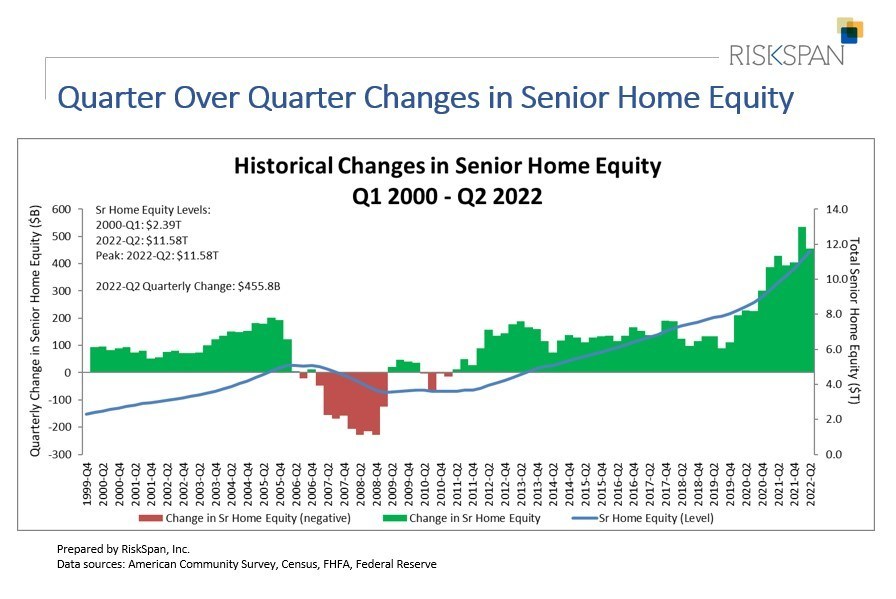

Homeowners 62 and older saw their housing wealth grow by 4.10% or $456 billion in Q2 to a record $11.58 trillion from Q1 2022, according to the latest quarterly release of the NRMLA/RiskSpan Reverse Mortgage Market Index.

Homeowners 62 and older saw their housing wealth grow by 4.10% or $456 billion in Q2 to a record $11.58 trillion from Q1 2022, according to the latest quarterly release of the NRMLA/RiskSpan Reverse Mortgage Market Index.

"At a time when we're seeing stock market volatility and the potential for a recession in the near future, it's the perfect time for families to gather and take stock of their retirement resources and make necessary adjustments to ensure continued financial security,” said National Reverse Mortgage Lenders Association (NRMLA) President Steve Irwin. “Housing wealth should be considered with other financial assets.

The NRMLA/RiskSpan Reverse Mortgage Market Index (RMMI) rose in the second quarter of 2022 to 405.23, another all-time high since the RMMI was first published in 2000. The increase in older homeowners' wealth was mainly driven by an estimated 3.82% or $506 billion increase in home values, offset by a 2.36% or $50 billion increase in senior-held mortgage debt.

According to NRMLA, the national trade association for the reverse mortgage lending industry representing the lenders, loan servicers, and housing counseling agencies responsible for more than 90% of reverse mortgage transactions nationwide, more than 1.21 million households have utilized an FHA-insured reverse mortgage to help meet their financial needs to date.

“Over the last two months, the impact of major increases in mortgage rates and inflation have finally been realized in the slowing rate of home price appreciation. It is once again clear that home prices are not impervious to the broader economic conditions around the country,” said Steve Gaenzler, SVP of Products, Data and Analytics for homegenius Real Estate. “However, the rate of appreciation is still well above the historical norm, at more than 12% month-over-month. While it is likely that appreciation rates will continue to drop, homeowners’ equity remains at all-time highs and inventory remains tight.”

As equity continues to reach record highs in the senior market, affordability remains a major hurdle for those seeking a home in today’s market. ATTOM’s Q3 2022 U.S. Home Affordability Report shows that median-priced single-family homes and condos remained less affordable in Q3 of 2022, compared to historical averages in 99% of counties across the nation analyzed. Numbers continue to be far above the near 70% of counties that were historically less affordable in Q3 of 2021—marking yet another high point reached during the country's 11-year housing market boom.

"Home price appreciation has slowed dramatically in most markets–and there are even price corrections in some areas–as home sales have declined significantly over the past few months," said Rick Sharga, Executive VP of Market Intelligence at ATTOM. "But mortgage rates have risen more rapidly and dramatically than they have in several decades, and as a result a monthly mortgage payment today is 35-45% higher than a year ago, making affordability too much of a challenge for many would-be buyers."

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news