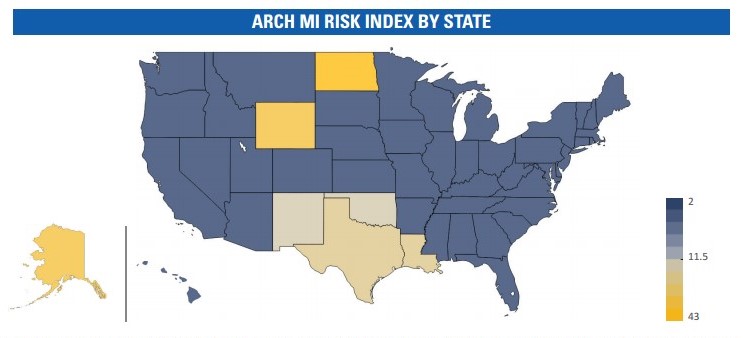

[1]The average risk of home price declines over the next two years rests at the low level of 6 percent, except for states that are highly dependent on oil production, the Arch Mortgage Insurance (MI) Risk Index showed.

[1]The average risk of home price declines over the next two years rests at the low level of 6 percent, except for states that are highly dependent on oil production, the Arch Mortgage Insurance (MI) Risk Index showed.

Arch (MI) Company [2], a provider of private mortgage insurance and a wholly owned subsidiary of Arch Capital Group Ltd., released their Fall 2015 Housing and Mortgage Market Review [3] Tuesday.

The review contains the latest Arch MI Risk Index model results which revealed that North Dakota had the highest risk of home price decreases at 43 percent, mostly due to the 1.8 percent drop in total employment and lower oil prices. Alaska and Wyoming followed with 35 percent and 36 percent chances, respectively.

In addition, energy-producing states such as Texas (29 percent), Louisiana (27 percent), New Mexico (25 percent), Oklahoma (26 percent), and West Virginia (5 percent) also have higher-than-average risks of price declines.

"Home prices in much of the country should continue to rise faster than inflation in the medium term, due to a shortage of homes for sale or rent, good affordability, and continued job growth of 2 to 3 million net new jobs a year," the report noted. "Most Oil Patch states will experience slower home price growth, but any price declines should be fairly limited in scope. No states received Risk Index scores above 50, the point where home prices are more likely to decline than rise."

[4]According to Arch MI, many oil-producing states have been experiencing slow home price growth, Texas home prices increase 7.5 percent in the last year, must quicker than the national average of 5.1 percent.

[4]According to Arch MI, many oil-producing states have been experiencing slow home price growth, Texas home prices increase 7.5 percent in the last year, must quicker than the national average of 5.1 percent.

"We expect the slowing trend to continue since there will be more energy-related layoffs to come (both directly and indirectly in manufacturing, transportation, etc.), due to long and uncertain lags and the recent continued declines in energy prices," the report stated.

"Since the trend in employment has turned negative recently in several states, it is reasonable to expect a slowdown in home price growth in the oil region overall in the coming year," the report said. "We do not foresee a repeat of the “Oil Patch” deep regional recession from the 1980s, thanks to a more diversified employment base, a well-capitalized financial sector, and the benefit of solid employment growth for the United States overall."

Click here [3] to view the complete report.