Mortgages rates, topping 5.6% for the first time in over a decade, have fluctuated significantly over the past few months but are now significantly higher than they were at the beginning of the year.

Mortgages rates, topping 5.6% for the first time in over a decade, have fluctuated significantly over the past few months but are now significantly higher than they were at the beginning of the year.

Higher rates obviously means higher interest rates which add up over time, but other options—like the 15-year, fixed-rate mortgage—usually require lower interest payouts.

Knowing this, LendingTree [1] analyzed 381,000 loans they offered to their customers between July and August 2022 to find out just how much picking a 15-year mortgage option would save them.

“Even though 15-year mortgages are more expensive monthly, getting one instead of a 30-year fixed mortgage could save borrowers an average of nearly $215,000 in interest over their loan’s lifetime,” LendingTree said in its report. “That said, borrowers with 15-year mortgages would need to shell out an average of $572 more monthly to take advantage of these long-term savings.

Top findings from the report include:

- 15-year mortgages could save borrowers hundreds of thousands of dollars over the lifetime of their loans. Through lower rates and shorter repayment periods, borrowers who choose 15-year, fixed-rate mortgages could save an average of $214,899 in interest over the lifetime of their loans compared to borrowers who choose 30-year mortgages.

- Mortgage rates are usually significantly lower for 15-year fixed mortgages. Across the nation’s 50 states, the average APR offered to borrowers with a 15-year fixed mortgage is 5.14% — 92 basis points lower than the average APR of 6.06% offered to 30-year fixed borrowers.

- Despite overall savings, 15-year mortgage borrowers will spend considerably more on their monthly payments than 30-year mortgage borrowers. On average, payments for 15-year fixed mortgages cost $572 more monthly than for 30-year fixed mortgages.

- California, Hawaii and Washington borrowers could save the most over the lifetime of their loans by choosing 15-year mortgages over 30-year ones. Across these states, the total lifetime cost of a 30-year mortgage averages $306,687 more than the total cost of a 15-year mortgage. That said, borrowers in these states who choose a 15-year mortgage over a 30-year one would spend, on average, $833 more a month.

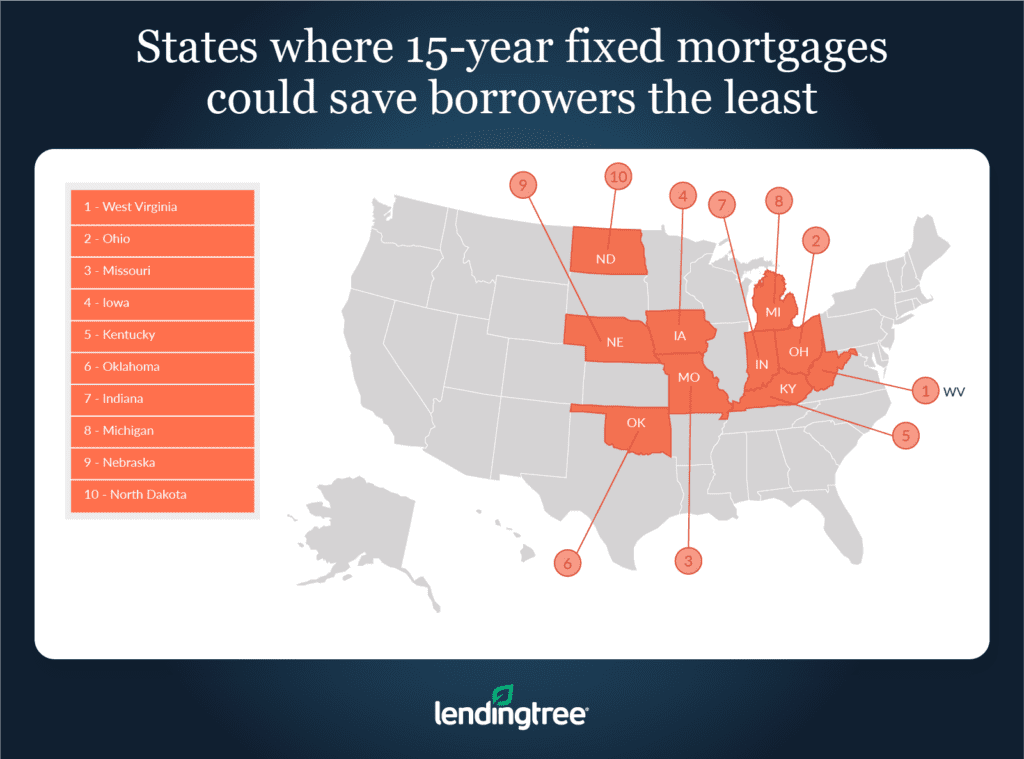

- West Virginia, Ohio and Missouri borrowers could save the least over the lifetime of their loans by choosing 15-year mortgages over 30-year ones. Despite appearing at the bottom of the list, borrowers in these states could save an average of $171,632 over the lifetime of 15-year mortgages compared to 30-year mortgages.

To view the report in its entirety, including state-level breakdowns of findings, click here [2].