It should be no surprise that with the sharp and continued rise in property values, that single-family home affordability continues to elude the average earner in the country.

It should be no surprise that with the sharp and continued rise in property values, that single-family home affordability continues to elude the average earner in the country.

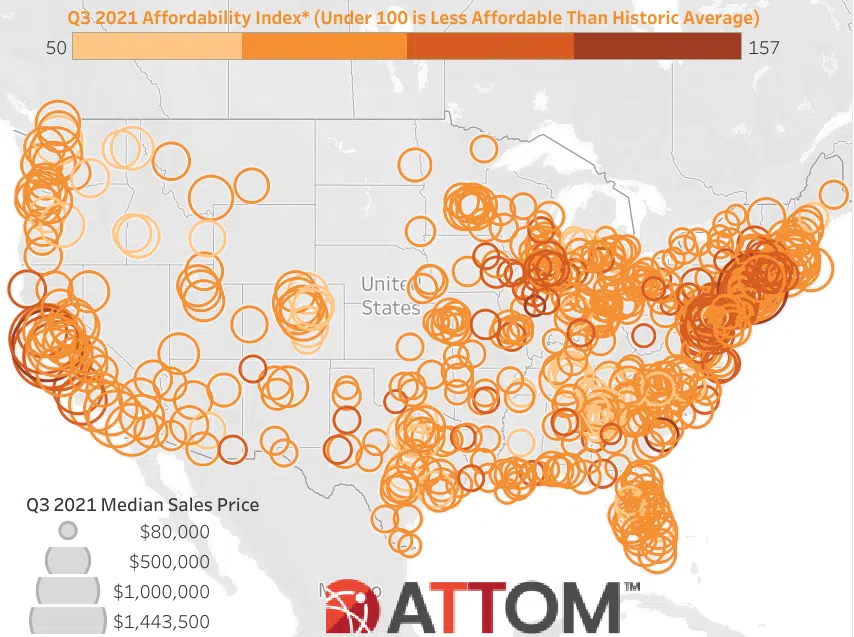

According to a report by ATTOM, a dataset covering the top 572 counties in the U.S was used to determine home affordability for average wage earners by calculating the amount of income needed to meet monthly household expenses—including mortgage, taxes, and insurance—and assumed a 20% down payment and a 28% debt-to-income ratio.

It found, yet again, that homes are less affordable in the third quarter compared with past years, with homes being less affordable in 75% of the counties surveyed. This is up from 56% during the same period in 2020 and is the highest level of unaffordability since 2008 due to the fact that wages have largely remained stagnant for years.

The latest pattern–home prices still manageable, but getting less affordable–has resulted in major ownership costs on the typical home consuming 24.9% of the average national wage of $64,857 in the third quarter of this year. That is up from 24.3% in the second quarter of 2021 and 22.3% in the third quarter of last year. Still, the latest level is within the 28% standard lenders prefer for how much homeowners should spend on mortgage payments, home insurance and property taxes.

“The typical median-priced home around the U.S. remains affordable to workers earning an average wage, despite prices that keep going through the roof. Super-low interests and rising pay continue to be the main reasons why,” said Todd Teta, Chief Product Officer with ATTOM. “But affordability keeps inching in the wrong direction as the housing market boom keeps roaring ahead. That’s pushing average workers closer and closer to the point where lenders might be reluctant to give them a mortgage. With much still uncertain about how the pandemic and many other forces could still affect the economy, affordability remains a crucial measure of market stability that could easily keep going in the same direction or swing back the other way.”

The costs of ownership

Major ownership costs on median-priced homes in Q2 of 2021 consumes less than 28% of average local wages in 303 of the 572 counties analyzed in this report (53%). Counties requiring the smallest portion are:

- Schuylkill County, Pennsylvania (outside Allentown) (9.5% of annualized weekly wages needed to buy a home)

- Fayette County, Pennsylvania (outside Pittsburgh) (10.6% of annualized weekly wages needed to buy a home)

- Cambria County, Pennsylvania (outside Pittsburgh) (10.9% of annualized weekly wages needed to buy a home)

- Macon County (Decatur), Illinois (11.3% of annualized weekly wages needed to buy a home)

- Bibb County (Macon), Georgia (11.4% of annualized weekly wages needed to buy a home)

A total of 269 counties in the report (47%) required more than 28% of annualized local weekly wages to afford a typical home in Q2. Counties that required the greatest percentage of wages include:

- Kings County (Brooklyn), New York (78.7% of annualized weekly wages needed to buy a home)

- Santa Cruz County, California (77.7% of annualized weekly wages needed to buy a home)

- Marin County, California (outside San Francisco) (75.1% of annualized weekly wages needed to buy a home)

- Maui County, Hawaii (66.2% of annualized weekly wages needed to buy a home)

- Monterey County, California (outside San Francisco) (63.7% of annualized weekly wages needed to buy a home)

While less than 28% of average local wages required to buy a home in half the nation, in 20 of the surveyed counties, it took over $75,000 in annual wages to afford a home. This was led by New York County (Manhattan), New York where one would need to make $247,479 to afford the average home and San Mateo County (outside San Francisco), California ($246,824).

The lowest annual wages required to afford a median-priced home in the third quarter of 2021 are in Schuylkill County, Pennsylvania (outside Allentown) where one would only need to make $15,834 to afford a median home and Fayette County, Pennsylvania (outside Pittsburgh) ($16,497).

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news