Sales Boomerang has released its Q3 2021 Mortgage Market Opportunities Report, which found that despite declines in loan volume, there were several fertile opportunities for mortgage lenders, including a high frequency of borrowers who are well-positioned to refinance for a better rate, remove FHA mortgage insurance, or tap into home equity.

Sales Boomerang has released its Q3 2021 Mortgage Market Opportunities Report, which found that despite declines in loan volume, there were several fertile opportunities for mortgage lenders, including a high frequency of borrowers who are well-positioned to refinance for a better rate, remove FHA mortgage insurance, or tap into home equity.

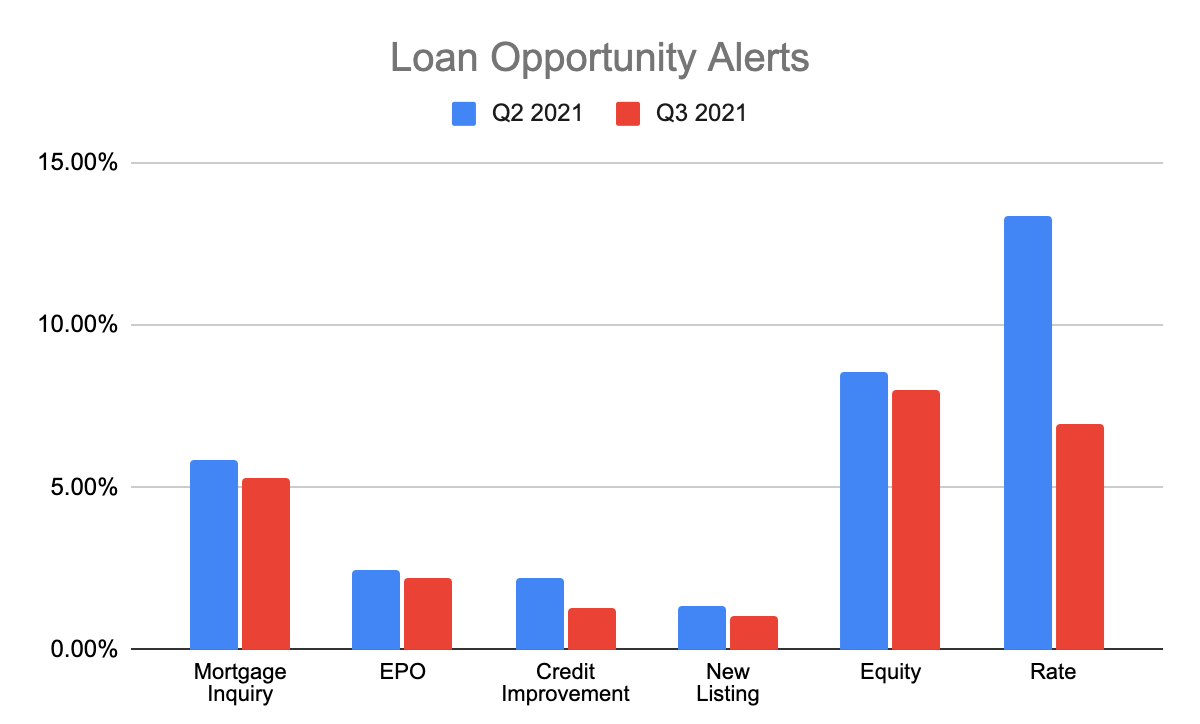

Sales Boomerang’s loan-opportunity alerts identify the contacts inside a lender’s database who are actively shopping for a mortgage loan or who may be able to benefit from a new mortgage loan. Across the sample group, the frequency of each alert type in Q3 2021 was as follows:

- Mortgage Inquiry Alert: 5.27% of monitored contacts (down 10.22% from Q2)—a customer or prospect has shopped with a competitor in the last 24 hours.

- EPO Alert: 2.23% of monitored contacts (down 8.23% from Q2)—a customer or prospect whose loan closed ≤ 6 months ago has shopped with a competitor in the last 24 hours.

- Credit Improvement Alert: 1.32% of monitored contacts (down 40.00% from Q2)—a customer or prospect has improved their FICO score.

- New Listing Alert: 1.04% of monitored contacts (down 24.09% from Q2)—a customer or prospect has listed their home for sale.

- Equity Alert: 8.02% of monitored contacts (down 6.20% from Q2)—a customer or prospect’s home equity has increased.

- Rate Alert: 6.96% of monitored contacts (down 47.79% from Q2)—the interest rate of a customer or prospect’s existing mortgage is significantly higher than current prevailing rates.

“As industry experts have predicted, we are starting to see the refinance market slow—and the purchase market has not yet picked up the slack,” said Sales Boomerang CEO Alex Kutsishin. “Still, the big-picture view says we are still in the midst of a housing boom. Ample purchase and refinance opportunities remain, and our data intelligence points to myriad ways lenders can improve borrowers’ financial position with the right loan product.”

Just last week, the Mortgage Bankers Association (MBA) found that the refinance share of mortgage application volume activity increased to 66.4% of total applications from 66.2% the previous week.

"The increase in rates—mostly later in the week—led to a decrease in both purchase and refinance applications, with a prominent decline in government loan applications,” said Joel Kan, MBA's Associate VP of Economic and Industry Forecasting. “Conventional loan applications increased, driven by a rise in conventional refinances. This was perhaps a sign that some borrowers reacted to higher rates and decided to refinance."

The window for refis may be slowly closing, as last week, Freddie Mac’s latest Primary Mortgage Market Survey (PMMS) found the 30-year fixed-rate mortgage (FRM) advance above the 3% mark to 3.01% for the week ending September 30, 2021.

The Mortgage Market Opportunities Report draws on Sales Boomerang system data to identify market opportunities of relevance to today’s borrowers and lenders. Sales Boomerang reviewed data from more than 150 residential mortgage lenders that use its borrower intelligence and retention tools to monitor millions of customer and prospect records. Sales Boomerang then calculated the aggregate frequency with which those contact records triggered loan-opportunity, prescriptive-scenario and risk-and-retention alerts during the second and third quarters of 2021.

Sales Boomerang’s prescriptive-scenario alerts analyze not only whether a consumer could benefit from a given loan type, but also whether or not the consumer is credit-qualified to apply for financing. The frequency of each alert during Q3 2021 was as follows:

- Cash-Out Alert: 4.31% of monitored contacts (up 291.82% from Q2)—a borrower is credit qualified and has built sufficient equity to tap into the cash in their home.

- Rate-and-Term Alert: 3.86% of monitored contacts (up 34.49% from Q2)—a borrower is credit qualified and can benefit from the current interest rates for a refinance.

- Debt Alert: 1.73% of monitored contacts (up 10.19% from Q2)—a borrower is credit qualified and can benefit from paying off other debts with the equity in their home.

- FHA MI Removal Alert: 7.27% of monitored contacts (up 366.03% from Q2)—an FHA borrower has exceeded 20% equity and can remove mortgage insurance (MI).

For a subset of lenders that maintain servicing portfolios, the frequency of risk-and-retention alerts was as follows:

- Risk & Retention Alert: 36.18% of monitored contacts (down 1.23% from Q2)—a customer is engaging in one or more of 15 credit activities that may put their serviced loan at risk.

Although the frequency of equity alerts fell slightly from Q2 to Q3, nearly one in 12 borrowers saw significant home equity growth over the last quarter. Moreover, the almost 300% quarter-over-quarter increase in Cash-Out Alerts shows that borrowers have grown their credit scores alongside their equity, paving the way for more cash-out refinance and HELOC activity in the coming months.

The strong performance of equity-based alerts is underscored by key observations from the latest CoreLogic Homeowner Equity Report, which found that the average homeowner gained $51,500 in equity during the past year, while U.S. homeowners as a whole have seen their equity increase by a total of nearly $2.9 trillion since Q2 of 2020.

“As long as interest rates remain low, refi opportunities remain on the table for many borrowers,” said the Report. “This opportunity is apparent in the quarter-over-quarter growth of the Rate-and-Term alert. However, with Mortgage Inquiry and EPO alerts both showing quarter-over-quarter decreases, lenders will need to be proactive in reaching out to potential refi customers, as many eligible customers do not appear to be shopping for rates on their own. With market experts long predicting a late 2021 home purchase boom, the 24% quarter-over-quarter decrease in New Listing alerts suggests lenders may need to revise their year-end revenue forecasts.”

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news