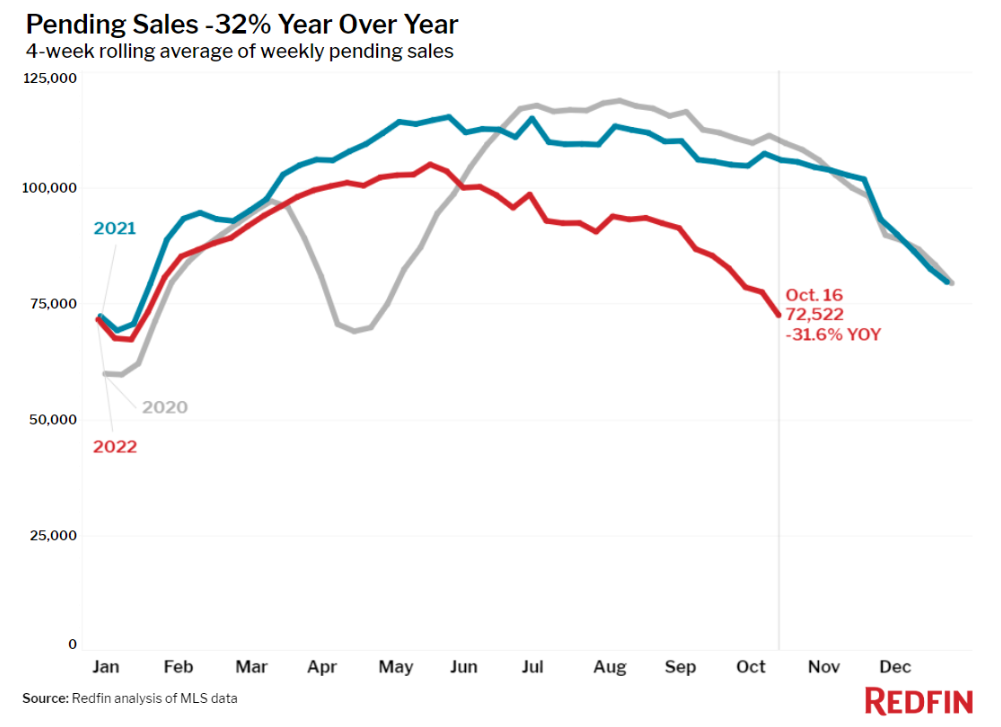

Redfin reports that pending home sales and new listings nationwide both saw their biggest year-over-year drops since the start of the pandemic, dipping to levels last seen in April 2020, as the U.S housing market activity continues to slow as mortgage rates sit at a 20-year high.

Redfin reports that pending home sales and new listings nationwide both saw their biggest year-over-year drops since the start of the pandemic, dipping to levels last seen in April 2020, as the U.S housing market activity continues to slow as mortgage rates sit at a 20-year high.

Mortgage rates continue to edge upward this week, as Freddie Mac reported the 30-year fixed-rate mortgage (FRM) averaged 6.94% with an average 0.9 point as of October 20, 2022

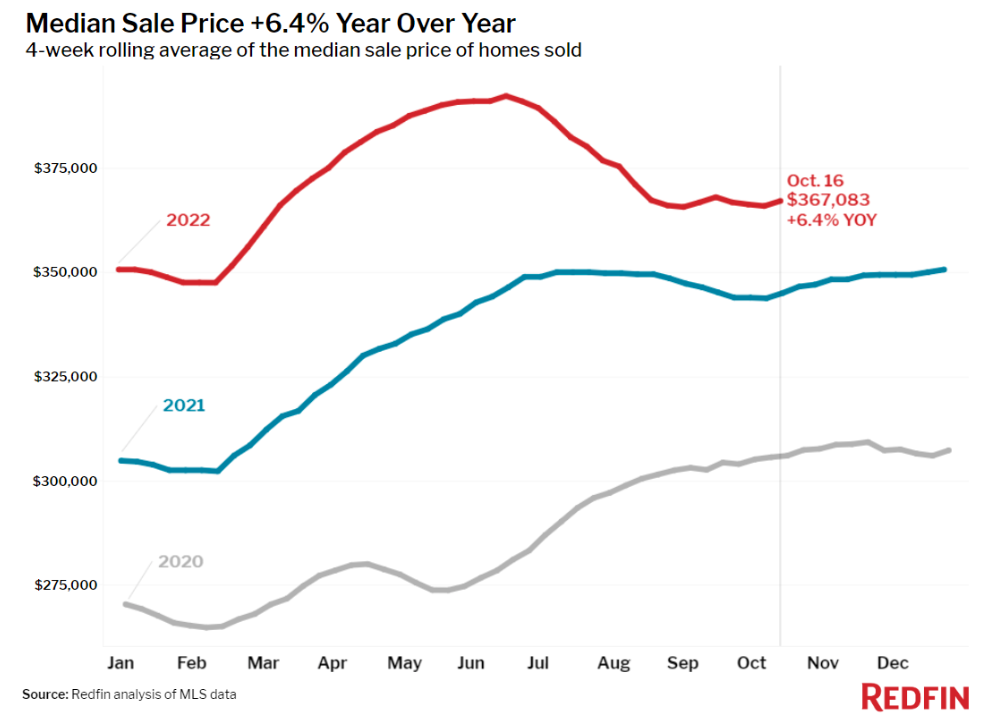

Overall, Redfin found sales are dropping more than listings, with sellers still catching on to the prices buyers who are in the market are willing and able to pay in the face of these near-7% rates. In turn, the rise in rates is resulting in homes taking twice as long to sell as they did in the spring. A record share of sellers have been found to cut their asking price, as the typical home is selling for 1% less than its final asking price–the biggest discount reported since August 2020.

“With rates sitting above 6.5% for three weeks and no indication they’ll come down before the end of the year, people are only buying and selling homes if they need to,” said Redfin Economics Research Lead Chen Zhao. “Prospective buyers are waiting for prices and/or mortgage rates to come down and sellers want to squeeze as much money out of their sale as possible. Homes will eventually sell, but it may take a few months, and sellers need to meet buyers where they are. That means lower prices and negotiations, including things like giving buyers a credit to buy down their mortgage rate and paying for home repairs. Prospective sellers may also consider renting out their home for a few months until demand recovers.”

Redfin found that fewer people searched for “Homes for Sale” on Google, with searches during the week ending October 15 down 32% year-over-year. Touring activity as of October 16 was down 25% from the start of the year, compared to an 8% increase at the same time last year, according to home tour technology company ShowingTime.

The decline in online home searches has kept consistent with the dip in overall mortgage application volume, as the Mortgage Bankers Association (MBA) found apps continuing to trend downward, dropping 4.5% week-over-week for the week ending October 14, 2022. This total marked the lowest level recorded since 1997, and 38% year-over-year.

Zhao added, “Buyers should keep similar things in mind when they’re doing the math of which homes they can afford. Try negotiating down the sale price; now’s the time to make what would have been considered a lowball offer six months ago. Ask for concessions and repairs to make up for high mortgage rates.”

Key housing market takeaways for 400+ U.S. metro areas as reported by Redfin covers the four-week period ending October 16:

- The median home sale price was $367,083, up 6% year-over-year and on par with the previous week.

- Home-sale prices fell from a year earlier in three U.S. metro areas: Prices declined 4% year-over-year in Oakland, 2% in San Francisco, and 1% in Philadelphia.

- The median asking price of newly listed homes increased 8% year-over-year to $378,225.

- The monthly mortgage payment on the median asking price home climbed to a near-record high of $2,552 at the current 6.94% mortgage rate, up 50% from $1,704 a year earlier, when mortgage rates were 3.01% and up from a recent low of $2,203 during the four-week period ending August 14.

- New listings of homes for sale were down 19% from a year earlier, the biggest decline since May 2020.

- Active listings (the number of homes listed for sale at any point during the period) fell 1% from the prior four-week period. On a year-over-year basis, they rose 5%.

- Months of supply—a measure of the balance between supply and demand, calculated by dividing the number of active listings by closed sales—rose to 3.1 months. That marks the highest level since June 2020.

- Homes that sold were on the market for a median of 34 days, up more than a full week from 26 days a year earlier and the record low of 17 days set in May and early June. Typical time on market has steadily increased since June.

Click here to view more of Redfin’s findings.

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news