[1]Home prices are not the only determining factor when looking at affordable living options. In fact, markets with cheapest homes are not necessarily always the most affordable.

[1]Home prices are not the only determining factor when looking at affordable living options. In fact, markets with cheapest homes are not necessarily always the most affordable.

Zillow research [2]released Thursday showed lower priced homes are not always the most attractive and budget-friendly option for those in the U.S. workforce.

Although homes cost less in the middle of the country, wages are also lower. Consumers that live here put a smaller percentage of their monthly income toward housing, further proving that cheap markets are not always the most affordable, the study found.

"There's a lot more to home buying affordability than just the cost of the home. Incomes vary a lot across the country–even within the same occupation," said Dr. Svenja Gudell, chief economist, Zillow.

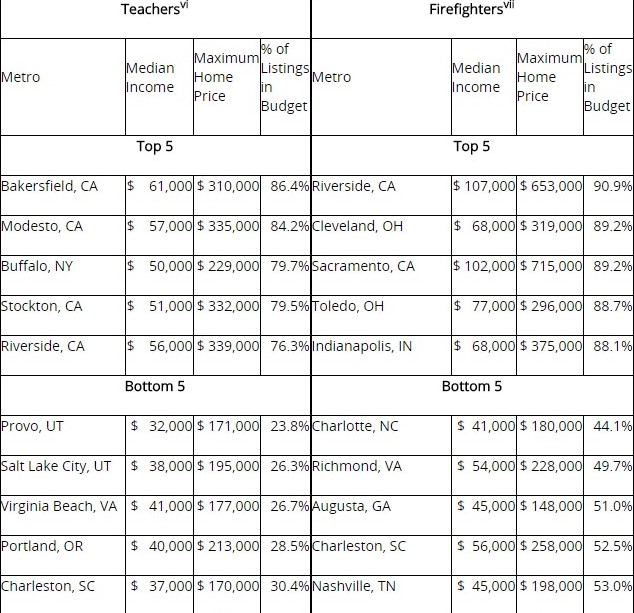

[3]Teachers that are budgeting to purchase a home in the future will have a harder time finding a home in Salt Lake City, Utah or Portland, Oregon than in some parts of California.

[3]Teachers that are budgeting to purchase a home in the future will have a harder time finding a home in Salt Lake City, Utah or Portland, Oregon than in some parts of California.

"Many potential buyers are checking all the right boxes prior to buying a home–saving a healthy down payment, organizing finances and qualifying for a loan–only to find there are few homes available within their budget and close to their job."

Zillow found that in Bakersfield, California, the median home value is $166,300, while the annual teacher salary is $61,000 annually. If 22 percent of this income is applied toward a house payment, a teacher in this area could afford a $310,000 home, which includes about 86 percent of all homes on the market.

In contrast, a teacher in Salt Lake City, Utah makes $38,000 annually and can afford a $195,000 home, only about 25 percent of homes in this market.

Riverside, California firefighters can purchase a $653,000, with the median local firefighter income of $107,000 and spending the average 26 percent to pay their mortgage, Zillow says. Meanwhile, Portland, Oregon construction workers will find less than 10 percent of listings within their budget, but can afford almost two-thirds of the homes for sale in Buffalo, New York.

"There's also the question of how much of your paycheck you're willing to put toward a house payment, and finally, whether you can find a home in your price range," Dr. Gudell said. "Many potential buyers are checking all the right boxes prior to buying a home–saving a healthy down payment, organizing finances and qualifying for a loan–only to find there are few homes available within their budget and close to their job."

Click here [2]to view the complete report.