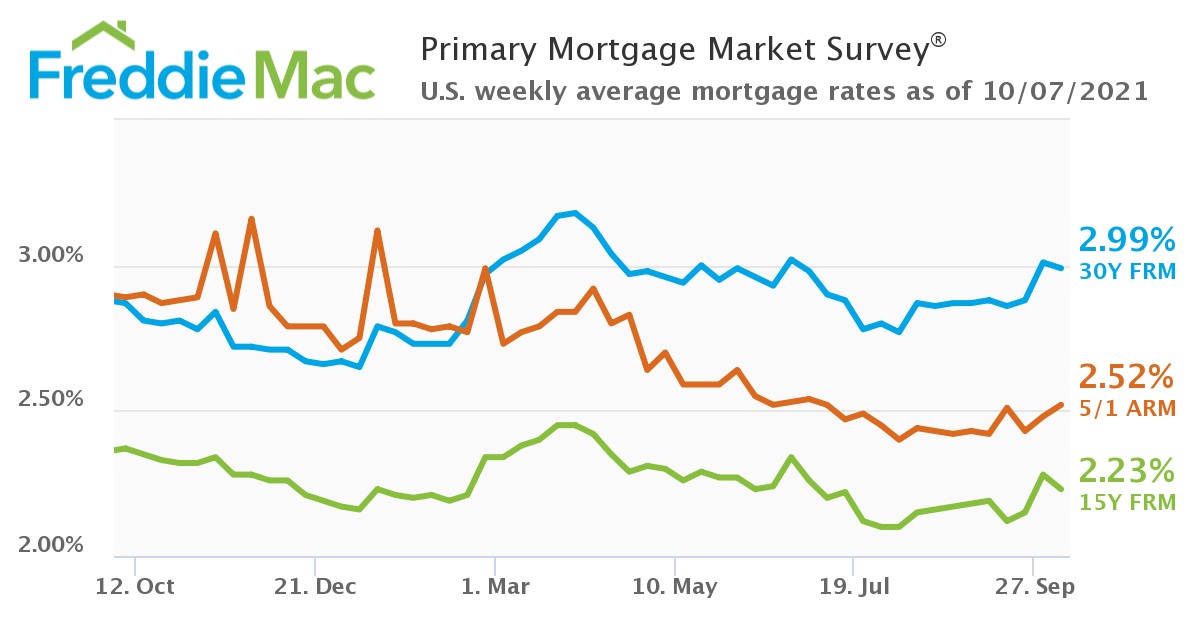

The latest Primary Mortgage Market Survey (PMMS) [1] from Freddie Mac found the 30-year fixed-rate mortgage (FRM) averaged 2.99% for the week ending October 7, 2021, down slightly from last week when it averaged 3.01%. A year ago at this time, the 30-year FRM averaged 2.87%.

The latest Primary Mortgage Market Survey (PMMS) [1] from Freddie Mac found the 30-year fixed-rate mortgage (FRM) averaged 2.99% for the week ending October 7, 2021, down slightly from last week when it averaged 3.01%. A year ago at this time, the 30-year FRM averaged 2.87%.

“Mortgage rates continue to hover at around three percent again this week due to rising economic and financial market uncertainties,” said Sam Khater [2], Freddie Mac’s Chief Economist. “Unfortunately, with the expectation that both mortgage rates and home prices will continue to rise, competition remains high and housing affordability is declining.”

In terms of affordability, it remains out of reach for many, as CoreLogic’s latest Home Price Index (HPI) and HPI Forecast [3] has found that home prices hit a fever pitch this summer, with annual price gains reaching an all-time high in August at 18.1%, compared to August 2020, marking the largest 12-month growth in the U.S. Index since the series began (January 1976–January 1977).

“Home prices continue to escalate at a torrid pace as a broad spectrum of buyers drive demand for a limited supply of homes," said Frank Martell [3], President and CEO of CoreLogic. "We expect to see the trend of strong price gains continue indefinitely with large amounts of capital chasing too few assets.”

The 15-year FRM averaged 2.23% with an average 0.7 point, down from last week when it averaged 2.28%. A year ago at this time, the 15-year FRM averaged 2.37%. The five-year Treasury-indexed hybrid adjustable-rate mortgage (ARM) averaged 2.52%, with an average 0.3 point, up from last week when it averaged 2.48%. A year ago at this time, the five-year ARM averaged 2.89%.

“Real estate markets are feeling the effects of seasonal fluctuations once again. As we move through fall, homes-for-sale are lingering on the market longer, and prices—while still rising—are confined to single-digit gains, a noticeable change from jumps we saw during the peak of the pandemic,” said Realtor.com Manager of Economic Research George Ratiu. “There is still a limited number of homes for sale, especially as new listings have been shrinking over the past four weeks. Rising mortgage rates are already putting pressure on first-time buyers’ budgets. At today’s rate, a homebuyer looking at a median-priced home will spend $134 more per month on their mortgage payment, adding over $1,600 a year to their payments. With declining affordability, we expect the pace of sales to moderate going into the last stretch of 2021.”

A recent data analysis by ATTOM [4] covering the top 572 counties in the U.S was used to determine home affordability for average wage earners by calculating the amount of income needed to meet monthly household expenses—including mortgage, taxes, and insurance—and assumed a 20% down payment and a 28% debt-to-income ratio. It found that homes were less affordable in Q3 compared with past years, with homes being less affordable in 75% of the counties surveyed. This is up from 56% during the same period in 2020, and marks the highest level of unaffordability since 2008, because wages have largely remained stagnant for years.

One bright spot was presented by the U.S. Department of Labor [5] who reported today that for the week ending October 2, the advance figure for seasonally-adjusted initial claims was 326,000, a decrease of 38,000 from the previous week's revised level. The previous week's level was revised up by 2,000 from 362,000 to 364,000. The four-week moving average was 344,000, an increase of 3,500 from the previous week's revised average. The previous week's average was revised up by 500 from 340,000 to 340,500.