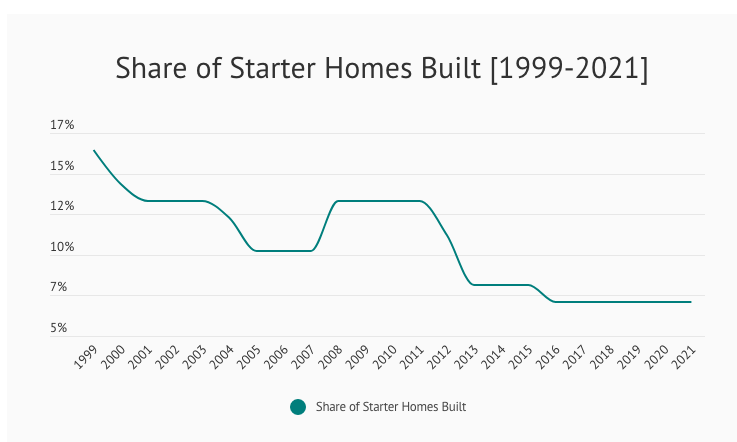

According to the latest market analysis from Point2 Homes [1], entry-level—also called starter homes—homes are becoming scarce, due to the increasing cost of land, zoning restrictions, and skyrocketing costs for building materials.

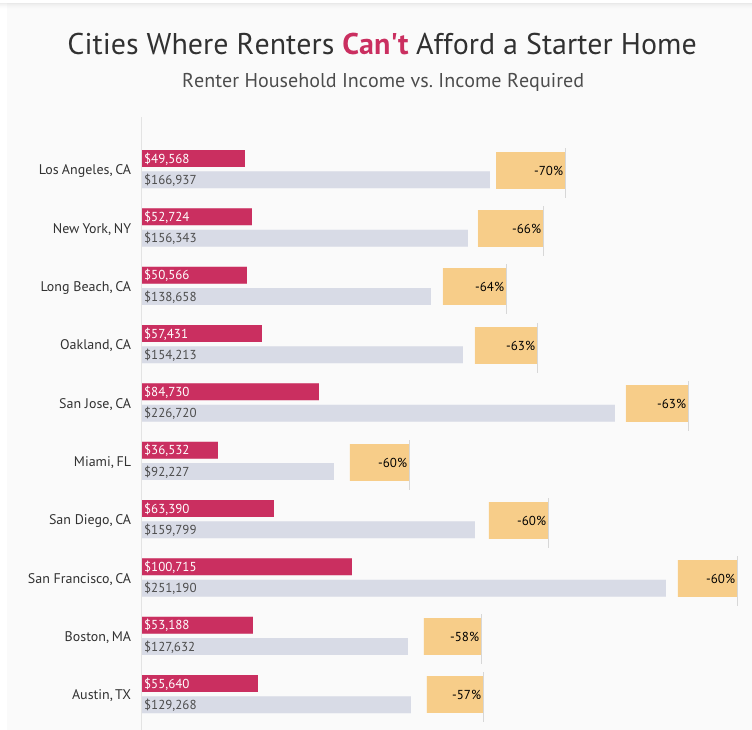

- Based on the latest renter income figures, starter home prices and mortgage rates, in October, renters in Los Angeles and New York only earned 30% and 34%, respectively, of the income they would need to buy a starter home.

- In 13 more of the 50 largest U.S. cities, renters earned less than half the income they would need to make the move from renters to homeowners.

- Renters in only 4 large U.S. cities (Detroit; Tulsa, Oklahoma; Memphis, Tennessee; Oklahoma City) earned 100% or more than what they needed to afford an entry-level home.

- This very short list was all the more shocking because just one month prior, in September, it also included Kansas City, Missouri. One month before that, in August, Baltimore was also affordable for renters who wanted to make the move to homeownership.

- In only 15 of the 50 largest U.S. cities, the price of a starter home still fits the “old” definition of the term: Entry-level houses here were $200,000 or less.

Further evidence that starter homes are vanishing is their changing definition. They used to be the small, affordable houses that a young or single person or family could buy in order to obtain homeownership. Now, they’ve come to represent the cheapest homes available in a market—or homes that fall within the 5th to 35th percentile price range. Data also revealed that downsizing baby boomers, second homebuyers, and property investors are in direct competition with first-time buyers for starter homes.

Scarce inventory also poses a challenge, with rapidly rising prices and interest rates having even more serious consequences. To gauge the effect of the mortgage rate hikes on affordability, Point2 analysts reviewed data on the median price of a starter home and renter households’ median incomes in the 50 largest U.S. cities.

When Is a Starter Home Not a Starter Home? When It Costs $1 Million

Data also found that the median starter home in San Francisco costs as much as the median starter homes in the top 10 most affordable cities combined.

Quickly rising interest rates took a large bite out of renters’ already limited buying power in the nation’s most expensive markets, entry-level homes remain unaffordable for renters in the majority of large U.S. cities.

For instance, in San Francisco, the average renter household made $100,715, but the amount a first-time buyer would need to comfortably cover mortgage payments was $251,190. This means that San Francisco renters are $150,475—or 60%—short of obtaining homeownership.

Meanwhile, in San Jose, California, Los Angeles, and New York, renters were more than $100,000 short of the amount they would need to cover their mortgage on a starter home. Los Angeles may have it the worst, as the average renter makes 70% less than the amount they would need to comfortably cover their monthly mortgage.

Earning 70% or 80% of the income renters need to comfortably cover their monthly payments keeps them in housing limbo—the question of whether they should or could make the switch to homeownership doesn’t have a clear no or a clear yes.

What a Difference a Month Makes: Affordability Window Closes Overnight for Renters in Kansas City, Missouri & Baltimore

In August, when interest rates were hovering around 5.5%, renters in 6 large U.S. cities could comfortably afford to buy a starter home. One month and an interest hike later, that number fell from 5 to 4.

Currently, the average renter in Tulsa, Oklahoma; Detroit; Memphis, Tennessee; and Oklahoma City earns more than what they would need to buy a starter home and transition to homeownership. Detroit; Tulsa, Oklahoma, and Memphis, Tennessee, stood out for their affordability mostly because the median starter home in all three cities was less than $100,000. Renter household incomes here were also high enough to cover the mortgage, taxes, and insurance, as well.

To read the full report, including more data and methodology, click here [1].