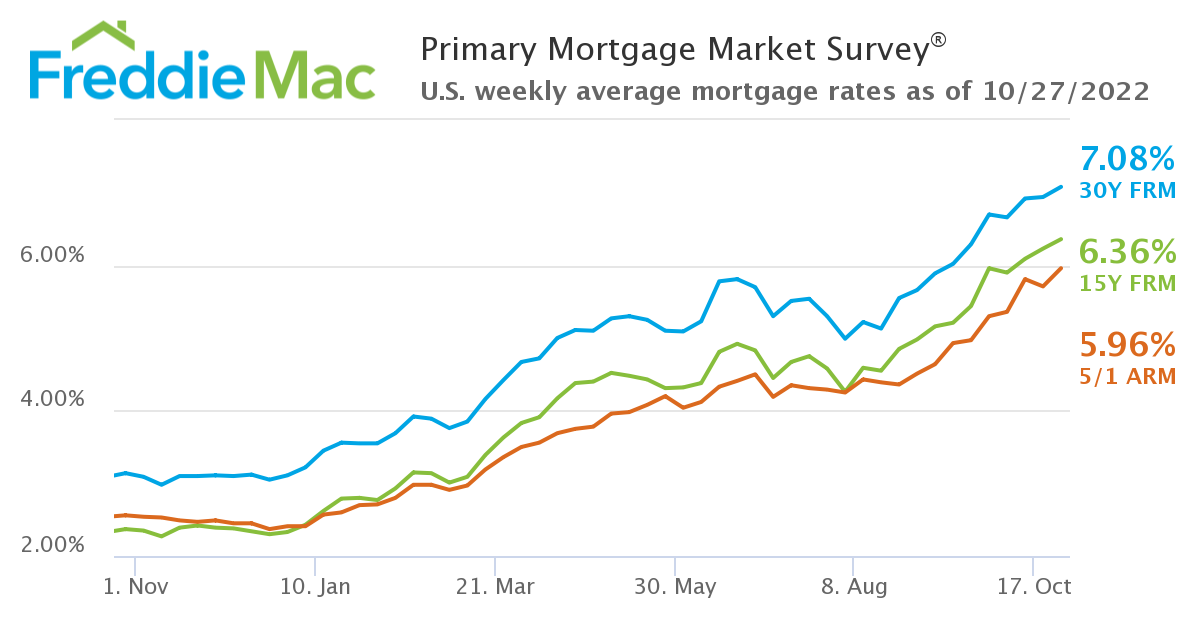

For the first time in two-plus decades, the 30-year fixed-rate mortgage (FRM) has passed the 7% mark, as Freddie Mac reported the 30-year FRM averaging 7.08% [1] with an average 0.8 point for the week ending October 27, 2022, up from last week [2] when it averaged 6.94%. A year ago at this time, the 30-year FRM averaged more than half that total when it stood at 3.14%.

For the first time in two-plus decades, the 30-year fixed-rate mortgage (FRM) has passed the 7% mark, as Freddie Mac reported the 30-year FRM averaging 7.08% [1] with an average 0.8 point for the week ending October 27, 2022, up from last week [2] when it averaged 6.94%. A year ago at this time, the 30-year FRM averaged more than half that total when it stood at 3.14%.

“The 30-year fixed-rate mortgage broke 7% for the first time since April 2002, leading to greater stagnation in the housing market,” said Sam Khater, Freddie Mac’s Chief Economist [3]. “As inflation endures, consumers are seeing higher costs at every turn, causing further declines in consumer confidence this month. In fact, many potential homebuyers are choosing to wait and see where the housing market will end up, pushing demand and home prices further downward.”

As rates climbed to cross a 20-year high, many eagerly await the outcome of next week’s Federal Open Market Committee (FOMC) meeting. The Fed has increased the nominal interest rate by 75-basis points at the conclusion of two-day meeting in late September, marking the highest interest rate in 14 years. September’s rate hike marked the fifth increase in 2022 alone [4] and the biggest consecutive rate hike on record, having raised rates in March (+25 points), May (+50 points), June (+75 points), and August (+75 points).

“Markets are preparing for next week’s Fed meeting and the resulting interest rate hike,” noted Realtor.com Economic Data Analyst Hannah Jones [5]. “In line with the last three meetings, next week’s session is expected to bring a 75-basis point hike as the most recent inflation data does not show sufficient signs of cooling. Four 75-basis point hikes in a row marks the largest series of target federal funds rate hikes in more than three decades. The FOMC is set to discuss future hikes at next week’s meeting as the Committee aims to bring down stubborn inflation without leading to widespread unemployment or economic strife.”

Also this week, Freddie Mac reported the 15-year fixed-rate mortgage averaging 6.36% with an average 1.4 point, up from last week when it averaged 6.23%. A year ago at this time, the 15-year FRM averaged just 2.37%. The five-year Treasury-indexed hybrid adjustable-rate mortgage (ARM) also averaged 5.96% with an average 0.3 point, up from last week when it averaged 5.71%. A year ago at this time, the five-year ARM averaged 2.56%.

“Hopeful buyers who remain on the hunt are finding affordability by searching in lower priced markets,” added Jones. “As a result, affordable markets are seeing sustained housing demand. Many of the year’s third quarter emerging housing markets are affordable places that offer a strong local economy. These affordable markets, similar to September’s hottest markets, have continued to see substantial demand despite the shifting housing market. As long as mortgage rates and prices remain high, buyers will be looking for a relief valve. Some may find renting to be the better option in the short term, while others may consider other home types such as condos. Buyers who remain in the market may see lower prices and have some leverage relative to the last few months, though they will have to be cognizant of how higher mortgage rates impact housing costs.”