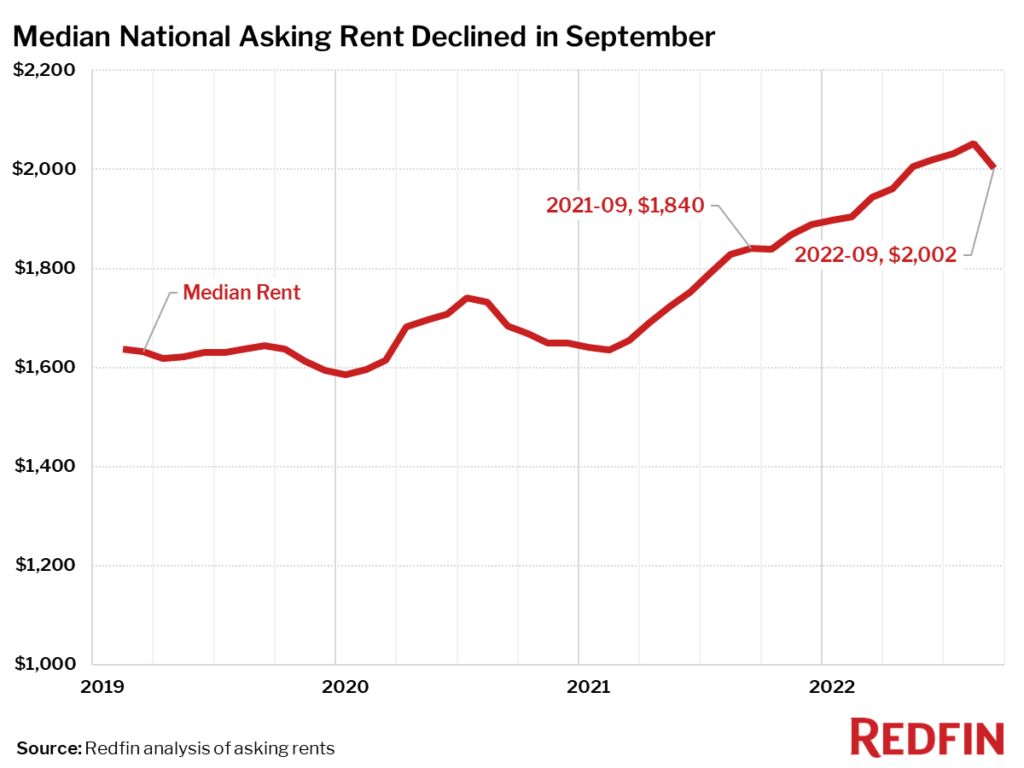

According to a new report from Redfin, the median U.S. asking rent rose nearly 10% year-over-year in September to $2,002, the slowest growth since August 2021 and the first single-digit increase in a year. September was the fourth-consecutive month in which annual rent growth decelerated, with rents climbing at half the pace they were six months earlier.

“The rental market is coming back down to earth because high rents and economic uncertainty have put an end to the pandemic moving frenzy of 2020 and 2021, when remote work fueled an enormous surge in housing demand that would’ve otherwise been spread out over the coming years,” said Redfin Deputy Chief Economist Taylor Marr. “Rising supply is also causing rent growth to slow. Scores of apartments that have been under construction are now coming on the market, and more homeowners are choosing to become landlords instead of selling in order to hold on to their record-low mortgage rates.”

Rents Rose 20% or More in Oklahoma City and Pittsburgh

In Oklahoma City, Oklahoma, asking rents increased 24.1% year over year in September, the largest jump among the 50 most populous U.S. metropolitan areas. Pittsburgh saw an increase of 20%. Next came Indianapolis, Louisville, Kentucky, Nashville, Cincinnati, Raleigh, North Carolina, and New York, all with gains of more than 15%.

Top 10 Metro Areas With Fastest-Rising Rents Year-Over-Year:

- Oklahoma City, Oklahoma (24.1%)

- Pittsburgh, Pennsylvania (20%)

- Indianapolis, Indiana (17.9%)

- Louisville, Kentucky (17.5%)

- Nashville, Tennessee (17%)

- Cincinnati, Ohio (16.5%)

- Raleigh, North Carolina (16.4%)

- New York, New York (15.4%)

- Portland, Oregon (14%)

- San Antonio, Texas (12.5%)

Five of the 50 most populous metro areas saw rents fall in September from a year earlier. Rents declined 14.3% in Milwaukee, 8.8% in Minneapolis, 2.8% in Baltimore, and less than 1% in Houston and Chicago.

Metro Areas Where Rents Declined Year-Over-Year:

- Milwaukee, Wisconsin (-14.3%)

- Minneapolis, Minnesota (-8.8%)

- Baltimore, Maryland (-2.8%)

- Houston, Texas (-0.6%)

- Chicago, Illinois (-0.5%)

“We expect rent growth to slow further into 2023 as Americans continue to hunker down and more new rentals hit the market,” Marr concluded.

To read the full report, including more charts and methodology, click here.

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news