New research conducted by First American has found that as mortgage rates have steadily risen (and look to continue this trend based on commentary from the Federal Reserve’s Open Market Committee) and affordability has decreased significantly for home buyers across all income levels.

New research conducted by First American has found that as mortgage rates have steadily risen (and look to continue this trend based on commentary from the Federal Reserve’s Open Market Committee) and affordability has decreased significantly for home buyers across all income levels.

However, potential first-time home buyers (who are most likely currently renting) saw affordability decline 19 percentage points in June 2022 compared to a year earlier as “rapid house price appreciation outpaced consumer house-buying power” which was already falling due to rising mortgage rates.

Location, however, is paramount to affordability.

According to report Author Ksenia Potapov, affordability outlooks remain “vastly different” based on where a potential first-time home buyer lives. The report aims to measure affordability for all renter households in the top markets based on their household income and the share of homes for sale they can “reasonably afford” to buy.

“The adage that real estate is local rings true but, even within a single city affordability can look radically different depending on where one sits in the income distribution,” Potapov said.

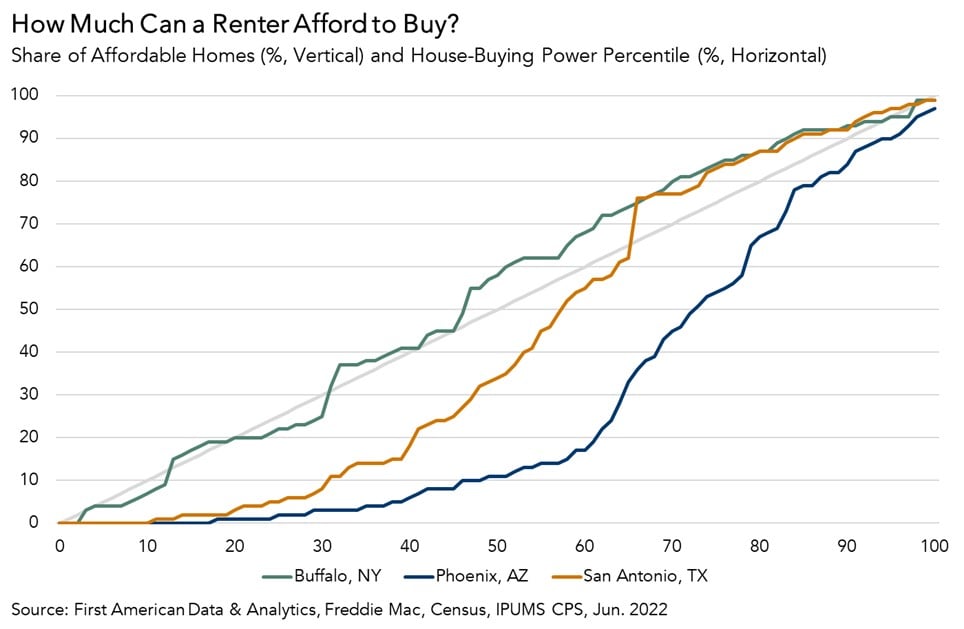

The shape of the affordability curve on the graph above tells a lot of the market, according to Potapov. Cities generally fall into one of three categories: affordable for all potential first-time home buyers, affordable for some, and unaffordable for all.

For example, in San Antonio, renters who make less than $79,000 cannot afford their share of homes for sale, while renters who make more than that can afford more than their share.

The most affordable markets for lower income households (or the 30th percentile) are:

- Buffalo, New York: 25% of lower income residents could afford a home

- Pittsburgh: 24%

- Oklahoma City: 20%

- Cincinnati: 17%

- Milwaukee: 17%

- Detroit: 15%

- Philadelphia: 14%

- Birmingham, Alabama.: 13%

- Cleveland: 13%

- Charlotte, North Carolina: 12%

Based on data from a year ago, lower income buyers in Buffalo, New York had a median household income of $29,800 which translates to $148,400 in house-buying power. Today, none of the top-10 affordable markets offers renters in the 30th percentile an equal or greater share of homes to buy.

“The adage that real estate is local rings true but, even within a single city, affordability can look radically different depending on where one sits in the income distribution,” Potapov concluded. “When considering where the dream of homeownership may be more attainable, potential first-time home buyers should look to the share of affordable homes available to them in each market.”

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news