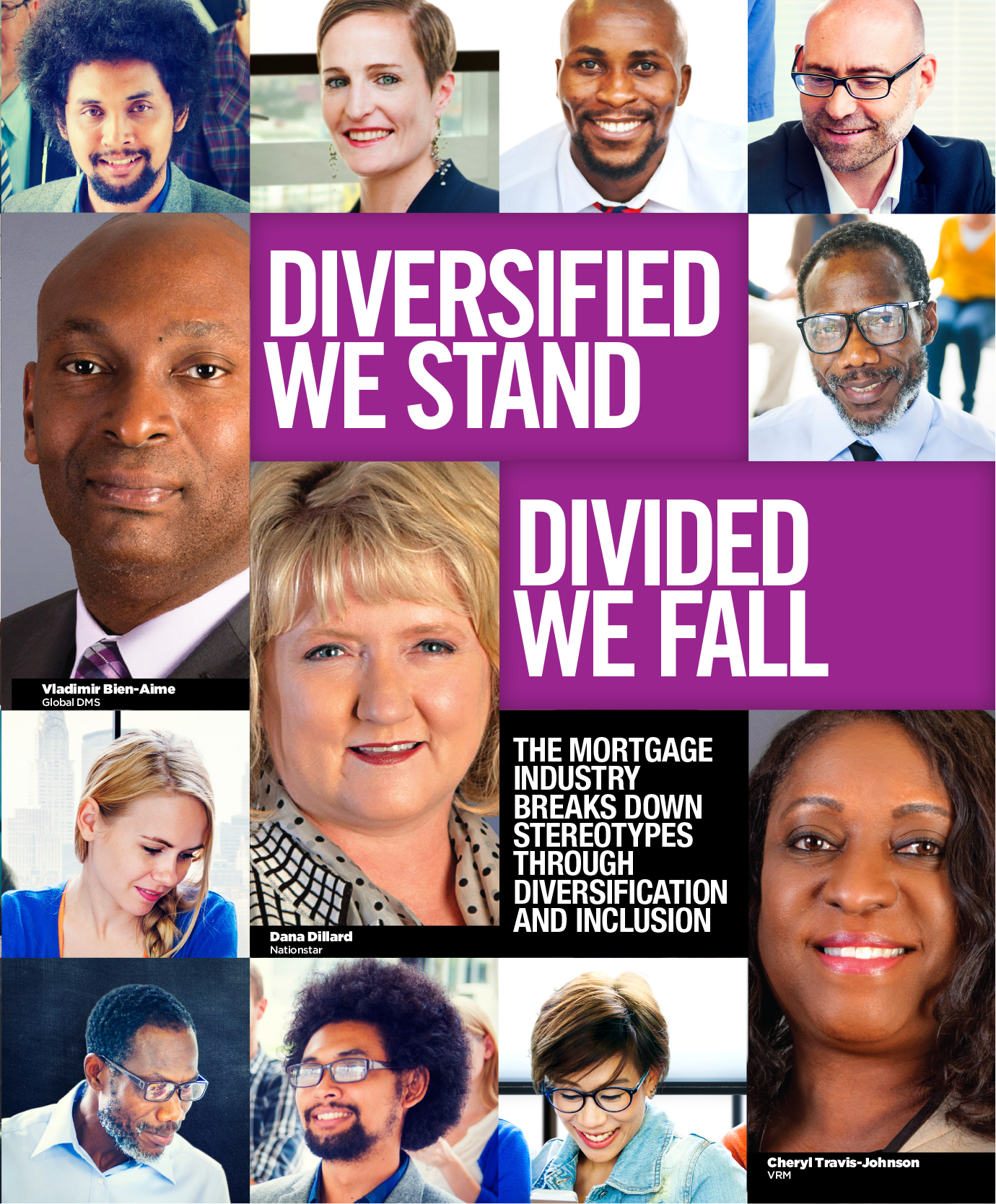

The Mortgage Industry Breaks down Stereotypes through Diversification and Inclusion

By Xhevrije West

There is a demographic shift happening within the mortgage profession. In an industry that is so male and white-focused, women and minorities are often passed over for well-deserved positions and promotions, but this idea is being reshaped and redefined right before our eyes.

Individual companies, government agencies, and trade organizations are working diligently to make diversity and inclusion a priority. In the process new definitions are being crafted for what it means to be a diverse company, and organizations that are lagging behind will soon find themselves racing to catch up as diverse organizations benefit from the innovation that a variety of ideas and backgrounds create.

“Our industry will look to diversity and inclusion as sources of competitive advantage,” explained Kevin Wall, president of First American’s Mortgage Solutions Group and member of the Five Star Institute’s newly created American Mortgage Diversity Council (AMDC). “Great leaders will recognize that their organization’s competitiveness can be enhanced by embedding diversity and inclusion into their business objectives, organizational structure, and approach to people. Diversity and inclusion aren’t just about recruiting or retentions, they’re levers to help transform the culture of an organization into one that is market-focused, leadership-focused, and people focused.”

Numbers Don’t Lie

According to data from the Bureau of Labor Statistics, as of 2014, women make up 46.9 percent of the entire workforce, while African American or blacks occupy 11.4 percent of the workforce, Asians make up 5.7 percent, and Hispanics or Latinos make up 16.1 percent.

There appears to be an even larger disparity between different ethnic groups in the mortgage industry.

In the financial activities sector, African Americans or blacks account for 9.1 percent of this workforce, Asians make up 6.3 percent, and Hispanics or Latinos make up 11.3 percent, the data showed.

The data also found that in the real estate workforce, African Americans or blacks make up 7.8 percent of this group, Asians account for 3.8 percent, and Hispanics or Latinos make up 14.9 percent.

“Today’s effective leaders will recognize that beyond race, gender, ethnicity, and sexual orientation, diversity also applies to thought, skill, and passion,” Wall said. “They will facilitate a corporate culture that provides the flexibility to challenge traditional thinking in search of the best business solutions. In such an environment, people are able to advocate their point of view passionately, even from the status quo. That is how you foster innovation.”

Legislative Action

On July 21, 2010, President Obama signed the Dodd-Frank Wall Street Reform and Consumer Protection Act into law. This intention was “to promote financial stability of the U.S. by improving accountability and transparency in the financial system, to end ‘too big to fail,’ to protect the American taxpayer by ending bailouts, to protect consumers from abusive financial services practices, and other purposes,” the Dodd-Frank Act says.

Among those ‘other purposes’ is a highly important portion of the Dodd-Frank Act—Section 342. The legislation requires inclusion of women and minorities in all levels of business activities and applies to contracts of the agencies for services of any kind, such as from financial institutions, investment banking firms, mortgage banking firms, asset management firms, brokers, dealers, financial services entities, underwriters, accountants, investment consultants, and providers of legal services.

This part of the Act requires federal agencies to establish an Office of Minority and Women Inclusion (OMWI). These offices are responsible for promoting diversity and ensuring the inclusion of minorities and women within management, workforce, and business activities.

Agencies covered by Section 342 of Dodd-Frank are the Federal Housing Finance Agency (FHFA), the 12 regional Federal Reserve Banks, the Consumer Financial Protection Bureau, the Federal Reserve Board of Governors, the Federal Deposit Insurance Corporation, the National Credit Union Administration, the Office of the Comptroller of the Currency, the Securities and Exchange Commission, and the Department of the Treasury.

Sharron Levine, director of the FHFA’s OMWI, oversees all diversity-and inclusion-related matters within the agency, including the policies, programs, and initiatives of Fannie Mae, Freddie Mac, and the Federal Home Loan Bank System, which includes 11 FHLBanks and the Office of Finance.

“I believe that being an integral part of this very important function could yield sustainable and far-reaching economic benefits for traditionally underrepresented groups,” Levine said. “In turn, that could translate into greater access to credit for those populations, with the attendant benefits that homeownership brings.”

Moving forward, Levine hopes the FHFA’s OMWI purpose and direction of diversity and inclusion spans further than just the ‘right thing to do’ and that economic implications of the global demographic trends and changes are considered.

“Given the vast number of challenges and opportunities that these changes and trends are likely to bring, the increased and increasing buying power of minorities and women, businesses would do well to consider taking steps to becoming more culturally competent to deal with diverse consumers and users of their goods and services,” she explained.

Another major legislative change that occurred in June 2015 was the U.S. Supreme Court’s 5-4 ruling in the case of Texas Department of Housing and Community Affairs v. The Inclusive Communities Project, Inc. The court concluded that disparate impact claims can legally be brought about under the Fair Housing Act of 1968. This ruling will allow courts to hold defendants liable for the discriminatory effects of their actions.

Mixing it Up

The American Mortgage Diversity Council (AMDC), a Five Star Institute Member organization, is comprised of executives from various mortgage companies and aims to shape the diversity agenda.

The council, launched in June 2015, was created to drive results that support the application and promotion of the mortgage industry’s best diversity practices, and advancing solutions that support initiatives outlined by Section 342 of the Dodd-Frank Act.

“The dialogue around diversity in the mortgage industry has not been advanced the way it needs to be,” explained Five Star Institute President and CEO Ed Delgado. “Five Star was presented with a tremendous opportunity to fill a leadership void and we will work with our industry partners to set the bar for diversity in the industry.”

Michael Ruiz, Director of Corporate Procurement with Fannie Mae and chairman of the AMDC for the 2015-2017 term, believes that companies could benefit from diverse practices within their businesses and the changes that the AMDC seeks to create within the industry.

“A diverse company is one that assembles a talent pool across all levels that is rich in all of the traits listed above, and embraces the concept of diversity as a key component of its business strategy, leveraging diversity in order to improve business outcomes,” Ruiz said.

He further explained, “I am firmly convinced that the development of effective and sustainable diversity and inclusion practices is a high-value exercise for all involved; corporations, diverse-owned suppliers, and communities served and sustained by the activities of the mortgage industry.”

As chairman, Ruiz hopes to develop a consensus framework for the adoption and implementation of impactful strategies and practices that deliver tangible benefit to all stakeholders, and also engage and activate senior leaders across the industry to become true champions of diversity, both within their organizations and their spheres of influence. Fannie Mae also has a multiyear diversity and inclusion strategy that is supported by three pillars: workforce, workplace, and marketplace.

However, Ruiz also noted that the AMDC’s commitment to diversity and inclusion practices is not compliance-driven and these practices are of value to all, especially in lieu of the changing demographics of communities and markets served by AMDC members.

“There is no ‘one size fits all’ approach to diversity and inclusion, but we should collectively be able to agree on definitions of successful activities and desired outcomes,” Ruiz said.

One AMDC member, Cheryl Travis-Johnson, COO at VRM Mortgage Services, feels that the idea of diversity is often confused with affirmative action, but says that “diversity is having an environment where all people have equal access to opportunities with businesses and organizations in terms of employment and also from a supplier sourcing perspective, in that you have programs in place to ensure transparency with opportunities.”

She added, “The Dodd-Frank Act is a first step to bring about some awareness and it really shouldn’t take a law to get people to do the right thing.”

For the future, Travis-Johnson hopes to get to a point where more women and minorities will take an interest in this industry because the numbers are dwindling down.

Dana Dillard, EVP and chief customer officer of Nationstar Mortgage believes that a diverse company has an “appreciation for the differences in perspective and thoughts that can add value to the business operations.” This belief is reflected in the 52 percent of the Nationstar’s staff that is comprised of women.

“We have intentionally hired key leaders in the company that come with backgrounds and experience different than the mortgage industry,” Dillard noted. “These key hires have helped shape and influence our culture and business priorities. We will continue to evaluate our team to make sure we are meeting the ever-changing needs of the home buying population—that’s how you create competitive advantage.”

Global DMS is also making strides to diversify their company and business practices. Vladimir Bien-Amie, CEO and president of the company and AMDC member, says that forcing a policy on their staff is something they try to avoid. Forty-one percent of their employees are minorities and women.

“Being exposed to different kinds of people brings a different point of view to things,” Bien-Aime said. “As America changes and grows, organizations and companies are going to need to adjust to meet the changing culture.”

Bien-Amie also said that most corporate diversity programs aim to only increase the percentages of certain minorities in the overall employee pool to mirror the country as a whole.

“This approach is a misguided and ineffective because it comes with an assumption that the potential employee must change to fit into the current workplace culture,” he said. “Our approach was to change our environment so it embraces diversity in both culture and in opportunity. We believe that diversity is a strategic initiative versus a tactical one; the results are evident.”

First American’s Mortgage Solutions is another company that is focused on bringing diversity and inclusion to the forefront of the mortgage industry. A few of the company’s diversity initiatives include the Women in Leadership program, Recruiting for Diversity, and their Employment Engagement Survey.

“Bringing attention to diversity and elevating conversations about diversity in the mortgage finance industry is positive,” Wall explained. “We’ve taken the view that diversity is a business imperative. Our customers are diverse. Homebuyers are diverse. So, a diverse employee population will make companies more competitive.”

The End Goal

As more join the diversity and inclusion movement, the mortgage industry is sure to see a huge change, not only internally, but also from the consumer perspective. By opening up the doors to people from a variety of backgrounds, the stereotype of working within this profession can and will be broken.

ZVN Properties hopes to boost their vendor diversity numbers in the future and drive financial recovery in compromised communities.

“I would say the end goal for diversity within my firm is to continue to grow the number to surpass the 35 percent mark as far as vendor diversity and by doing so hire specific diverse groups that live within or come from the community that they will be servicing,” said Bryan Lysikowski, Co-Founder and CEO, ZVN Properties Inc., and AMDC member.

He further explained, “If we can do that it will put a sense of pride back into some of these blighted communities and help bolster the financial recovery in those areas. I also think if we can add to our network with diverse firms it will help correct some of the problems the National Fair Housing Alliance sees with the condition of some of the blighted properties inside of the urban areas.”

As mentioned earlier, Nationstar already hosts a pretty diverse staff, but sustainability problems persist.

“I think our overall diversity numbers already look strong,” Dillard said. “Our challenges are how to sustain the numbers for the long haul and continue growing the numbers within our leadership ranks. Through mentoring, career pathing, and a concentrated effort in encouraging the next generation of leaders, I’m hopeful we can get there.”

VRM Mortgage Services would like to see every company in the industry adopt the proposed standards outlined in Section 342 of the Dodd-Frank Act.

“The initiatives proposed by 342 would drive an enterprise-level of employee awareness around a company’s commitment to diversity and inclusion and the programs in place,” Travis-Johnson explained. “Most importantly, every program would be designed to ensure that everyone has equal access to employment, succession planning, and sourcing opportunities with selection and retention practices based on proven performance. I see this as a natural progression towards true inclusion for the mortgage and real estate industries. In short, equal access to opportunities for employees, solution providers, vendors, and the consumer.”

Bien-Amie also mentioned that “the ultimate goal for diversity for both Global DMS and the industry is growth.”

“The industry participants need to vastly increase their ability to sense new opportunities, develop creative solutions, and execute with much greater speed,” he noted. “The only way to reach these goals and ultimately grow your business is through a revamped workplace culture that embraces diversity so that opportunity awareness, creativity, and speed are all immensely improved.”

Editor's note: This select print feature appears in the October 2015 [2]edition of MReport magazine, available now.