[1]The availability of mortgage credit to borrowers declined slightly in the second quarter of 2015, despite impactful federal efforts to expand the credit box.

[1]The availability of mortgage credit to borrowers declined slightly in the second quarter of 2015, despite impactful federal efforts to expand the credit box.

The Urban Institute's Housing Finance Policy Center [2] reported in their Housing Credit Availability Index [3](HCAI) that mortgage credit availability decreased from 5.5 in the first quarter to 5.3 in the current quarter.

However, the report notes that credit access remains above the all-time low of 4.6, which occurred in the third quarter of 2013.

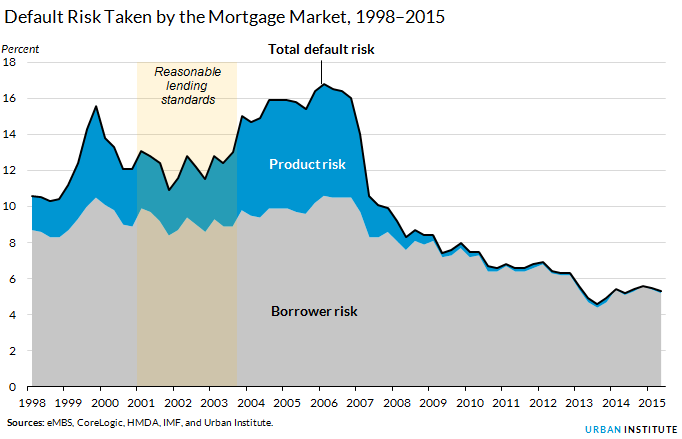

The HCAI determines the percentage of purchase loans that are likely to default, or go unpaid for over 90 days past their due date. Urban Institute explained that a lower HCAI number means that lenders will not tolerate default loans and are issuing higher lending standards, but a higher HCAI means that lenders will tolerate defaults, ease lending standards, and accept more risks.

[4]Credit availability has eased 17 percent since September 2013 in the GSEs, while availability in the government channel has eased 7 percent, the institute noted. In the portfolio and private-label securities channel, credit remains tight at well below 3 percent since 2013.

[4]Credit availability has eased 17 percent since September 2013 in the GSEs, while availability in the government channel has eased 7 percent, the institute noted. In the portfolio and private-label securities channel, credit remains tight at well below 3 percent since 2013.

Many mortgage lenders are still applying credit overlays that are stricter than what Freddie Mac [5], Fannie Mae [6], or Ginnie Mae [7] require.

Survey data [8] from Fannie Mae's Economic & Strategic Research group found that approximately 40 percent of lenders who deliver loans to the GSEs or Ginnie Mae reported applying credit overlays that are more stringent than what the GSEs or Ginnie Mae require.

Effort to expand the credit box have been made on both ends and are "having an impact" within the mortgage industry.

In August [9], Fannie Mae [6] made an effort to ease harsh lending standards by revamping its HomeReady affordable loan program to offer creditworthy borrowers with low and moderate incomes the opportunity to obtain a mortgage.

"Our priority is a safe, responsible balance between expanded access to mortgage financing and the long-term viability of today’s mortgage loans—limiting risk to lenders, investors, homeowners, and taxpayers," Fannie Mae said. "Our goal is straightforward: to work with lenders to make mortgages more accessible, affordable, and sustainable."

The Federal Housing Administration [10] also introduced [11] their Supplemental Performance Metric [12], intended to evaluate the lending practices of FHA-approved lenders and help them understand the type of borrowers they are serving.

Although getting a mortgage has been progressively getting easier since 2012, the first few months of this year indicate that credit is tightening and obtaining a mortgage is no easier than it was a year ago.

The Zillow Mortgage Access Index [13] (ZMAI) quarterly report found in early September that access to mortgage credit [14] reached 65 in Q1 and is over two-thirds of the way back to 2002 pre-crisis levels. In August 2004, mortgage credit was easiest to obtain when the ZMAI reached 136.8.

"Recent market volatility is causing some lenders to be more cautious in their underwriting," said Zillow Chief Economist Dr. Svenja Gudell. "Tighter mortgage access will make it harder for people with low credit scores to get a home loan, and even people who can get approved for a mortgage will have fewer options in terms of available mortgage products."