage averaged 5.66% with an average 0.8 point as of September 1, 2022, up from last week when it averaged 5.55%. A year ago, at this time, the 30-year FRM averaged 2.87%.

- A 15-year fixed-rate mortgage averaged 4.98% with an average 0.8 point, up from last week when it averaged 4.85%. A year ago at this time, the 15-year FRM averaged 2.18%.

- The 5-year Treasury-indexed hybrid adjustable-rate mortgage (ARM) averaged 4.51% with an average 0.4 point, up from last week when it averaged 4.36%. Last year at this time, the 5-year ARM averaged approximately 2.43%.

“The Freddie Mac fixed rate for a 30-year loan maintained its upward momentum this week, rising to 5.66%, following the climb of the 10-year Treasury," said Realtor.com's Manager of Economic Research, George Ratiu. "Financial markets continue to react to the Federal Reserve’s firm commitment to monetary tightening in order to bring inflation closer to the 2% mark. This week’s remarks by Cleveland Fed President Mester —who is also a voting member of the FOMC— were a clear indication of the current policy direction. She stated that the Fed needs to drive the benchmark rate above 4% by early 2023, and keep it steady through next year. The current policy rate is in the 2.25%-2.5% range, pointing to expectations of aggressive rate increases over the next few months."

The PMMS is focused on conventional, conforming, fully amortizing home purchase loans for borrowers who put 20% and have excellent credit. Average commitment rates should be reported along with average fees and points to reflect the total upfront cost of obtaining the mortgage. Borrowers may still pay closing costs which are not included in the survey. To see further terms and definitions, click here.

"Homebuyers can expect mortgage rates to stay in the 5%-6% range over the next few months, as a combination of still-high inflation and the Fed’s increasing borrowing costs will keep them elevated," said Ratiu. "With rates about 250 basis points higher than a year ago, the median monthly payment will hover near $2,000, about 60% more than last year. This will challenge many first-time buyers, especially as wages are rising at just 5% per year. The silver lining for those still looking for a home is that houses are staying on the market longer, pushing sellers to drop asking prices and leaving more room for negotiation. As we move into the fall, and the pace of sales slows even further, some buyers may find discounts growing larger, offering opportunities that fit within their budgets.”

Freddie Mac continues to make homeownership possible for millions of families and individuals by providing mortgage capital to lenders. Since their inception by Congress in 1970, they’ve made housing more accessible and affordable for homebuyers and renters in communities nationwide. Fannie Mae stands firm on building a better housing finance system for homebuyers, renters, lenders, investors, and taxpayers.

To read the full release, click here.

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news