In modern-day America, even a top job’s paychecks do not always open the door to acquiring homeownership. However, regional differences still make it possible for workers in a wide range of professions to buy a home in locations where their job skills are needed, according to a new report form StorageCafe.

With major changes in demographics and the evolution of real estate in American cities, researchers wanted to see where people can realistically be homebuyers these days, based on what they are earning. StorageCafe took 58 groups of professions into consideration –those that experienced growth in numbers over the last decade– and calculated which US metros allow a worker to buy a home there.

Key findings:

- Ohio, followed by nearby Pennsylvania and Upstate New York, provide the best opportunities for homeownership across all trending professions

- Cardiologists and anesthesiologists are among the medical professionals needing the least time to save a down payment for an average home — even in NYC it’s only 1.6 years

- For blue-collar workers, Toledo and Scranton housing markets are affordable for employees in the food processing and material moving sectors

- Ogden, UT, lets life scientists buy homes, while Chattanooga, TN, welcomes agricultural workers and Little Rock, AR, is suitable for homebuying foresters

- Over the last decade, the largest employee growth occurred in the math sciences, home healthcare and material moving sectors

To make it to the affordability list, each profession needed to earn no less than the ‘qualifying income’ —mortgage payments account for 30% of this, which is a long-standing rule of thumb regarding advisable expenditures. They must also be able to save up a mortgage down payment —20% of the cost of the average home in their area— in no more than five years using a maximum of 20% of their salary.

According to StorageCafe's most recent study, metropolitan areas offering the best chances of homebuying for the widest arrays of professions are clustered in a midwest-northeast region of the country, which includes Toledo and Dayton in Ohio, Scranton in nearby Pennsylvania and Syracuse in Upstate New York. In line with their reputations, Californian metros are difficult places to buy in, due to increasing home prices outstripping salary raises, and Utah is also marching towards unaffordability, with home prices there experiencing a huge surge recently.

Crucially, the metros where one can afford a home vary across the professions. For example, Chattanooga, TN, is preferable for agricultural workers, Seattle, Washington, is better than California for top executives, Little Rock, Arkansas, welcomes foresters and Ogden, Utah, is looking good for life scientists.

Utah joins California & Seattle, becoming a tough market to buy in

At the other end of the spectrum, the Californian metros centered on San Francisco, San Diego and San Jose are the least affordable, with no groups of professions able to easily buy an average home there. It would take no less 14.2 years to save for a deposit in San Francisco-Oakland-Hayward on the average salary across all professions, and in San Jose-Sunnyvale-Santa Clara the figure is 13.8. The San Jose metro —which includes Silicon Valley— has the highest average income across all professions at around $113K. However, this is not enough to enable residents to afford the nation’s highest-priced homes, which average out at over $1.5M. San Francisco is in 2nd place in both respects.

Utah’s recent ascension among the most popular moving destinations across the US has driven a massive increase in home prices, and local salaries do not always follow suit. Salt Lake City, Provo-Orem and Ogden-Clearfield are all only affordable for homebuyers from four groups of professions, namely lawyers and judges, air transport workers and managers in some sectors. Ogden-Clearfield is the exception in that life scientists also earn enough there, slightly more than the national average of $100K. Average salaries in the three metros are either slightly more or less than $60K while average home prices are clustered around the $500K mark.

Between 2019 and 2021, average home prices in Salt Lake City rose 44% from around $385K to $556K, somewhat more than the nationwide increase of 30%. Incomes in Salt Lake City, meanwhile, rose just 9% during the same period. Downsizing is often a good solution to financial challenges, and Salt Lake City is no exception. At the end of 2021, a 3-bedroom home there cost an average of about $517K while a 2-bedroom home could be bought for an average of $423K, so swapping the former for the latter would net $94K. Switching to a 1-bedroom home would yield an average of $152K.

Seattle-Tacoma-Bellevue in Washington State is another metro offering affordable housing to only four profession groups. Its top executives are one group that is able to buy, earning $157K, which is somewhat higher than the national average. For increased affordability in Seattle, a 3-bedroom home, which costs an average of around $675K, could be sold and exchanged for a 2-bedroom or 1-bedroom one —the price differentials are $122K and $242, respectively.

Ohio’s metros emerge as US’s most affordable, along with Scranton, Pennsylvania, and Syracuse, New York

Toledo, Ohio, is an affordable metro for the highest number of groups of professions, 51 in total. Average incomes in the Glass City hover around $56K and homes cost an average of $156K, making it possible to save up a 20% down payment of $31,286 in a reasonable average time of 2.77 years across all the professions. If you’re a marketing or sales manager, you’ll already earn about $136K here —and you’ll need only a little over a year to save up— while judges, lawyers, executives and air transportation workers all make averages of more than $100K.

Scranton-Wilkes Barre-Hazleton in Pennsylvania is in second place in terms of affordability for a variety of groups of professions, 49 of them. The overall cost differential is slightly less friendly than Toledo’s: the average salary across the metro is around $53K and the average house price approaches $162K. However, some professions do particularly well in this city famous for rolling up its sleeves. Employees who supervise construction and extraction activities —whose numbers rose by almost 50% in the last decade— earn a good average wage here getting on for $76K, which is close to the national average, something that cannot be said for many professions in this city.

In third place is Syracuse in upstate New York, offering employees in 46 groups of professions the possibility of affordable homebuying. The metro has a higher average wage of over $64K and average home prices approaching $182K to match. Syracuse follows Scranton with its appreciation of building professionals, and their supervisors of construction and extraction workers earn slightly more than the national average. The same is true for supervisors of installation, maintenance and repair workers here.

Other places in Ohio also entice potential homeowners. Dayton, in 4th position with home prices averaging around $177K and an average of income of almost $62K, is an affordable metropolitan area for 45 groups of professions, and an average of 2.9 years would be needed to save up a down payment. Along with the usual top professionals, engineers also have average salaries above $100K here, but lawyers and judges earn less than in Toledo.

With Pittsburgh in joint 4th place, Pennsylvania contributes another top metro for affordability, having average housing prices of $203K and average wages of around $63K, enabling workers in 45 profession groups to buy a home there. They will need an average of 3.2 years to save up for the down payment.

Further emphasizing Ohio's affordability, Cleveland-Elyria and Akron are in 6th and 7th places with home prices of around $203K and $192K, respectively. As with Dayton, the average income in Cleveland-Elyria is around $62K, while the equivalent figure in Akron is slightly less. Residents of both Cleveland-Elyria and Akron need only 3.3 years to save up for the down payment, and these metros are affordable for 44 and 43 profession groups, respectively.

Also in New York State —on the banks of Lake Ontario— Rochester is in joint 7th place for the number of profession groups who can afford to buy a home, 43, and it takes an average of only 3.2 years to save up for a down payment here. The average home price is $200K and the average income is $63K.

Top managers, legal professionals and executives can still buy a home in 90% or more of the metros

All across the US, there is good news for managers in many sectors. Those in the fields of advertising, marketing, promotions, public relations and sales, with average nationwide salaries of $150K, could afford to buy a home in 94 out of the 100 metros. Operations specialties managers, who work in a variety of other sectors and earn an average approaching $147K, exhibit the same pattern. Five of the six places where even these highly paid professionals are not easily able to buy a home are in California —the metros centered on Los-Angeles, San Francisco, San Jose, San Diego and Oxnard— while Urban Honolulu in Hawaii rounds out the list.

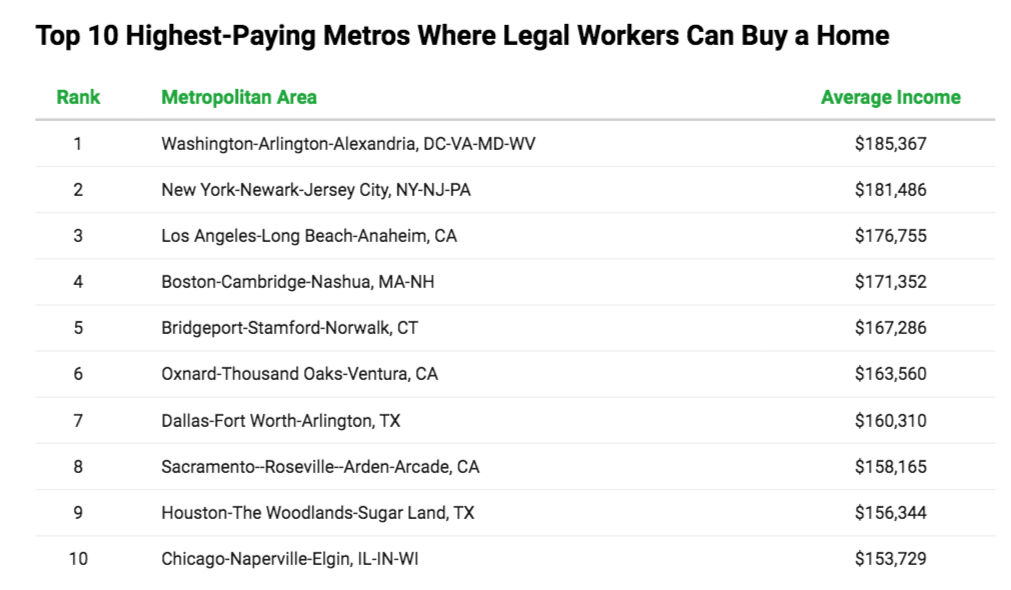

Lawyers, judges and similar workers, with an average salary of around $152K nationwide, can afford homes in 93 of the 100 largest U.S. metros. Unlike the well-remunerated managers, they would not be able to buy a home in the metros centered on Ogden, Utah, Seattle in Washington State, and also Worcester, Massachusetts. By way of compensation, however, they would be able to afford one in two homebuyers’ markets that are hard to crack: Los-Angeles-Long Beach-Anaheim and nearby Oxnard-Thousand Oaks-Ventura, where their average salaries exceed $176K and $163K, respectively.

The nation’s top executives, earning an average of around $128K per year, can afford to buy a home in 90 of the 100 largest U.S. metros. In the list of those that are not currently affordable, the ‘usual suspects’ in California, Utah and Hawaii are joined by Boise City, Idaho. These employees in The City of Trees earn an average of only $80K there, and with home prices of around $500K, this is both slightly lower than qualifying income and also not enough to save up a down payment within five years.

Blue-collar workers may be able to buy homes in Toledo, Scranton and the South

Americans on lower incomes have been struggling to buy homes, but some parts of the country still let them climb the property ladder. Agricultural workers —a profession group that includes inspectors and ranchers as well as laborers, for example— can afford to buy homes in the Chattanooga metro, straddling the Tennessee-Georgia border, but in no others.

Food processing and material moving workers — including many essential vehicle operators — can only buy a home in Scranton-Wilkes Barre-Hazleton, PA, and Toledo, OH. For extra space, Chattanooga self storage is reasonable at $96 per month for a 10’x10’ non-climate-climate controlled unit, and the same deal in Scranton and Toledo costs an average of $103 or $84, respectively.

Forest, conservation and logging workers have slightly more options, and rather different ones. They can afford to buy a home in Augusta-Richmond County, GA-SC, Jackson, MS, and Little Rock-North Little Rock-Conway, AR, experiencing good differentials between wages and home prices in these places. In the Little Rock metro they have the highest average income of the three, at $48K, and the shortest time needed to save a deposit, 3.8 years.

Medical specialists can afford to buy in even the most expensive metros

Within the profession groups, certain vocations shine particularly brightly as money-makers, making purchasing a home not so much of a worry. The years of training that go to make a medical specialist are not in vain when it comes to buying a home. Cardiologists, dermatologists and anesthesiologists, for example, all earn average salaries in excess of $300K, often several times the qualifying income for an average home — even in a metro like NYC where the average home price is around $578K — and they should be able to save up the down payment for an average home in less than couple of years. New York self storage will provide Gothamites with extra space if they choose to buy a home that is smaller than they would ideally like.

Even so, some medical specialists may not find homebuying so straightforward. Psychiatrists, while they earn an average of around $250K nationwide, make only $153K in Honolulu, Hawaii, and although this just clears the qualifying income threshold, it would take them slightly longer than five years to save up the average down payment. A similar situation arises for general pediatricians in Los Angeles-Long Beach-Anaheim, but the local Los Angeles self storage sector can provide extra space, with prices for a 10’x10’ climate-controlled unit around $209 per month.

Just as important as the doctors, America's nurses — whether they are midwifes, anesthetists or regular practitioners — are well paid in many parts of the nation. While they would not make the qualifying income in San Jose, San Francisco or Los Angeles, buying in other Golden State metros such as Sacramento, Fresno, Stockton, Riverside, and Bakersfield would be more than possible with their relatively high salaries there. In addition, nurses in Minneapolis, Minnesota, Las Vegas, Nevada, and Spokane in Washington State would be able to buy a home, as would many in Connecticut’s metropolitan areas.

Managers, lawyers, techies & media professionals can buy out East, especially in Connecticut and North Carolina

Advertising, marketing, promotions, public relations, and sales managers also witnessed significant increases in numbers. Marketing managers in particular are well remunerated, and could successfully buy homes in metros across the nation from the East Coast to Seattle in the Northwest, with Colorado housing markets also making them welcome.

Legal workers include judges, lawyers and other related employees. Some Californian metros are difficult places for buying homes even for this well-paid group, but Los Angeles in this case is affordable. East Coast metros are joined by the big Texan urban centers, plus Chicago, as other places that make homebuying quite possible for legal sector workers.

America's many IT professionals, perhaps surprisingly, cannot easily buy a home in hotspots for their industry such as Silicon Valley and Seattle. However, some places out east, such as Washington DC and nearby Baltimore, Maryland, plus no fewer than three North Carolina metros, make homebuying a lot more possible for computing professionals.

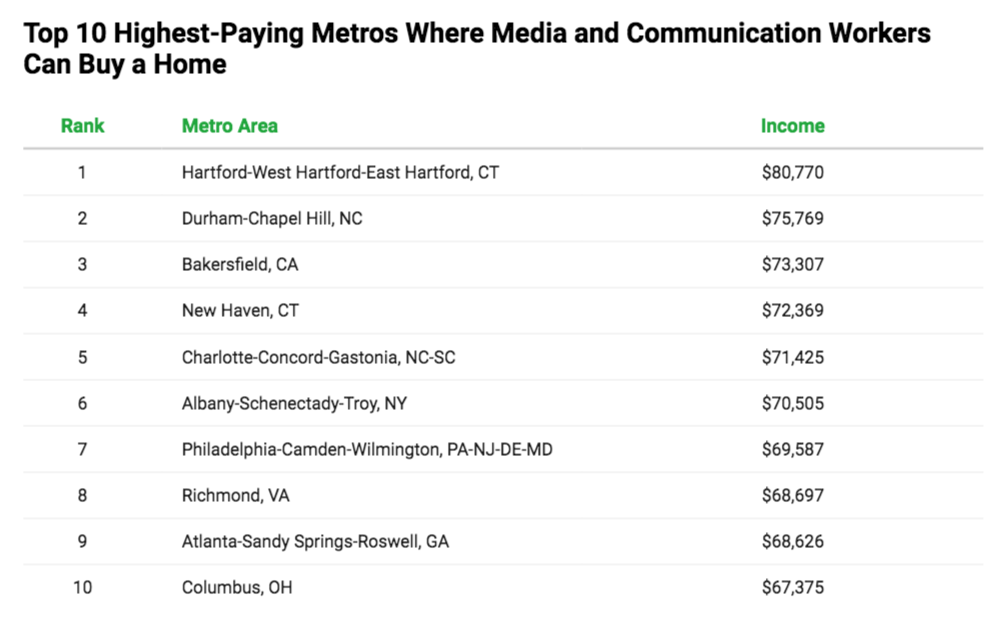

Employees in the media and communications sectors include broadcasters, translators, editors and technical writers, and it is no surprise that they get good wages in the nations' media-savvy northeast cities. Connecticut, a stone's throw from The Big Apple, registers two metros in the top 5, New Haven and Hartford. New York State itself gets a 6th-place spot with Albany-Schenectady-Troy. Further down the coast, North Carolina also contributes twice to the top five with Durham-Chapel Hill and Charlotte-Concord-Gastonia, while Richmond, VA, and Atlanta, GA, are in the top 10. Although California's big cities don't reach these heights, Golden State media people might be interested to know that Bakersfield, in third place, would offer them an average salary of more than $73K.

Math experts and personal care aides increased most in numbers over the last decade

The future of home affordability is bound up with the numbers of workers employed in the various professions. Changing times can boost new professions while traditional ones may decline. We looked at the last decade (2012 vs. 2021) in order to find out which sectors gained the most employees in this time span. The numbers employed in math occupations doubled, while material moving workers and business operations specialists, along with animal care workers and transportation supervisors, saw an increase of 50% or more during that period.

Metros clustered in a region where the Midwest meets the Northeast prove to be the most affordable across the widest ranges of jobs. Workers in the highest-paying professions can afford a home almost anywhere but might have to content themselves with something costing below the average in places such as California. Professionals of different stripes may not necessarily find it is the same metros that get them onto the property ladder, so they can look around. Worker migration has been a feature of life in America for a long time, and this will surely continue as workers find new jobs, professions and homes to buy.

To read the full report, including more charts, detail and methodology, click here.

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news