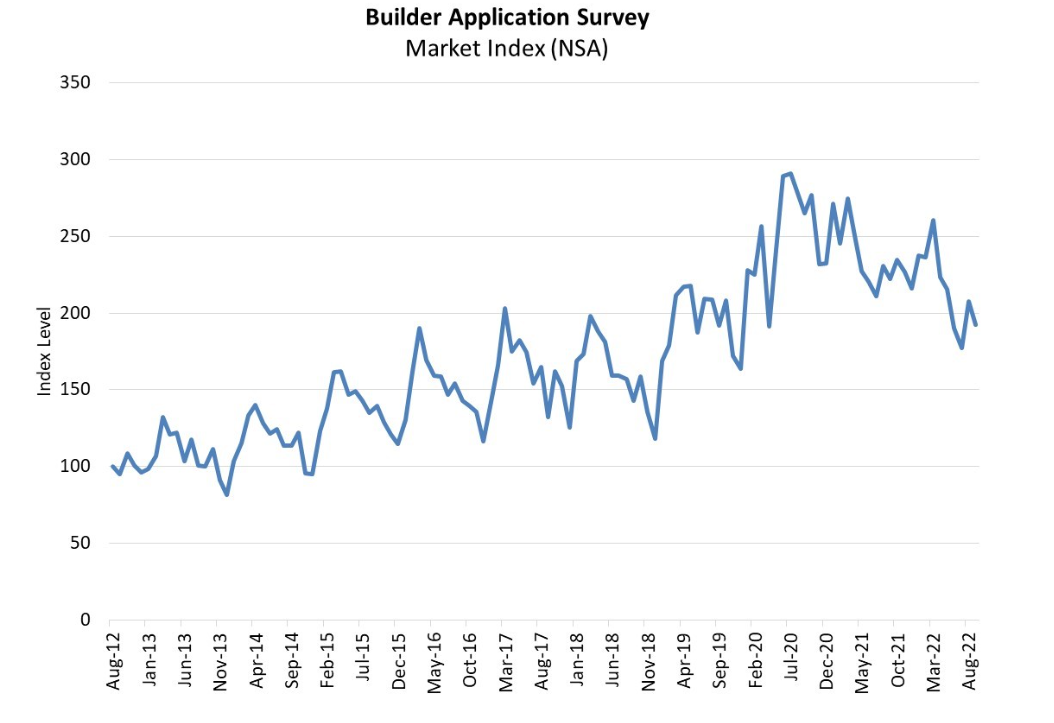

The Mortgage Bankers Association (MBA) has reported that mortgage applications for new home purchases fell 13.2% in September 2022 year-over-year, according to data from its latest Builder Application Survey (BAS). Month-over-month, builder applications decreased by 7%.

The Mortgage Bankers Association (MBA) has reported that mortgage applications for new home purchases fell 13.2% in September 2022 year-over-year, according to data from its latest Builder Application Survey (BAS). Month-over-month, builder applications decreased by 7%.

“New home purchase activity declined in September as prospective homebuyers pulled back in response to higher mortgage rates, increased concern about an impeding recession, and a broader slowdown in home-price growth,” said Joel Kan, MBA’s VP and Deputy Chief Economist.

In mid-September, the Federal Reserve, for the third consecutive time, raised the nominal interest rate by 75-basis points at the conclusion of their scheduled two-day meeting to a rate of 3.00-3.25%, marking the highest interest rate in 14 years, and fifth increase in 2022.

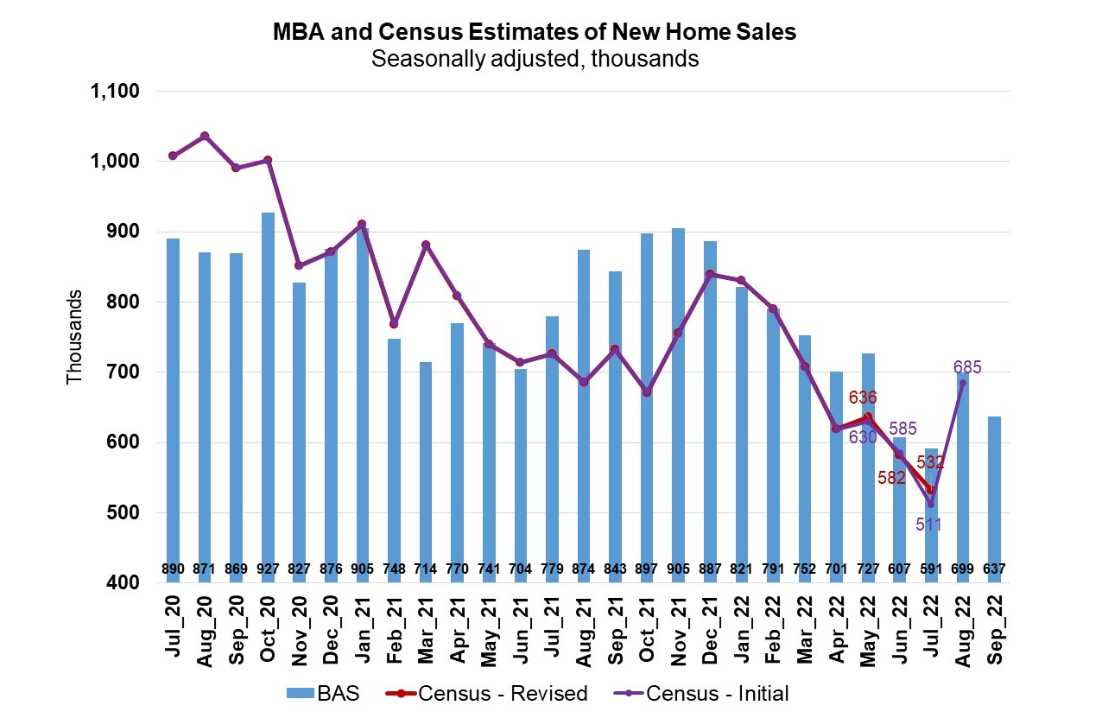

The MBA estimates new single-family home sales, which has consistently been a leading indicator of the U.S. Census Bureau’s New Residential Sales report, is that new single-family home sales were running at a seasonally adjusted annual rate of 637,000 units in September 2022, based on data from the BAS. The new home sales estimate is derived using mortgage application information from the BAS, as well as assumptions regarding market coverage and other factors.

And as the Fed took action to curb inflationary concerns, the 30-year fixed-rate mortgage has steadily risen over the past month, coming in last week at 6.92% as they close in on the 7% mark.

Continued high rates are scaring potential buyers away from the market, as continued increased economic volatility and persistent inflation join the mortgage rate dilemma as yet another affordability hurdle. Redfin recently reported that pending home sales and new listings both posted even bigger annual declines than during the summer when buyers and sellers initially reacted to rapidly rising rates. Data on home sale prices, which typically lags a couple months behind other demand indicators, is also weaker than it was over the summer when the pandemic homebuying boom ended. The share of home listings with a price drop rose to its highest level on record, and the portion of homes sold above final list price dropped to its lowest rate since the early days of the pandemic.

“The average 30-year fixed mortgage rate increased almost a full percentage point in the last month, greatly reducing the purchasing power of many home shoppers,” added Kan. “MBA’s estimate of new home sales declined 9% in September, partially reversing the 18% increase in August during that brief period when mortgage rates decreased.”

The seasonally adjusted estimate for September is a decrease of 8.9% from the August pace of 699,000 units. On an unadjusted basis, MBA estimates that there were 52,000 new home sales in September 2022, a decrease of 10.3% from 58,000 new home sales in August.

By product type, conventional loans composed 69.8% of loan applications, while FHA loans composed 18.7%, RHS/USDA loans accounted for 0.3%, and VA loans composed 11.2%. The average loan size of new homes decreased from $415,594 in August to $406,767 in September.

“The average loan size measured in the survey fell for the fifth consecutive month–after reaching a survey high in April 2022–to $406,767,” added Kan.

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news